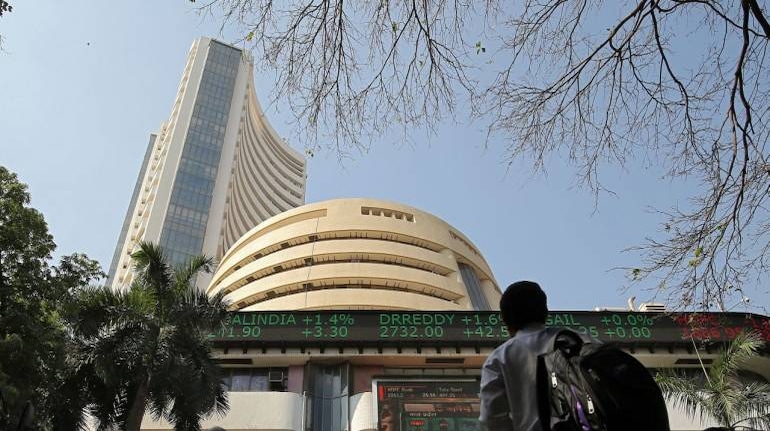

Taking Stock: Sensex witnesses biggest fall on Budget Day in 11 years as FM disappoints

The NiftyBank plunged 3.3 percent or 1026 points weighed down by losses in RBL Bank, SBI, Bank of Baroda, ICICI Bank, and IDFC First Bank... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 82,327.05 | -173.77 | -0.21% |

| Nifty 50 | 25,227.35 | -58.00 | -0.23% |

| Nifty Bank | 56,625.00 | 15.25 | +0.03% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Adani Ports | 1,437.80 | 28.40 | +2.02% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Tata Motors | 660.75 | -18.20 | -2.68% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 7713.95 | 18.15 | +0.24% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty FMCG | 54473.80 | -492.65 | -0.90% |

Consolidated net profit at Rs 479.2 crore versus Rs 159.6 crore and revenue was up 36.5% at Rs 3,832 crore versus Rs 2,807 crore, YoY.

The markets have reacted negatively to the Budget, mainly due to some disappointments on account of non-abolition of LTCG, confusion about the impact of DDT removal and taxing dividends in the hands of recipients.

We expect tepid start on Monday with negative bias. As long as it trades below 11800 levels we expect some consolidation in the range of 11500-11800 zone. However, it ended the extended session near its 200-DMA which is placed at 11650.

The budget is good on intent. However, the key is efficient execution in a time-bound manner. There are many positives to simplify things and encourage entrepreneurs but again, key will be execution in a time-bound manner. Intent needs to be converted into implementation.

We are quite satisfied with the budget math. Tax receipts appear achievable, especially once some flow comes through the amnesty scheme for direct tax cases. Likewise, disinvestment proceeds will also be large with LIC IPO on the cards. On the expenditure front, 13% yoy growth budgeted for FY21 matches with our estimate. Ramp up in GST revenues is a key monitorable.

We feel that the budget is balanced and has taken care of a number of sectors. It will certainly have a positive impact in the long run. Technically, the short-term trend is weak and is likely to continue for the next few trading sessions.

Markets have taken a cautious view on the budget, the tax rate cut and DDT benefit will help economy to grow and corporate payouts to increase, at these levels one should buy for long term.

Dividend Distribution Tax (DDT) has been abolished and therefore obviously foreign investors will benefit but then it becomes fully taxable in the hands of shareholders which is not the right way of doing it because shareholders are also owners and as owners of the company they pay tax on profits and it gets taxed again. So, this might change the dividend culture of many companies, it will impact the private sector investment which has been very sluggish for the last 2 to 3 years at least.

: I would wait for a full working day at the stock market. Not sure if every aspect of the market was open today. We will wait for Monday. I am confident that when the market opens on Monday, we will see a positive reaction.”

Total January sales up 3.8% at 3,700 units versus 3,564 units, YoY.

The Union Budget has tried to balance higher expenditure and still maintain a prudent Fiscal Deficit target of 3.5% for FY21.Market expectations were high on capital market reforms which have not materialised and to that extent there could be some near term disappointment. As earnings recover in the course of next fiscal year, markets will also follow a similar path.

Capital markets though currently disappointed should take this in their stride and will take cues from the expected rural india recovery post a bumper Rabi season and global reactions to coronavirus and expected trade standoffs between the US and Europe.