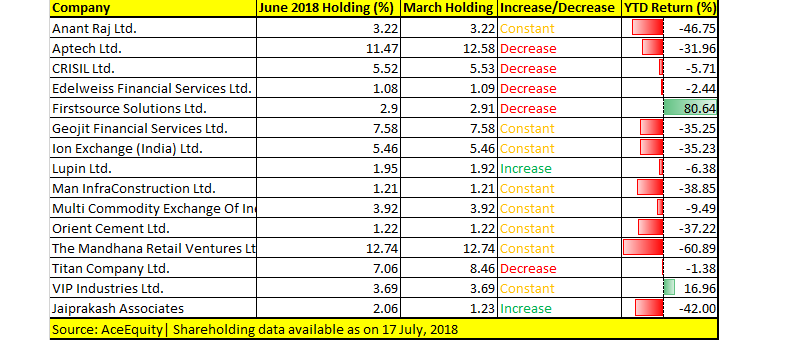

Rakesh Jhunjhunwala, popularly known as the big bull of D-Street, increased his stake in Lupin by 0.03 percent to 1.95 percent as per the latest shareholding data for the quarter-ended June.

He also raised his stake in Jaiprakash Associates by 0.83 percent to 2.06 percent. The billionaire investor now holds 5 crore shares in the company. Jhunjhunwala had re-entered the counter in March quarter after having sold off his entire holding in 2017.

He also reduced his stake in five companies: Aptech, CRISIL, Edelweiss Financial Services, Firstsource Solutions and Titan Company.

Jhunjhunwala buys shares through his company Rare Enterprises or in his own or wife Rekha’s name. Companies in which Jhunjhunwala or persons acting in concert held over a percent stake are disclosed in the shareholding data released by the BSE as of July 17.

Only 15 of nearly 30 companies in Jhunjhunwala’s portfolio released their shareholding data for the quarter-ended June till now. Of the 14 companies, only two have delivered positive returns.

The 57-year-old billionaire kept his stake constant in eight companies, which fell up to 60 percent in 2018 till date. These companies include: Geojit Financial Services, Ion Exchange (India), Man Infraconstruction, Multi Commodity Exchange of India, Orient Cement, Mandhana Retail Ventures and VIP Industries.

Even though the benchmark index hit a record high in July, the portfolio of most investors are seeing deep cuts as a large part of the small and midcap universe are still seeing selling pressure.

The carnage on D-Street can be seen in the Jhunjhunwala’s portfolio, who is sometimes referred to as India’s Warren Buffett. According to Forbes India, the ace investor is ranked 41 among billionaires in India with a net worth of USD 1.25 billion.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.