A nationwide lockdown of 21 days was imposed by the government from March 24, 2020, and that was the day when D-Street made an intermediate bottom.

The S&P BSE Sensex hit an intraday low of 25,638 while the Nifty50 made a swing low of 7511 on March 24, and since then both the benchmark indices have rallied more than 30 percent to climb above crucial resistance levels.

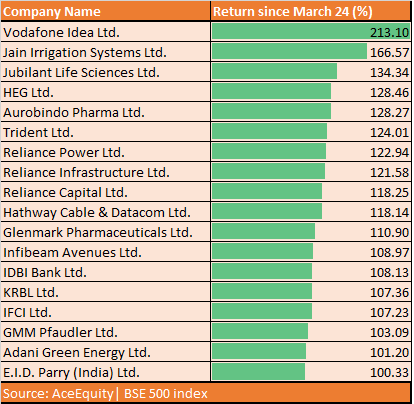

While Sensex and Nifty might have rallied by over 30 percent since March 24, there are 18 stocks in the S&P BSE500 index that have more than doubled investor wealth in the same period.

Stocks that have more than doubled investors’ money include EID Parry, Adani Green Energy, IFCI, KRBL, Aurobindo Pharma, HEG, Reliance Power, and Vodafone Idea.

“Stock like Vodafone have witnessed massive erosion in prices. Being highly oversold, these stocks have bounced back. Further, Aurobindo Pharma, Glenmark, and Jubilant Life Science have been in a correction since 2018. Being oversold and the pharma sector reviewing was the initial trigger for these stocks to rally,” Abhishek Karande, CMT, Senior Analyst at Reliance Securities told Moneycontrol.

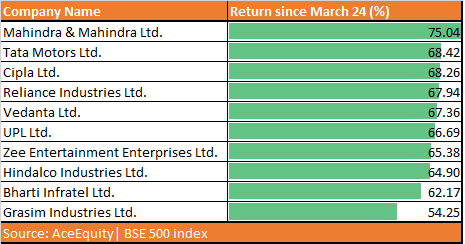

As many as 23 stocks rallied more than 35 percent since March 24, and 10 stocks gave a return of more than 50 percent in the same period.Stocks that rallied more than 50 percent include names like M&M, Tata Motors, Cipla, Reliance Industries, Vedanta, ZEE Entertainment and Bharti Infratel.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.