August 04, 2022 / 16:26 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

The Nifty tested the 78.6% retracement of the Apr – June decline on August 04. It missed the short term target of 17500 by a small margin from where profit booking got triggered. As a result, the index witnessed a steep decline in the first half of the session. In the second half, it managed some recovery but ultimately formed a bearish outside bar & a Hanging Man candle on the daily chart.

This shows that the index is now stepping into a short term consolidation phase. 17000-17500 is expected to be the short term consolidation range. As the index has stumbled near the upper end of the range, it is now likely to move down towards the lower end of the range i.e. 17000 in the coming sessions.

August 04, 2022 / 16:18 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets witnessed erratic swings throughout the weekly expiry day and finally settled on a flat note. The beginning was upbeat; thanks to firm global cues however the updates on lingering geopolitical tension between China-Taiwan led to nervousness and triggered a sharp dip.

The situation improved gradually as the day progressed, with noticeable traction in the IT, pharma, metal and FMCG pack. Finally, the Nifty index closed almost unchanged at 17,382 levels. Meanwhile, broader indices traded mixed wherein midcap gained over half a percent while smallcap slipped in the red.

Markets will be closely eyeing the outcome of MPC’s monetary policy meet on Friday. Before that, the performance of the global indices amid the fresh developments on China-Taiwan tension would dictate the trend in early trades. On the index front, the Nifty has been seeing consolidation on the expected lines however rise in the volatility is making life tough for the traders. We recommend preferring hedged positions and focusing on the defensive pack as well.

August 04, 2022 / 16:14 IST

Prashanth Tapse - Research Analyst, Senior VP (Research), Mehta Equities:

Markets snapped its 6-day winning streak on the back of profit booking. Volatility was the hallmark of today’s trade as Nifty wobbled amidst reports of rising US-China tension. The positive takeaway however was that Nifty recouped most of its losses from days low of 17161 to end a tad below the dotted lines at 17382 mark.

Technically speaking, the immediate support for Nifty is seen at 17121 and below the same, expect the index to quickly slip towards 16750-16800 zone. Alternatively, if Nifty’s support at 17121 holds, then expect the benchmark to shoot to the moon with targets at 17557 and then at 18100.

August 04, 2022 / 16:11 IST

Siddhartha Khemka, Head - Retail Research, Motilal Oswal Financial Services:

Volatility has increased in the domestic market in the last 3 days. However strong buying at lower levels have helped Nifty to sustain its positive closing for 6-7 consecutive days. This shows the underlying strength in the Indian markets despite increasing volatility as well as escalating geopolitical tensions. After the sharp run up in the last few days, Nifty now trades at 20x FY23 PE, which is above its 10-year average, thus offering limited upside in the near term.

RBI’s policy outcome on Friday would be the key event that the market would track. Going forward, it could be a tug of war between domestic and global factors which would determine the market direction.

August 04, 2022 / 15:55 IST

Vinod Nair, Head of Research at Geojit Financial Services.

Taking positive momentum from the robust US economic data, the domestic market opened with gains, while worries over the US-China conflict kept investors on the defensive, leading to heavy volatility.

Weak PMI and trade deficit data witnessed downside pressure on the Indian rupee & equity market. However, sustained foreign interest in Indian equities is led to buying on dips, resulting in a late recovery.

August 04, 2022 / 15:52 IST

Rupak De, Senior Technical Analyst at LKP Securities:

Nifty remained highly volatile before closing flat for the day. On the higher end, it found resistance around 17500 and slipped lower. The momentum indicator RSI is in bullish crossover.

The trend is likely to remain sideways to negative as long as it remains below 17500. On the lower end, support exists around 17100-17000.

August 04, 2022 / 15:39 IST

Kunal Shah, Senior Technical Analyst at LKP Securities:

The Bank Nifty index witnessed high volatility a day before the RBI Policy with movements on both sides. The bulls and the bears are trying to fight from both ends with support at 37,200 and resistance at 38,200 levels. The index needs to break on either side on a closing basis for a trending move on either side. The index is already trading in an overbought zone and a correction cannot be ruled out from the current level.

