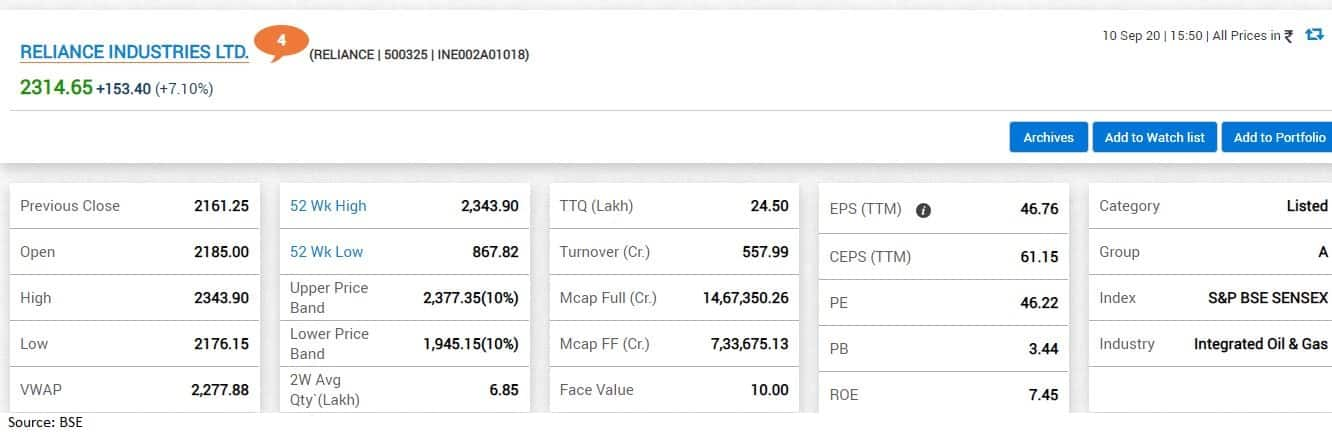

The share price of Reliance Industries (RIL) closed 7.10 percent higher at Rs 2,314.65 on BSE on September 10.

The stock jumped 8.5 percent to hit its fresh all-time high of Rs 2,343.90 in intraday trade on BSE.

Reliance Industries became the first Indian company to hit a market cap of $200 Billion. In 2020, Reliance has gained a market cap of over $70 billion, while the second-placed TCS has gained less than $10 billion.

As of September 10 close, the company's shares have jumped over 54 percent on BSE against a 6 percent fall in the benchmark Sensex.

In terms of market capitalisation (m-cap), RIL is India's largest company, with an m-cap of Rs 14.7 lakh crore as of now.

TCS is second, with an m-cap of Rs 8.8 lakh crore.

Shares of Reliance Industries Partly Paid (PP) stock closed 10 percent higher at Rs 1,394.55. The cumulative m-cap of RIL and RIL PP now stands at Rs 15.3 lakh crore.

Investors lapped up shares of the company as private equity giant Silver Lake Partners gets ready to invest Rs 7,500 crore in Reliance Retail for a 1.75 percent stake in the company's retail unit. Investors see it as a sign of the beginning of another round of investments.

The oil-to-telecom conglomerate is expanding its retail business and lining up a posse of global investors to take on rivals such as ecommerce giant Amazon and Walmart-owned Flipkart in India’s fast-growing online retail business.

Also read: Reliance Retail-Silver Lake Deal: 5 key things to know

Here is what top brokerages have to say on the stock:

HSBC

The global financial firm has maintained a "hold" call on the stock with a target price of Rs 2,020.

"Silver Lake’s valuation of Reliance Retail is in-line with our valuation. It could potentially start another round of investments," CNBC-TV18 reported, quoting HSBC.

Citi

Citi has a "neutral" rating on the stock, with a target price of Rs 2,250 and said the monetisation in retail has commenced and valuations are in-line.

As per CNBC-TV18, Citi said a strategic investment in retail could lead to a valuation premium being ascribed

Citi is of the view that the strategic investment in O2C and visibility on Jio’s listing are other catalysts.

Credit Suisse

Credit Suisse, too, has a "neutral" rating on the stock with a target price of Rs 1,980.

Credit Suisse, as per CNBC-TV18, said upside from kirana integration and e-commerce ramp-up is not fully factored in.

The brokerage said RIL's retail valuation implies 30 times FY22 EBITDA.

Morgan Stanley

The global financial firm has an "overweight" rating on the stock with a target price of Rs 2,247.

"Silver Lake valued Reliance Retail at $57 billion against our retail base case valuation of $45 billion. At these valuations, it would add 6 percent to Morgan Stanley’s base case NAV for RIL," CNBC-TV18 quoted Morgan Stanley as saying.

Morgan Stanley believes the price should help reduce investor concerns on RIL's retail valuations.

The global financial firm sees RIL emerging stronger post-COVID-19 and believes its margin should surprise as pricing power rises.

Cap allocation, execution and de-gearing will be the next leg of stock outperformance, Morgan Stanley said.

Disclosure: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!