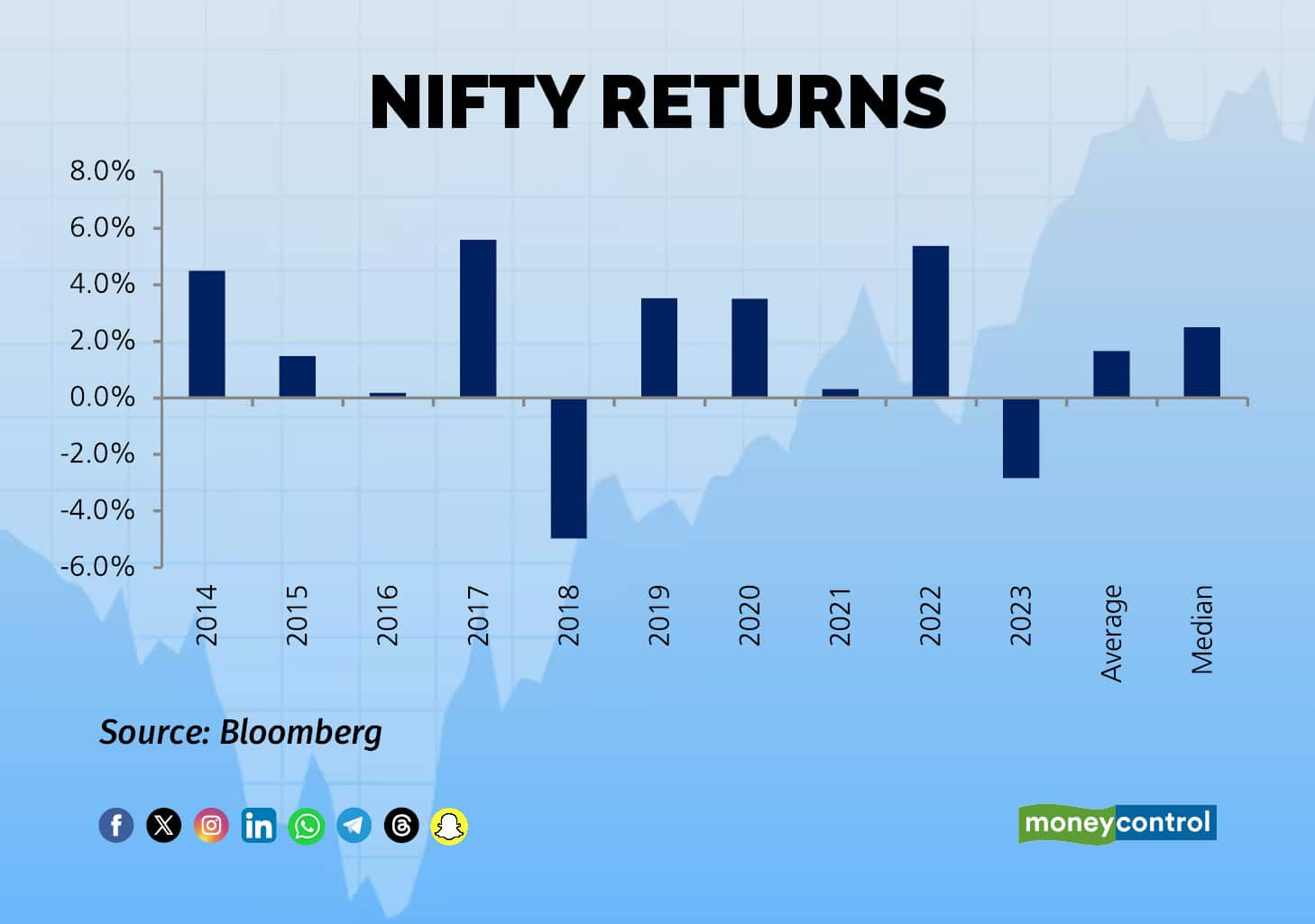

October could bring further positivity to the Nifty 50 index, which has ended on a positive note for the month in eight of the past ten years.

Domestic brokerage JM Financial's analysis for the month of October indicates that the Nifty has shown one of the strongest positive price seasonality. Seasonality refers to the tendency of an index to perform better during certain periods of the year and worse during others.

In the last 10 years, the index has closed in the green on eight occasions with an average return of 1.7 percent and a median return of 2.5 percent.

