Reliance Industries Ltd has unveiled an ambitious roadmap to double its earnings by 2030, driven by expansion in its core oil-to-chemicals business, an aggressive push into digital and retail segments, and a renewed focus on new energy ventures.

After evaluating the plans outlined at RIL’s 47th annual general meeting, brokerages have maintained a positive outlook on India’s largest conglomerate, assigning new valuations to each segment. Here’s how they determined their target prices.

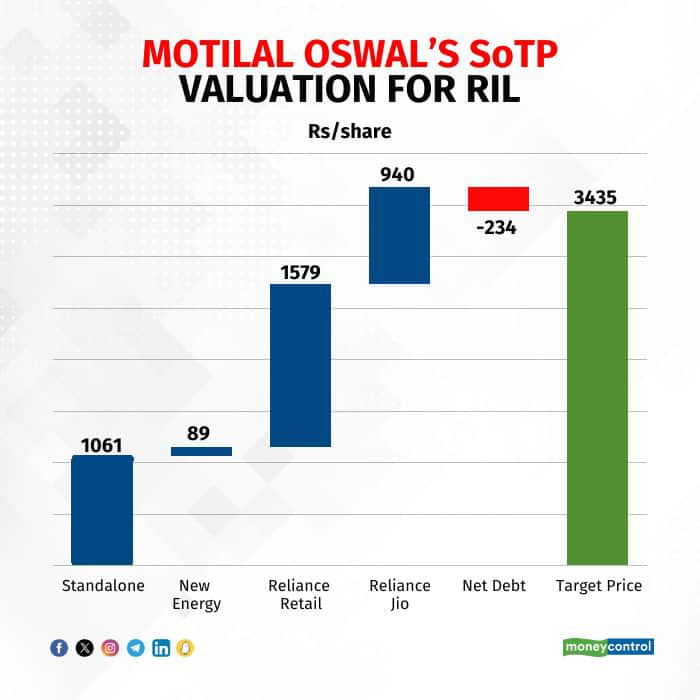

Motilal Oswal

Reliance Retail has been valued at Rs 1,797 per share by Motilal Oswal. Since Reliance Industries holds 87.9 percent of Reliance retail, its value in RIL's share price comes to Rs 1,579 per share. "Our premium valuation multiples capture the opportunity for a rapid expansion in its retail business and the aggressive rollout of digital platforms," said the brokerage.

After factoring in the various stake sales in Reliance Jio, Motilal Oswal arrived at a price of Rs 940 per share for Jio. The higher multiple captures Reliance Jio's market leadership and market share gains, growth in the wireline (JioFiber and JioAirFiber) business, and its recently announced AI-based opportunities.

These valuations combined led to a total target price of Rs 3,669 per share. However, the brokerage valued Reliance Industries' debt, which is largely capex-driven, at Rs 234 per share. When this is removed from the base target price, Motilal Oswal is left with a final fair value target of Rs 3,435 per share.

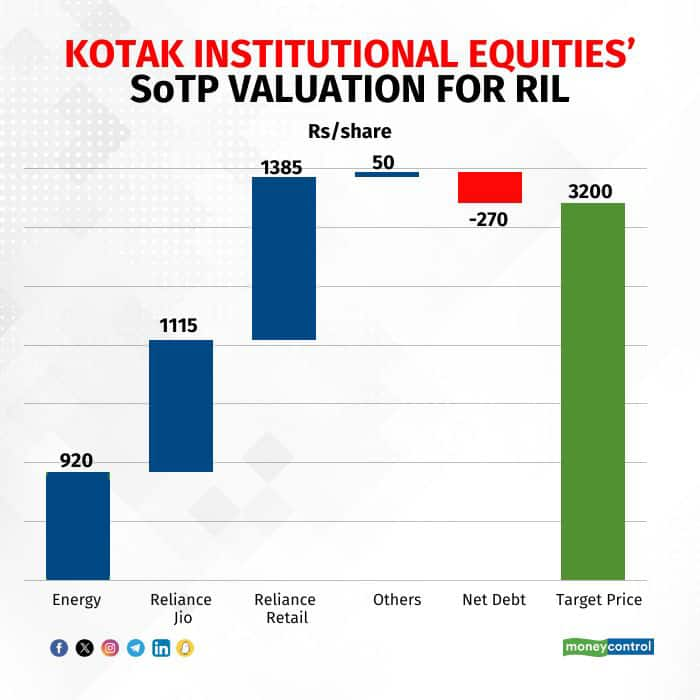

Kotak Institutional Equities

Kotak Institutional Equities gave the energy arm a valuation of Rs 920 per share, of which, New Energy contributes Rs 103. The brokerage has given Reliance Industries' Disney-Viacom JV a valuation of around Rs 50/51 per share.

