Defence stocks have been unstoppable lately, leaving investors ecstatic. The likes of Mazagon Dock Shipbuilders, Zen Technologies, Bharat Dynamics Ltd (BDL), Hindustan Aeronautics Ltd (HAL), and Taneja Aerospace and Aviation have soared high, like invincible aerial fighters.

Until two to three years ago, the defence sector had minimal representation in the equities market. However, this scenario has now changed, according to Ashwini Shami, smallcase Manager, EVP & portfolio manager at OmniScience Capital.

Sector still import-heavyWhat is fuelling this remarkable rally is the strategic push towards indigenisation and a possible surge in exports. The runway for growth is huge, because the Indian defence budget stands at $72.9 billion (Rs 6,03,101.7 crore), making it the third largest globally.

Catch all the market action LIVE here

India heavily depends on imports for its defence requirement, with a significant 60 percent being sourced from external suppliers.

As for stock performances, the growth is visible in the numbers. The Union Budget for FY23-24 envisaged a total outlay of Rs 45 lakh crore. Of this, the Ministry of Defence has been allocated a total budget of Rs 5.9 lakh crore, which is 13 percent of the total budget.

And in sync with that, order books of Indian defence players have grown remarkably over the past years. But after this explosive growth in stock performance, are stocks still worth buying, or for that, matter holding?

The fervent buying spree, however, has sparked concerns of euphoria in the defence space. Market participants fear that defence stocks are likely to have entered an overbought territory.

Is it euphoria?A large pocket of the market agrees to the defence sector witnessing some bit of euphoria. This has been led by strong government thrust on indigenisation in the defence sector - be it army, air force or navy - coupled with robust demand environment, domestically as well as in international markets.

Past rallies were the result of availability of defence companies at deep discounts and a strong growth outlook with huge order books, Shami highlighted.

“The defence segment is certainly euphoric and justifiably so. Valuations are relatively high, but remain largely justified in context of growth expectations,” said Nirav Karkera, head of research at Fisdom.

Even Shami sees the growth outlook continuing to remain strong because of the strong book-to-bill ratio and the continuous indigenisation efforts. Though, defence companies are clearly closer to their fair valuations as compared with the steep discount that was there a year or two back, investors should have reasonable expectations going forward, he added.

“Besides, from the valuation perspective, given the execution pipeline, we believe revenue and profit growth would support the high valuations in the coming years,” according Khadija Mantri, DVP at Sharekhan by BNP Paribas.

Large-sized contracts have been awarded to major defence players like HAL, BEL, BDL, and Mazagon Dock Shipbuilders. This has led to an all-time high order book for these companies. Further, most of the companies are seeing margin expansion due to operating leverage, he explained.

However, the market is somewhat divided on whether the current stock valuations consider the full potential of future growth and how much revenue visibility is already priced into the shares.

Taking a slightly different view, Anirudh Garg, partner and head of research at Invasset PMS, believes the book-to-bill ratio may not fully reflect the long-term potential, given the dynamic nature of the defence sector and the evolving opportunities.

However, he agrees to the larger view that the defence sector is poised for significant expansion as the government's focus on infrastructure development and modernisation intensifies.

“While the defence sector has indeed experienced a significant growth, it is crucial to recognise that every sector goes through its time and price corrections as part of the market cycle,” Garg pointed out. He thinks sector rotation is a common occurrence in the market, and the defence sector is the biggest beneficiary and leader of the current bull run.

A lot of rerating has already happened in the sector and replacement of aging equipment in all three services is likely to drive more capital expenditure, said Amit Anwani, Prabhudas Lilladher.

Since the sector is evolving and there are more opportunities arising in the space, it is less relevant to compare companies on the basis of P/E multiples which are unlikely to reflect the complete growth potential. But what could be the right way to evaluate the stock valuation in defence sectors is cash flows and order book perspective, Anwani highlighted.

Also Read: Defence stocks might be riskier in the short term, says Kotak Mahindra AMC MD Nilesh Shah

Here’s what led to the buying spree:

Strong order bookOne of the main reasons for the sky-high surge in defence stocks was the huge order books that ranged 4-10 times the current revenues, like Shami pointed out.

“On the back of such macro tailwinds, order books of defence companies have started filling up at a significant pace with a similar quantum. Domestic producers are also witnessing promising traction, through export orders as well,” said Karkera.

He pointed out that the book-to-bill ratios are at higher levels, reflecting a robust demand environment. While order books are filling in, the incremental focus is gradually shifting towards capacity and pace of order servicing, he added.

IndigenisationThe Indian government is promoting 'Atmanirbhar Bharat' in the defence sector through policies such as increased indigenisation, strategic partnership model for private participation, import embargoes, indigenisation lists, higher Foreign Direct Investment (FDI) limit of 74 percent, and defence corridors in Uttar Pradesh and Tamil Nadu.

