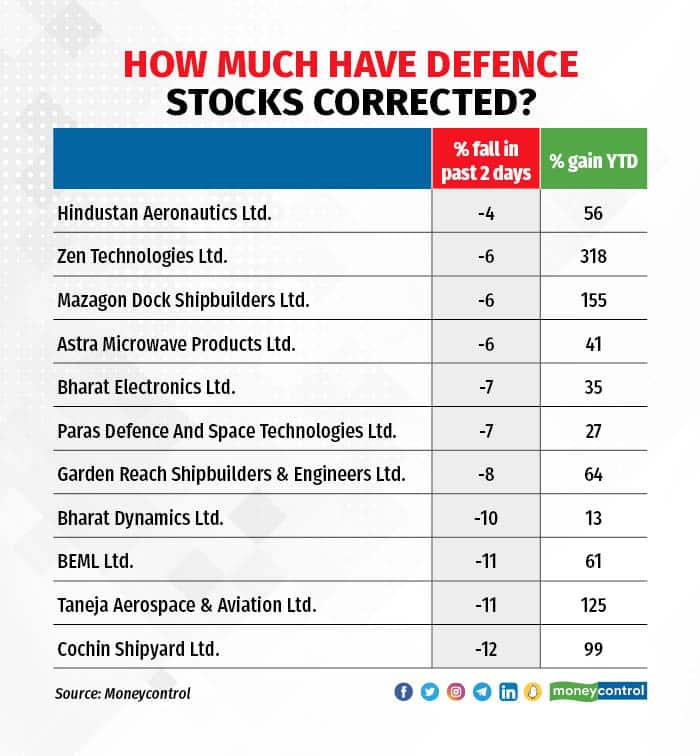

As defence stocks soared to dizzying heights during their recent rally, a correction seemed to be in the offing. And, sure enough, there has been a 4-12 percent fall in the share prices of these stocks towards the end of the weekly trading session.

“Defence stocks have undergone a correction of approximately 10 percent following a robust rally,” Anirudh Garg, Partner and Head of Research, Invasset, confirmed.

Profit booking

The recent selling pressure can primarily be attributed to profit booking by individual retail investors. However, it is worth noting that this selling was not accompanied by substantial trading volumes in recent days, Garg explained.

Some retail investors may have booked partial profits in defence stocks due to the recent corrections in the mid-cap and small-cap segments. Given the substantial returns generated by defence stocks over the past few months, it is understandable that investors sought to secure their profits, Garg added.

Read more | Defence stocks fly high: Unravelling the secret behind euphoria and valuation

Backdrop

Defence stocks had skyrocketed recently, fuelled by the Make in India initiative, soaring exports, and hefty order books. However opinion was split among investors over valuation.

How much have defence stocks corrected

How much have defence stocks corrected

On one side, sceptics believed these stocks had blasted past reasonable valuations and entered the overvalued zone. On the other side, the optimists argued that there was value in the sector that was yet to be unlocked, and that the best days were yet to come.

Untapped potential

The market has long acknowledged that the defence sector is a source of alpha generation (massive returns), and market experts have consistently underscored the significant untapped growth potential that remains to be explored in these stocks.

“Stock valuations were stretched, but when taking a long-term perspective into account, investors generally found the premium acceptable,” remarked Amit Anwani, Research Analyst at Prabhudas Lilladher.

Anwani cautioned, however, that a further correction should not be discounted at this point. Nevertheless, he was quick to point out that the sector’s long-term growth prospects remain robust. He suggested that long-term investors consider accumulating defence stocks, noting that a minimum correction of 20-25 percent would be necessary to put them in a sweet spot.

Read more | Story of valuations – Analysing disparity in defence stocks

Solid long-term prospects

Garg believes these stocks have limited downside risks because of the increase in institutional ownership, which has led to a reduction in their overall market liquidity.

Meanwhile, Antique Stock Broking is of the opinion that the multi-year growth prospects of the sector have expanded significantly, thereby justifying the current valuations. “Given the long-term potential of the Indian defence manufacturing sector, valuations of stocks at 24-25 times FY25 earnings are not stretched by any means,” the brokerage firm said.

The broking house has maintained its positive stance on Bharat Electronics, Bharat Dynamics, Hindustan Aeronautics, Mazagon Dock Shipbuilders, and Garden Reach. It concurs with Anwani's perspective that the sector harbours substantial growth potential and, as a result, warrants a long-term investment approach.

Even Garg said it might be wise to view the current sell-off as a buying opportunity, especially for long-term investors. “So, for those with a long-term horizon, using further dips as a chance to accumulate positions could be a more favourable strategy,” he added.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before making any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.