August 04, 2022 / 15:37 IST

Rupee Close:

Indian rupee ended lower by 31 paise at 79.47 per dollar against previous close of 79.16.

August 04, 2022 / 15:35 IST

Market Close

Indian benchmark indices ended marginally lower in the highly volatile session on August 4.

At Close, the Sensex was down 51.73 points or 0.09% at 58,298.80, and the Nifty was down 6.20 points or 0.04% at 17,382. About 1515 shares have advanced, 1735 shares declined, and 141 shares are unchanged.

Cipla, Sun Pharma, Nestle India, Infosys and Apollo Hospitals were among the major gainers on the Nifty. The losers included NTPC, Tata Consumer Products, Coal India, SBI and Reliance Industries.

Among sectors, Metal, IT and Healthcare up 1-2 percent, while Realty index down 1 percent.

BSE midcap and smallcap indices ended with marginal gains.

August 04, 2022 / 15:24 IST

Britannia Industries Q1 Earnings:

Net profit was down 13 percent at Rs 336 crore against Rs 387 crore, YoY. Revenue stood at Rs 3,701 crore for the quarter ended June 2022.

August 04, 2022 / 15:19 IST

Prabhudas Lilladher View on InterGlobe Aviation

"IndiGo reported impressive performance on revenue front led by improved yield. However, soaring fuel costs and higher forex losses continue to play spoilsport," the brokerage said.

Load factor at 79.6 percent remains considerably below pre-COVID levels of 89 percent, impacted by price hikes. We anticipate the September quarter to be a weak one impacted by seasonality and weak macros," it added.

"We believe IndiGo is better placed than peers with 55 percent market share. The company will benefit in the medium to long term from (1) demand recovery along with capacity deployment (2) local and global network expansions (3) commodity softening (4) superior balance sheet (4) better than industry cost structure and (5) strong management," the brokerage added.

"However, inflationary cost environment and rupee depreciation will continue to drag profitability. Maintain ‘hold’ with a revised target price of Rs 1,900 (Rs 1,800 earlier)," it said.

August 04, 2022 / 15:12 IST

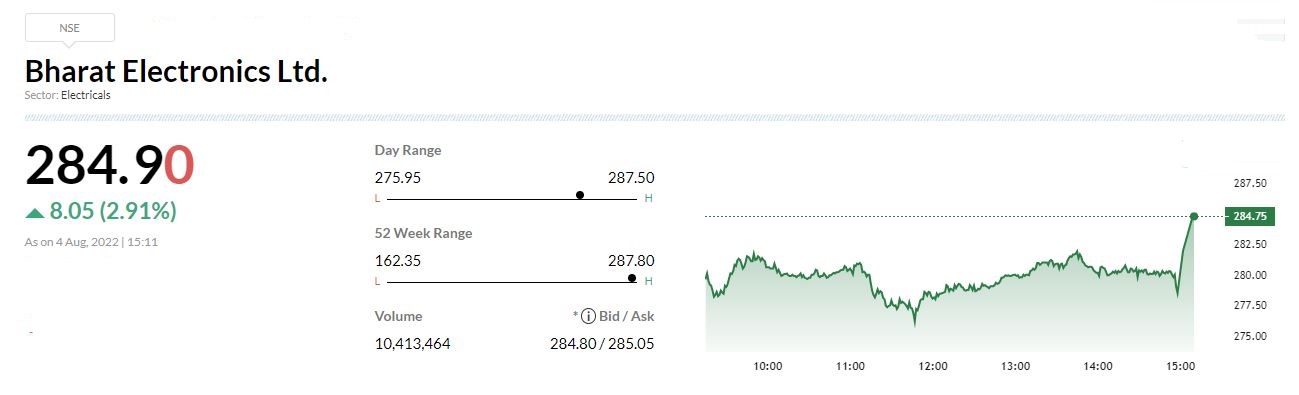

The Board of Directors of Bharat Electronics at their meeting held on 4th August, 2022 has considered and approved the issue of bonus shares to the shareholders of the company in the ratio of 2:1 by capitalizing 4,87,31,85,886 standing to the credit of the free reserves and surplus of the company.