Taking Stock: Nifty Reclaims 14,900, Sensex Jumps 447 Pts; Mid & Small-caps Outshine

Mid and small-caps outperformed their larger peers adding 1.5 percent each.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,950.95 | 388.17 | +0.46% |

| Nifty 50 | 26,013.45 | 0.00 | +0.00% |

| Nifty Bank | 58,962.70 | 0.00 | +0.00% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Eternal | 309.55 | 5.80 | +1.91% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| TMPV | 372.70 | -18.50 | -4.73% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8491.65 | 91.75 | +1.09% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10495.90 | 1.10 | +0.01% |

Markets extended rebound and gained over a percent amid excessive volatility. The benchmark started the day on a strong note, tracking firm global cues however profit-taking in the index majors, mainly from the banking pack, capped the upside as the session progressed. However, renewed buying in select heavyweights in the last hour helped the index to close around the day’s high. Consequently, Nifty settled above 14,900 levels; up by 1.1%. The broader market indices, midcap and smallcap, continued their outperformance and ended with strong gains of 1.6% each. On the sector front, all the indices ended in positive with IT and Auto leading the pack.

Markets are mirroring global indices and we expect this trend to continue in the coming sessions. Nifty is likely to fill the open gap but the performance of the banking index would be critical. We feel it’s prudent to continue with a stock-specific trading approach in the present market scenario while keeping a check on leveraged positions.

Markets exhibited buoyancy today despite its share of volatility in Tuesday's afternoon trade. IT stocks and Auto stocks led the rally while the broader market saw keen interest in Paper stocks on rising product prices.

The Nifty has crossed 14,950 which is the upper end of the resistance patch. If we can keep above that level for the next couple of days, we would be all set to reactivate the bullish undertone of the markets and should then see higher levels of 15,200-15,300. The new updated support for the Nifty is 14,600-14,650.

Indian market witnessed a positive opening backed by a strong US market due to steady treasury bond yields, but market pared its gains as Asian peers traded weak. A quick recovery was seen towards the end of the session as investors hurried to buy on dips showing huge confidence & liquidity in the market. An improved outlook post-February auto sales numbers resulted in continued buying in auto stocks with IT sector also being a major contributor in the rally.

Rupee traded with range to weak moves between 73.30-73.50 cooling of after last two days of volatile scenario. As crude prices witnessed some ease of price and the Dollar index showed some stable range, rupee followed suit. Going ahead rupee can be seen between 73.25-73.60 range for a few session.

Index again opened a day with gap & hold its bullish stream for second consecutive day and activated the bullish harami candle pattern which formed in yesterday session hinting we may see some more upside if index managed to save 14,500 zone in the near term. On the immediate basis, index has support near 14,800-followed by 14,750 zone and any dip near said levels will be again buying opportunity and resistance is coming near 15k mark.

Indian rupeeended 19 paisehigher at 73.36per dollar, amid buyingsawin the domestic equity market for the second consecutive day.It opened 20 paise higher at 73.35 per dollar against Monday's close of 73.55 and traded in the range of 73.31-73.48.

Jagran Prakashan at its meeting held on March 02 approved the buyback of the company's fully paid-up equity shares of face value of Rs 2 each for an aggregate amount not exceeding Rs 118,00,00,000 at a price not exceeding Rs 60 per equity share.

Benchmark indices ended higher for the second consecutive session on March 2 with Nifty above 14,900 supported by the IT and Auto stocks.

At close, the Sensex was up 447.05 points or 0.90% at 50,296.89, and the Nifty was up 157.60 points or 1.07% at 14,919.10. About 1813 shares have advanced, 1138 shares declined, and 166 shares are unchanged.

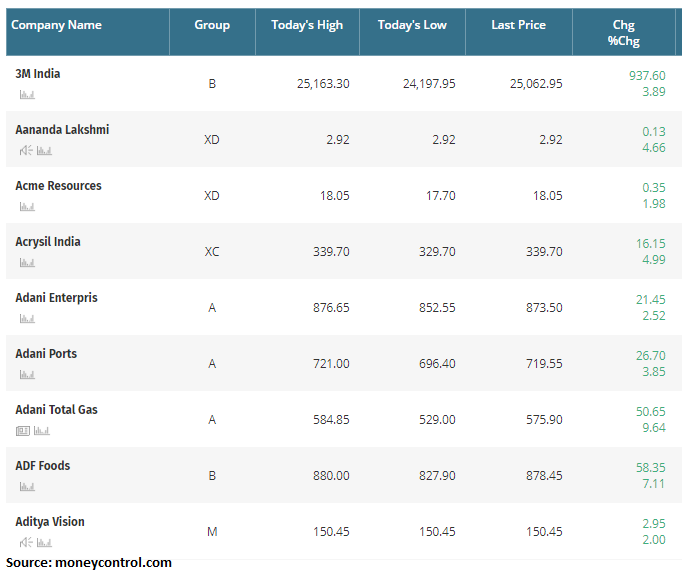

Tata Motors, M&M, Wipro, Adani Ports and NTPC were among the major Nifty gainers, while losers were ONGC, HDFC, Dr Reddy’s Labs, Coal India and Power Grid Corp.

Among sectors, Nifty IT and auto indices rose 3 percent each. BSE Midcap and Samllcap indices each added 1.5 percent.

The market witnessed some lackluster but positive movement in the market. Nifty 50 traded in a range between 14,800-14,940. The market has sustained over the decisive level of 14,850. The market to gain momentum and continue till the levels of 15,100. The momentum indicators like RSI, MACD to stay positive supporting our view that the upside movement is likely to continue.

MTAR Technologies has come up with a Rs 600 crore IP0 which is set to open on Wednesday. The objective of the issue is to repay debt, working capital requirements and general corporate purposes. MTAR’s revenue and profits have grown at a CAGR of 15.7% and 140.3% respectively over FY18 to FY20. Overall the company has a good financial track record with a debt to equity ratio of 0.13 only.

On the risks front, the company derives over 80% of its revenue from its top 3 customers and 49% of revenue from Bloom Energy leading to concentration risk. Besides it does not have any long term contracts with its clients. Over all MTAR is overpriced at a FY20 P/E of 57.5 times. But it has been commanding a good grey market premium, indicating the offer will sail through. Keeping the risks in mind, we recommend to subscribe to this IPO for listing gains only.