Taking Stock: Sensex, Nifty End Higher Led By IT Stocks; Mid, Smallcaps Underperform

On the broader market front, the BSE midcap index fell 0.90 percent and the smallcap index shed 1.5 percent... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,900.71 | -331.21 | -0.39% |

| Nifty 50 | 25,959.50 | -108.65 | -0.42% |

| Nifty Bank | 58,835.35 | -32.35 | -0.05% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Tech Mahindra | 1,494.70 | 33.20 | +2.27% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Bharat Elec | 403.80 | -12.55 | -3.01% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37006.80 | 121.50 | +0.33% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10017.90 | -124.60 | -1.23% |

Heavy selling continued in small and mid-cap stocks, while headline indices traded positive due to strong support from IT stock and positive global peers. The key factor for the correction is the good performance during 2020-21 leading to peak valuations while liquidity is expected to normalise in the future. The ongoing correction will provide an opportunity for long-term investors to re-enter quality stocks.

Markets ended marginally in the green amid volatility, taking a breather after the recent dip. Initially, the benchmark opened on a firm note following positive global cues. However, continuous profit-taking not only capped upside but also trimmed the gains. Finally, Nifty settled with marginal gains of 0.3% to settle at 16,496 levels. The underperformance from broader markets continued as both midcap and smallcap ended lower by 1% and 2% respectively. Amongst the sectors, a mixed trend was witnessed as sectors like IT, telecom, and oil & gas ended with gains whereas auto, realty and metal ended with losses.

Markets are currently dancing to global tunes and we expect this trend to continue in absence of any major domestic event. Besides, the upcoming derivatives expiry of August month contracts and continuous fall in the broader markets would keep the participants on the edge. Amid all, we reiterate our cautious view and suggest keeping positions on both sides. Investors, on the other hand, can consider accumulating stocks that are now available at good bargains.

On the Technical Front, the index has formed a hammer candlestick on four hourly charts which points out strength for upcoming sessions. Moreover, the Index has taken support from 89-HMA and has been trading above 21&50 DMA, which suggest strength for the upside. Momentum Indicator MACD is also showing positive crossover on daily time frame which further adds strength in the index. At present, the Nifty index has immediate resistance at 16,600 levels while downside support shifted up to 16,350 levels.

Index opened a day with gap up but showed selling pressure since the start of the session and closed a day at 16496 with minimal gains forming a bearish candle on the daily chart. It seems the index is forming a fresh consolidation zone in the range of 16350-16600 zone as last two days we have been witnessed a choppy move in the same range which suggest traders can use the same rage for trading purpose, going forwards immediate support is coming near 16450-16400 zone and resistance is coming near 16550-16600 zone.

Benchmark indices ended on positive note in the volatile session on August 23 led by the IT stocks.

At close, the Sensex was up 226.47 points or 0.41% at 55555.79, and the Nifty was up 46 points or 0.28% at 16496.50. About 745 shares have advanced, 2438 shares declined, and 135 shares are unchanged.

HCL Technologies, Nestle, TCS, Bajaj Finserv and Bharti Airtel were the top Nifty gainers. Grasim Industries, Adani Ports, M&M, Eicher Motors and Bajaj Auto were among the top losers.

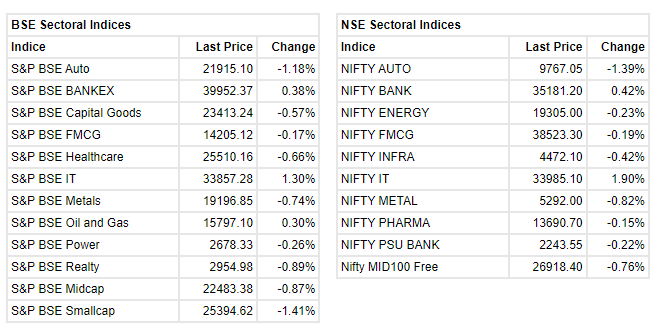

Among sectors, the Nifty IT index gained 1.7 percent each, while metal, auto and PSU bank indices lost 0.5-1.5 percent. BSE midcap index fell 0.90 percent and smallcap shed 1.5 percent.

Indian markets started on a positive note following positive Asian markets cues after as Hong Kong’s Hang Seng edges out of bear territory seen in last week. During the afternoon session markets recovered from lows seen post opening session led by buying in TECK, IT and Energy stocks. Gains in frontline blue chip stocks such as HCL Tech and TCS also helped lift the markets.

Sentiments were upbeat as Crisil Ratings revised the credit quality outlook of India Inc for fiscal 2022 to positive from cautiously optimistic earlier. Also, positive European and western markets after a losing week added strength to the markets as investors eye a key event where the Federal Reserve could hint at prospects for tapering stimulus.

The market witnessed trading in fine fettle with nifty crossing 16500 levels in the afternoon session. Market t is going to be crucial for the short-term market scenario to sustain above the 16500 level. If the market is able to sustain the level of 16500, market can witness higher levels of 16700 as the momentum indicators like RSI and MACD to stay positive and market breadth to improve, further strengthening a short-term bullish outlook.

Oil prices jumped 3% on Monday, recovering from a seven-day losing streak, with gains driven by a weaker dollar despite demand concerns stoked by rising cases of the Delta coronavirus variant.

Gold rose on Monday as the dollar pulled back, with lingering concerns over possible roadblocks to global economic growth from rising COVID-19 Delta virus cases boosting bullion's appeal.

After seven straight months of net inflows, gold exchange traded funds witnessed a pullout of over Rs 61 crore in July as investors diverted their money to equity and debt funds that generated attractive returns.

Despite the negative flows in the category, the number of folios went up to 19.13 lakh in July from 18.32 lakh in the preceding month, data with Association of Mutual Funds in India (Amfi) showed.

Barring February 2020, November 2020 and July 2021, investments into ETFs that track the yellow metal have been witnessing a steady uptick since August 2019. Read More

Benchmark indices were trading higher with Nifty around 16500.

The Sensex was up 258.89 points or 0.47% at 55588.21, and the Nifty was up 52.60 points or 0.32% at 16503.10. About 675 shares have advanced, 2340 shares declined, and 115 shares are unchanged.