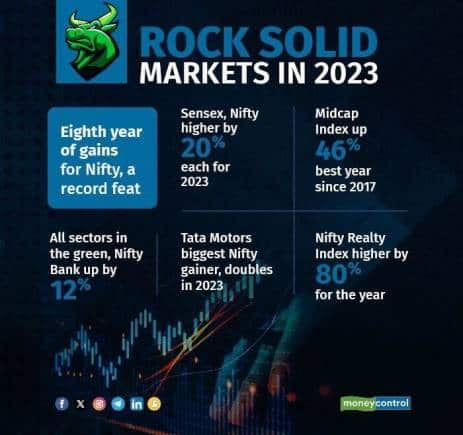

The equity markets finished 2023 on an upbeat note as the benchmark indices Nifty 50 and BSE Sensex hovered near all-time highs, gaining 20 percent and 18 percent, respectively, through the year.

Retail investors' risk appetite for equities improved in the latter half of the year after a slew of factors played out, including hopes of easy monetary policy going into 2024, bets on stable government formation post-2024 general elections, cooling bond yields and commodity price moderation.

However, as 2024 is poised to start on a high base will the non-stop bull run continue? Analysts believe that the upcoming months might see some bouts of volatility due to elevated valuations. After an 'inevitable' correction, markets may again turn healthy and experience good run-up, they added.

2024 beginning on high base: Returns to be muted, correction possible

"2024 is beginning on a high base, hence it may be difficult to expect a similar performance by the time 2024 ends," said Dhiraj Relli, MD & CEO at HDFC Securities. However, factors such as the resurgence of foreign portfolio buyers and placement of India as an attractive market versus other emerging market peers may help register some gains early in the year, he added.

On the other hand, Sahil Kapoor, Market Analyst and Head of product, DSP Mutual Fund expects markets to eventually hit an air pocket of consolidation or correction stepping into 2024 due to excessive valuations versus historical averages.

"Around 1,200 stocks listed on BSE and NSE are trading on an average 40x price-to-earnings (PE) ratio as compared to the historical average of 23-24x PE multiple. This indicates that we should not start the year with very large expectations as we are trading at higher valuations in terms of our history," he told Moneycontrol.

ALSO READ: Driving out in style: Tata Motors becomes first Nifty stock to double in 2023

Factors that will guide markets in 2024

Going into 2024, some of the crucial factors that will shape market direction are 2024 general elections, interest rate cuts and commodity prices, among others.

Commenting on whether markets have completely baked in rate cuts, analysts said there is more room available. Deven Choksey, Managing Director at KRChoksey Holdings said that markets will eye every rate cut and it has not been fully priced in yet. "Every rate cut will shape the market direction and look for further cues on how the interest rate trajectory would look like," he said.

2023 saw Indian markets recover from the grips of two wars - Russia-Ukraine and Israel-Hamas, Brent crude prices cooling below $80 a barrel from $123 per barrel, retreating of decadal high US bond yields below 4 percent-mark, and weakening of US dollar index below 101 levels. The factors that helped markets outshine other peers were strong corporate earnings growth, cooling inflation trends, and aggressive buying by domestic investors.

The broader end of markets, meanwhile, outperformed benchmark indices as Nifty Midcap 100 and Nifty Smallcap 100 indices surged 46 percent and 55 percent, respectively. However, with heightening retail exuberance, analysts remain cautious of these segments entering a 'bubble territory', making correction 'inevitable.'

Sectorally, the Nifty Realty index emerged as the star performer of 2023, soaring over 80 percent. Nifty Auto, Infrastructure and PSU Bank indices were also among the lead performers of 2023.

Stepping into 2024, analysts expect the Bank Nifty index to fare well over the benchmark index as plenty of catch-up is left. "The progress has not been as vociferous for Bank Nifty as Nifty after state elections. We expect Bank Nifty to cross 50,000 barrier in the next month as valuations remain inexpensive," said Raja Venkatraman, Co-Founder at Neo-Trader.

Dnyanada Vaidya, Research Analyst - BFSI, Axis Securities, too, remained bullish on banking sector prospects in 2024, adding that they will continue to deliver healthy performance on growth driven by buoyant demand and pick-up in capex cycle. "Our top picks from the sector include HDFC Bank, ICICI Bank, SBI, and Federal Bank," she said.

Overall, experts remained cautious of an overbought market and suggested investors to move their capital from mid and smallcap space to largecaps.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.