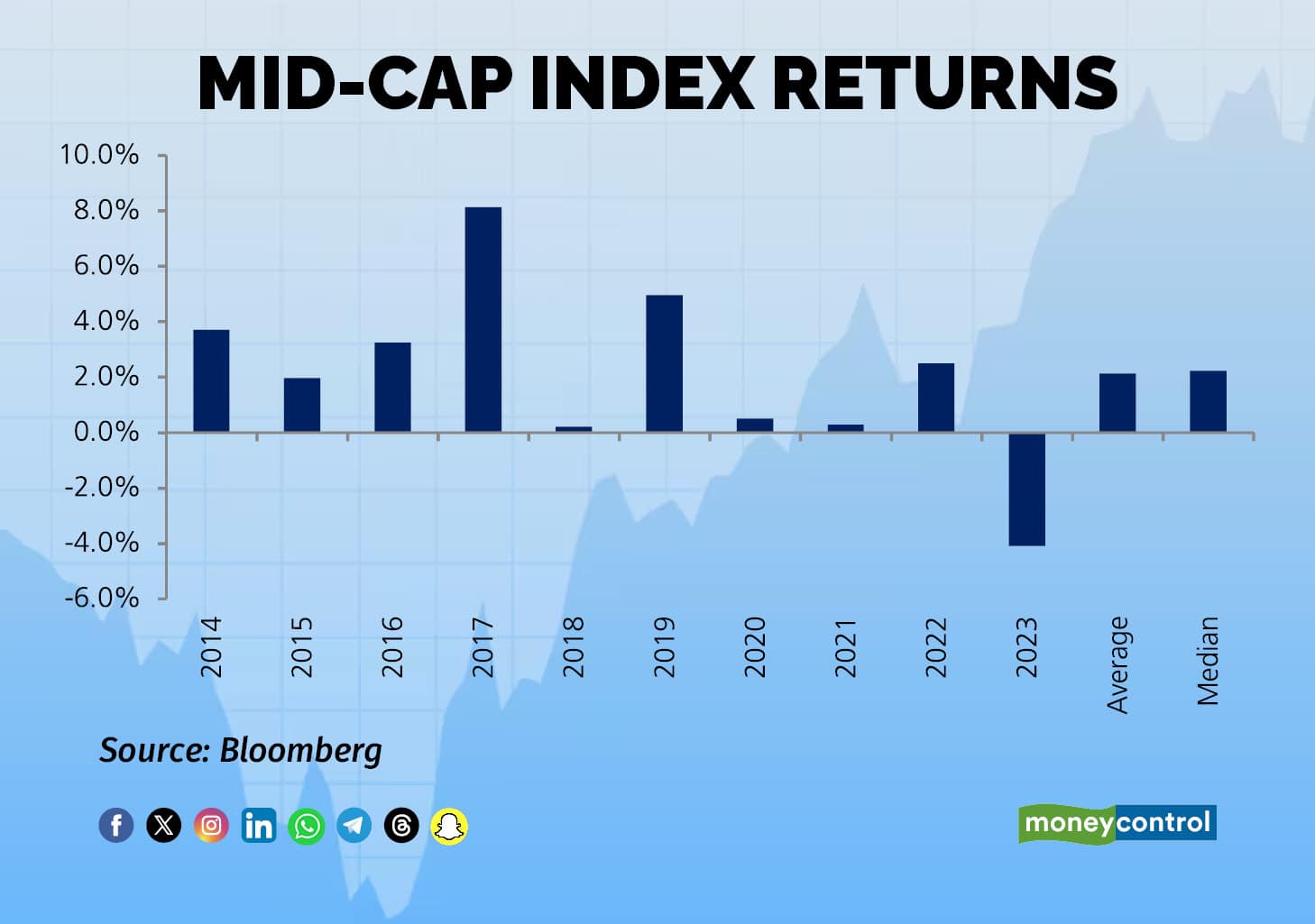

The Nifty Midcap 100 index has a stronger seasonality tied to October, settling in the green on nine occasions with an average and median return of 2.1 percent and 2.2 percent respectively.

However, it has managed to outperform the Nifty 50 only on five occasions with an average outperformance of 0.4 percent, noted JM Financial.

Follow our market blog to catch all the live updatesVarious sectors usually have strong seasonality with different months in a year. For October, JM Financial noted that Bank Nifty, along with the auto, metals and energy indices have settled with gains. While the banking index rose nine out of ten years, the other indices ended the month with gains in seven out of ten years.

On the other hand, Nifty FMCG seems to fare poorly in October, sinking into the red 70 percent of times in the past decade, with an average and median negative return of 0.6 percent and 0.5 percent respectively.

The brokerage also analysed the relative performance of a sector over the Nifty 50. In the month of October, the Nifty Energy and Nifty PSU Bank outperformed the frontline index on seven occasions.

The Nifty IT index underperformed the Nifty 50 in October on eight occasions, while the FMCG index underperformed the benchmark seven times.

Certain stocks too, exhibited a strong seasonality factor in October. Canara Bank, Delta Corp, TVS Motor Company, ICICI Bank, NMDC, Power Finance, SAIL, REC and Manappuram Finance closed in the green on eight or more occasions, with an average positive return of eight percent, noted the brokerage.

Meanwhile Vodafone Idea, Astral and Biocon have negative seasonality, closing in the red on seven occasions, with an average return of -3 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.