Overall, Kotak Institutional Equities sees Reliance Industries' fair value rating at Rs 3,200 per share. "We are optimistic on the earnings outlook and estimate ~13 percent earnings CAGR over FY24-27," it said.

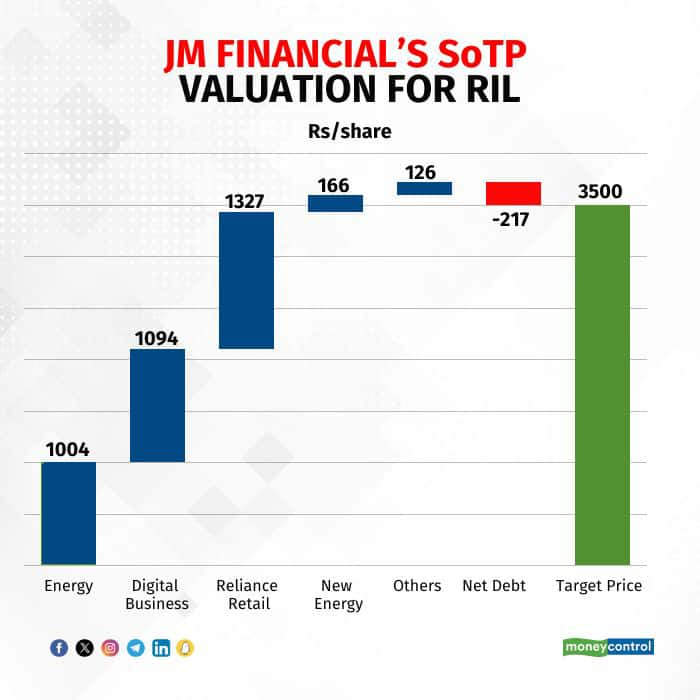

JM Financial

JM Financial has valued Reliance Industries' digital business, including its telecom arm, at Rs 1,249 per share, with Jio contributing Rs 1,107 of that value. The brokerage assessed RIL's New Energy arm at Rs 1.12 lakh crore, which is 1.5 times the announced capital expenditure of Rs 75,000 crore, translating to Rs 166 per share.

"We believe Reliance Industries' peak capex/net-debt is behind it, and also because the company has industry-leading capabilities across businesses to drive robust 16-17 percent EPS CAGR over the next 3-5 years," said the brokerage.

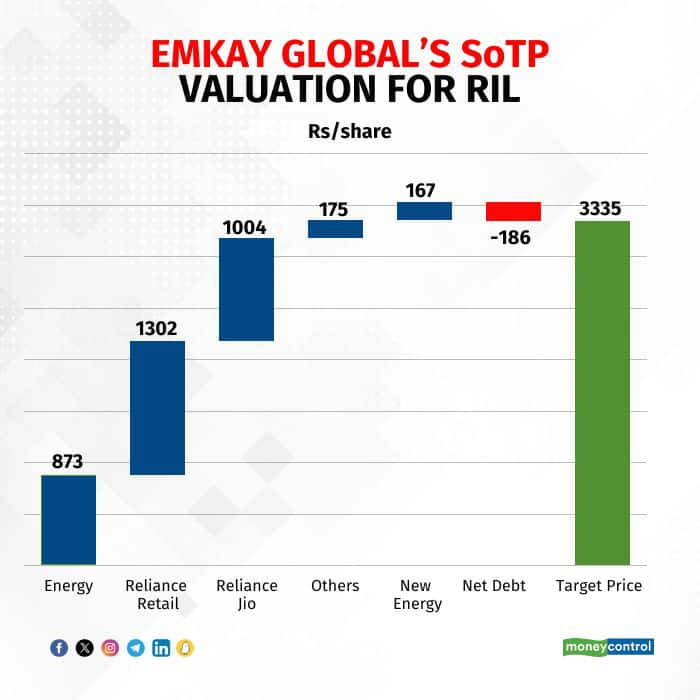

Emkay Global

According to Emkay Global, after adjusting for net debt, the equity value per share is Rs 3,335. The organized retail segment contributes the highest value per share at Rs 1,302, followed by the telecom segment or Reliance Jio at Rs 1,004. Based on its sum of the parts (SoTP) analysis, Emkay sees RIL's price-to earnings (PE) ratio at 24.8x by September 2026.

"We retain our estimates and target price, though there is upside risk to the tune of 15-

20 percent in valuation, based on the AGM commentary if execution is flawless, and timelines are met," wrote Emkay Global.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.