More than 3 percent plunge in benchmark indices within hours of the opening bell, driving investors poorer by over Rs 10 lakh crore, has made the Thursday's market rout one of the worst in the history of the Indian stock market.

Stock markets the world over were apprehensive of the imminent attack for the past few weeks but investors hoped that diplomacy would prevail when French President Emmanuel Macron tried to broker a peace deal with his Russian counterpart Vladimir Putin.

When Russia gave recognition to two separatist-controlled regions of Ukraine, the markets braced for more headwinds. But nothing worked when Putin authorised military operations against Ukraine on February 24 morning and Russian forces began making inroads into the the East European nation.

The markets couldn’t absorb the shock. A massive sell-off that started in Asian markets spilled over to India and other indices. A reign of panic sent the volatility index, which is also known as the fear index, in India past 30 percent to a 20-month high.

Trading was suspended on the Moscow Stock Exchange in the morning and when it resumed, the MOEX opened 50 percent down.

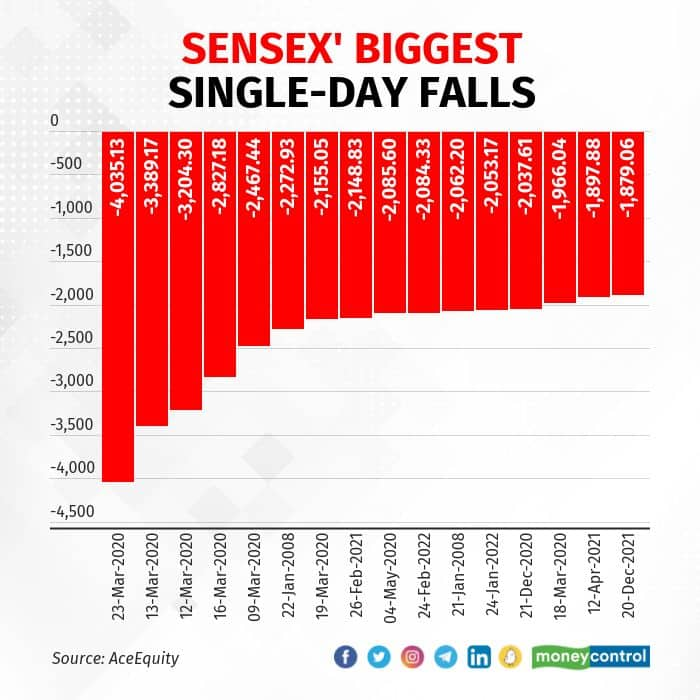

In India, traders were anticipating the markets to open with a huge correction and the 30-pack BSE Sensex opened with gap of more than 1,800 points in the morning at 55,418.45. It tanked further to make an intra-day low of 55,147.73 which was 2,084.33 points below Wednesday's close, registering the biggest intra-day loss so far this year.

The Sensex had so far witnessed its worst intra-day decline on January 24 when it tanked by 2,053.17 points on interest rate hike worries before the crucial US Fed meeting.

Thursday's loss turned out to be the tenth biggest intra-day fall in the history of the BSE Sensex. The top five biggest crashes were attributable to the news of the outbreak of Corona virus when it lost a mammoth 4,035.13 points intra-day on March 23, 2020.

Two crashes days before this - 3,389.17 points and 3,204.3 points on March 13 and March 12 - because of the news of the contagion had paved the way for this worst rout.

Thursday's crash impacted all sectors and commodities with Brent crude shooting past $104 a barrel in the international markets for the first time since 2014. The sanctions on Russia by the West will escalate the crude prices further as it is one of the top three oil producers in the world. Western Europe is the biggest customer of Russian oil, followed by China and South Korea.

Though India imports less than one percent of its crude from Russia as Indian refineries are unable to process the heavy crude that Russia produces, it will indirectly face the brunt of higher crude prices as its import will shoot up immensely which would impact the already high CPI inflation leading to a widespread increase in food and commodity prices.

“Geopolitical events often come up with short-term reactions in the market as the dominant news flow leads to market volatility. The Russia-Ukraine crisis would lead to a rise in oil prices, higher than the current levels,” said Naveen Kulkarni, Chief Investment Officer, Axis Securities.

“We believe the present macroeconomic developments are leading to volatility in all major asset classes, including equity and debt. The volatility is here to stay for some time before we conclude a market direction,” he said.

Experts have advised retail investors to wait and watch and not try to buy this correction in a hurry. “The selling may continue for a more correction of 8-10 percent in the benchmark indices and the Nifty may touch the level of 15,500 in this scenario,” said Ravi Singh, Vice President and Head of Research at Shareindia.

Long-term investors with an investment horizon of 3-5 years will get a good opportunity to avert their portfolio, once the global situation stabilises, according to him.

Vijay Chandok, MD and CEO, ICICI Securities hopes to see an end to the imbroglio in the near term. "We do not expect major sanctions which may drive big spike in crude, equally harming Europe and the US, or even in terms of aggressive rate hikes, leading to slower economic growth,” he said.

The medium-to-long-term thesis on Indian equities, however, remain intact amid the economic recovery as reflected by key macroeconomic indicators, strong capex spends and robust corporate earnings.

“We continue to see this correction as an opportunity for the investors to add on the companies with sustainable growth visibility,” Chandok said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.