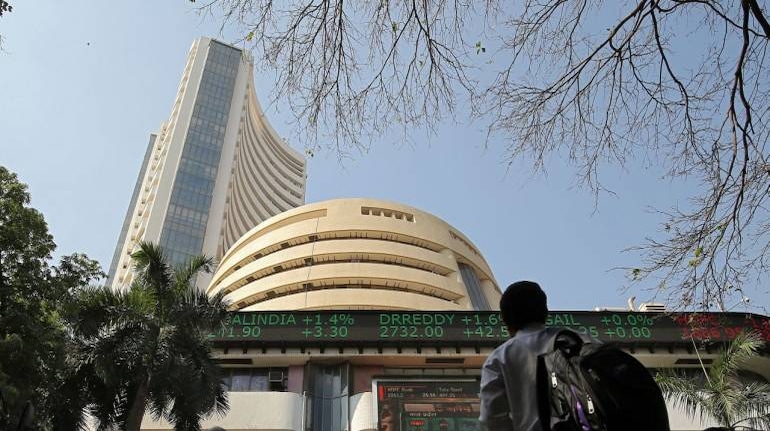

Taking Stock | Supported By Auto And Metal Stocks, Bulls Take Nifty Close To 14k

The BSE auto, metal and realty indices rose 1 percent each, while capital goods and FMCG indices ended in the green.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,900.71 | -331.21 | -0.39% |

| Nifty 50 | 25,959.50 | 0.00 | +0.00% |

| Nifty Bank | 58,835.35 | 0.00 | +0.00% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Tech Mahindra | 1,494.70 | 33.20 | +2.27% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Bharat Elec | 403.80 | -12.55 | -3.01% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37037.90 | 152.60 | +0.41% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10017.90 | -124.60 | -1.23% |

Nifty Commodities and Nifty Auto indices gave an exceptional support to the market. Finally, the passing of $2.3 trillion of stimulus package and fall in the US dollar has helped commodities to recover from lower levels. Today we also witnessed huge buying in building materials along with real estate stocks. Nifty 50 Index has formed a “Dragon Fly Doji” at the psychological hurdle point of 14000.

Tomorrow, on the day of monthly and quarterly expiry of F&O contracts, Nifty 50 index could trade between the range of 14150 and 13800 levels. Buy Nifty 50 index if it corrects to 13900/13850 with a final stop loss at 13800. As the market is following sectoral rotation the market could find support from Financials. The Nifty 50 index is poised to hit the levels of 31800/32000 in the near term.

After a pandemic ravaged year, the risk sentiments are ending 2020 on a positive note on the back of US fiscal stimulus, Brexit deal and coronavirus vaccine. However, until the global economy is capable of recovering at a rapid pace once COVID-19 is defeated, the upside risk to USDINR spot will remain intact. With the viable vaccine’s ability to battle even the transmissible variant of the virus, the worries of further lockdowns has been eased.

So what happens to Indian rupee largely depends on how the major economies controls the virus in 2021. In USDINR spot, since the beginning of Dec, the psychological level of 74 has not been breached and the spot is trading below that. So we expect the short term range to be 73-74, only either side breakout will provide further clarity over the trend.

Rupee traded with gains as the dollar index keeps trading weak below 90$ which has helped the rupee to scale above 73.25. Majorly prices can take resistance near 73.10-73.25, going ahead price have also been sideways which has helped the rupee to appreciate.

Indian rupeeendedhigher by 12 paise at 73.30per dollar, amid selling seen in the domestic equity market.It opened higher at 73.36 per dollar against Tuesday's close of 73.42 and traded in the range of 73.23-73.36.

Domestic sentiment is upbeat, expecting a nod for Oxford-AstraZeneca Covid vaccine usage in India. Growth sectors like auto, realty and metal led the rally while defensives like pharma continued to remain under pressure. Although the market is at its most expensive valuation level, FPIs continue to pump in funds and roll the Indian market higher on a daily basis.

Index closed a day on a positive note for a fifth consecutive session at 13982 with gains of half a percent and formed a dragonfly Doji kind of candle pattern on the daily chart. The index reached to its immediate and strong hurdle zone of 14k mark. Now if index managed to hold above 14k mark then only we may see current bullish momentum to extend further towards 14200 zone otherwise some profit booking can witness and we may see the index to trade in the range of 13800-14000 zone.

Once again the Nifty attempted to hit the 14000 level but was unable to. From a technical perspective it is all set to achieve 14,100 as the next level of resistance. It is a matter of time that we see that magical level on our screens. We have a good support at 13,600 and any dip should be utilised to enter fresh long positions for higher targets.

Bulls stepped on the accelerator in afternoon trade to end the day just shy of the 14k mark led by cement & steel stocks on hopes of higher spend on infrastructure. Vaccine approval in the UK and hopes of approval back home led strength to the rally despite profit booking seen across several stocks.

: Benchmark indices gained for the six straight session and ended near the day's high level on December 30 with Nifty closing shy away of 14,000 mark.

At close, the Sensex was up 133.14 points or 0.28% at 47,746.22, and the Nifty was up 49.40 points or 0.35% at 13,982.00. About 1642 shares have advanced, 1257 shares declined, and 177 shares are unchanged.

UltraTech Cement, Shree Cements, Grasim, Bajaj Finance and UPL were among major gainers on the Nifty, while losers included IndusInd Bank, Sun Pharma, Axis Bank, Bharti Airtel and TCS.

Except bank and pharma, other sectoral indices ended in the green led by the auto and metal. BSE Midcap and Smallcap indices ended in the positive territory.

The country's exports may reach USD 290 billion by the end of this fiscal as the outbound shipments were hit hard by the COVID-19 pandemic during the first half of the year, FIEO said on Wednesday.

Federation of Indian Exports Organisations (FIEO) President Sharad Kumar Saraf also said that 2021 would bring a ray of hope and optimism for the exporting community. Read More

The market witnessed continues to trade in a tight range between 13800-14000. In the first half bears tried to take control with the opening of the market but in the second half bulls took control of the market and the market rallied from low of 13864.95 to 13960 to near all time high. Given the fact that most of the oscillators are trading at its extreme and diverging, a sideways movement is likely to continue till it breaches the resistance of 14000.

India is likely to approve Oxford-AstraZeneca COVID-19 vaccine on December 30 hours after the UK approved the coronavirus jab. "India approval of Oxford vaccine is expected today in all likelihood," a highly-placed source at Central Drugs Standard Control Organisation (CDSCO) told News18.

The Subject Expert Committee (SEC) of Drugs Controller General of India (DCGI) is scheduled to meet on December 30 to consider the Serum Institute of India's application for emergency use approval of its COVID-19 vaccine. Read More