Ashish Kacholia, known for spotting quality stocks in the small and midcap universe, increased stake in four companies and reduced exposure sequentially in two during the June quarter, shareholding data available on AceEquity as on July 31 showed. He left his stake unchanged in eleven companies.

The D-Street veteran investor raised his stake more than 1 percent in HLE Glascoat during the June quarter to 1.03 percent. Beating the downturn, shares of HLE Glascoat have more than doubled investor wealth so far in 2020.

HLE Glascoat is based in the western part of India, specializes in the design and manufacturing of Carbon Steel Glass Lined Equipment viz. Reactors, Receivers / Storage Tanks etc.

HLE Glascoat caters to the requirement of leading Pharmaceutical / API, Specialty Chemicals, Dyes / Colours, Agro Chemicals, Food Processing, and allied Industries.

The other three companies in which Kacholia raised his stake sequentially at the end of June quarter are Poly Medicure, Apollo Tricoat Tubes, and Religare Enterprises, data from AceEquity showed.

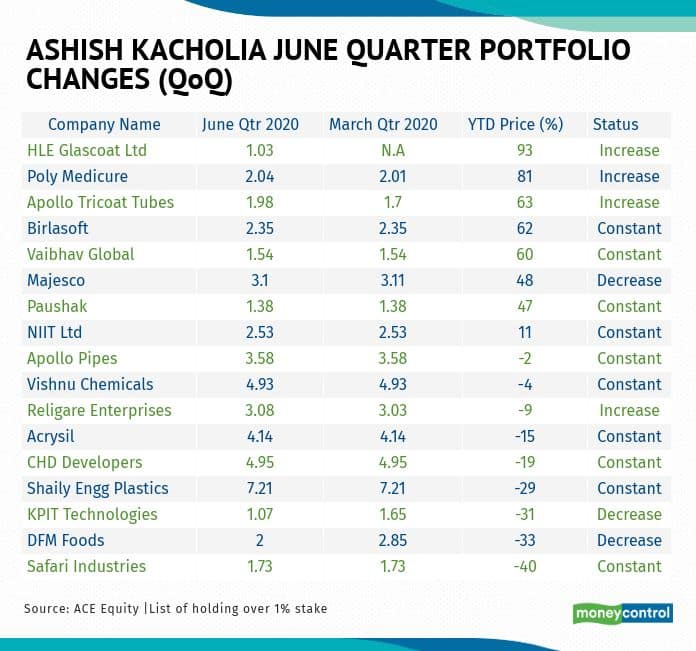

Table: It mentions only those companies in which Ashish Kacholia held over 1 percent stake in the June quarter as of data collated on July 31. This may not be his complete portfolio. The table is for reference and not for buy or sell ideas:

If you are a risk-taker, then a peek into his portfolio for the June quarter will reveal plenty of stocks that have the potential to deliver good returns and the ones which could turn out to be value traps.

Ashish Kacholia pared stake in two companies which fell more than 30 percent each year-to-date, and reduced stake to fall below 1 percent in almost 6 companies in the June quarter.

Kacholia reduced stake below 1 percent in Hikal, MIRC Electronics, Mold-Tek Packaging, Mastek, Nocil, and Gati fell below 1 percent in June quarter, data showed.

The small and midcaps that were marked underperformer in the calendar year 2018, and 2019 are showing signs of recovery in 2020. But, not all small & mid-caps stocks are buys.

The companies in which Kacholia reduced stake are KPIT Technologies and DFM Foods which were down more than 30 percent each so far in 2020.

Six out of eleven companies in which Kacholia kept his stake constant recorded negative returns so far in 2020 that include names like CHD Developers, Sgaily Engineering, Safari Industries, etc. among others.

Five out of eleven companies in which Kacholia kept his stake constant gave positive returns that include names like Birlasoft, Vaibhav Global, and Paushak, etc. among others.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions. These are not buy or sell recommendations.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!