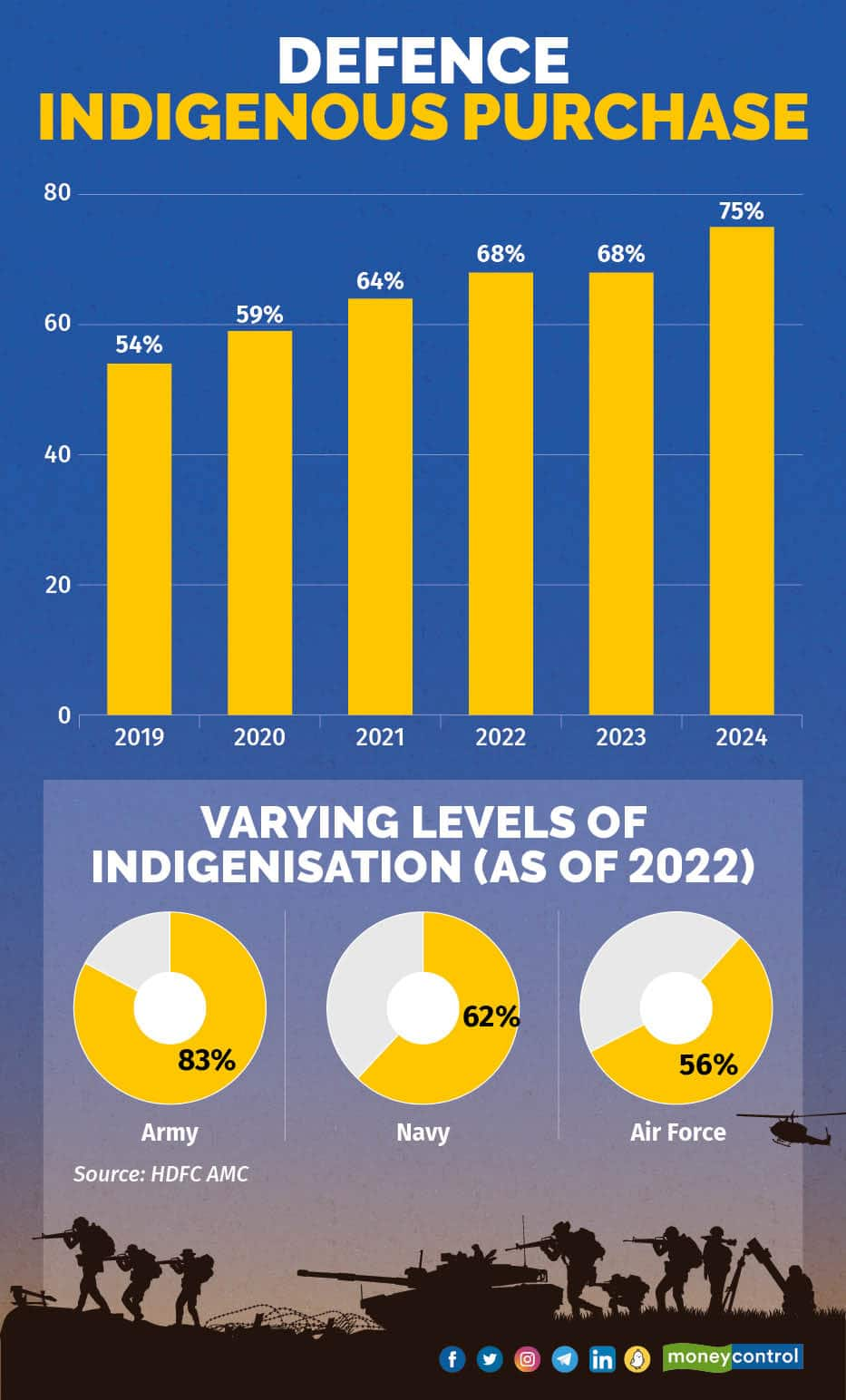

According to PhillipCapital, the Make-in-India initiative has led to a significant increase in domestic defence capital procurement. In FY23, it accounted for 68 percent of the total, up from 38 percent in FY13. Further, the streamlining of defence procurement procedures and relaxation of the offset clause have attracted foreign investment, the brokerage firm said.

Indigenous defence purchase is seen increasing to 75 percent in 2024 and in following years, from 54 percent in 2019, as per a presentation by HDFC Asset Management Company.

In FY23, the government approved the acquisition of defence equipment, with 99 percent domestic sourcing, worth around Rs 2.7 lakh crore. But a large part of indigenisation benefits is yet to reflect in the revenues of domestic companies, given the time lag in execution, post orders, the AMC pointed out.

Karkera believes that the euphoria is also attributable to the positive re-rating of the sector and players within.

Also Read: Private defence stocks over public ones? Here’s what the market thinks

Rising exportsIndia’s defence exports grew 5.5 times between FY2015 and 2019 because of the many reforms and steps, boosted by the government’s efforts towards ease of doing business, PhillipCapital highlighted in a research report.

Some of the major export destinations for defence products have been Italy, Maldives, Sri Lanka, Russia, France, Nepal, Mauritius, Sri Lanka, Israel, Egypt, UAE, Bhutan, Ethiopia, Saudi Arabia, Philippines, Poland, Spain, and Chile, etc, according to the brokerage report.

In 2020-21, exports experienced a decline primarily due to supply chain and manufacturing disruptions. However, those disruptions have now eased. The Indian government has set an ambitious goal to increase defence exports to Rs 35,000 crore by FY25, a significant rise from Rs 11,600 crore in FY22.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.