The rally in Indian stocks was interrupted in the last week of February due to a sharp rise in bond yields and weak global cues, but the benchmark indices - Nifty and Sensex - closed the month with gains of at least six percent each. This was the second highest globally, just behind Indonesia's gain of 6.5 percent.

After hitting a high of 52,516 earlier in the month, Sensex broke below 50,000 on February 26. Nifty also declined more than 900 points during the month from the high of 15,431 recorded on February 16.

Investors should aim to have a long-term investment strategy as some dips are part of every healthy bull market. Experts say the recent dip was largely on account of external factors and does not change the structural view for Indian markets, which is largely on the upside.

“For India, most of the factors driving markets are in place except for valuations. As time goes by India’s valuations will moderate making it a good buy on the dips market going forward. The Nifty-50's range of 13,000 to 14,500 is an ideal range to accumulate stocks from 2 to 3 years perspective,” Rusmik Oza, Executive Vice President, Head of Fundamental Research at Kotak Securities told Moneycontrol.

“Our belief in economy-driven sectors has further strengthened after the Budget. Few sectors and pockets that we can visualise can make money for investors given their past underperformance are banks, capital goods, construction, engineering, oil & gas, cement, real estate & metals. Hence, one can have an accumulation strategy in economy-driven sectors on every decline,” he said.

Neeraj Chadawar, Head - Quantitative Equity Research, Axis Securities told Moneycontrol that the BFSI sector has underperformed the broader market in 2020 by a significant margin, owing to issues of moratorium and stress in the system.

Currently, Axis Securities is overweight on BFSI, auto, IT, specialty chemicals, telecom; equal weight on consumer staples, consumer discretionary, cement, metal & mining, pharma, real estate; and underweight on capital goods and oil & gas.

We have put together 4 portfolio allocation options as recommended by experts that can help you design your portfolio:

Portfolio 1

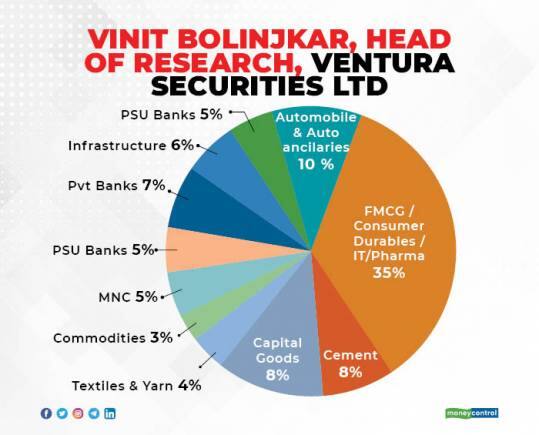

Expert: Vinit Bolinjkar, Head of Research, Ventura Securities

He feels that infrastructure, 2-wheelers, textiles, and PSU banks are expected to do well in FY22. With the pick up in construction activities and spending on automobiles, lower rates, and easy availability of credit, he is expecting a strong lending growth in PSU banks, which remained subdued in the past several years.

Bolinjkar has advised allocating 35% of equity portfolio to FMCG, consumer durables, IT and pharma stocks.

Portfolio 2

Expert: Sanjeev Hota, Head of Research, Sharekhan by BNP Paribas

Hota believes it’s a good time to tweak the portfolio and allocation should be higher towards private banks, infrastructure, building materials, autos and industrial & capital goods sectors.

"I would suggest 60% of the portfolio allocation should be towards these sectors and the rest 40% should be towards IT, FMCG, specialty chemicals, pharma and consumer discretionary.

Portfolio 3

Expert: Gopal Kavalireddi, Head of Research, FYERS

While the Budget has brought most of the old economy-facing sectors into focus, investors should rebalance their portfolios taking into account valuations and growth prospects.

"As IT and pharma continue to remain in portfolio, albeit at a lower weight post their excellent run over the last 1 year, infrastructure and realty sectors can be introduced in smaller portions. Banking, financials and insurance will continue to rule the roost at the highest allocation in the portfolio," Gopal Kavalireddi said.

Portfolio 4

Expert: Atish Matlawala, Sr Analyst, SSJ Finance & Securities

Matlawala suggests investors to allocate 25% of equity portfolio in banks, 20% in steel, 10% in cement, 25% in manufacturing (auto, electric & electronic goods, white goods), and 20% in Real Estate (Realty, Tiles & Sanitary-ware, Plywood, Pipes).

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.