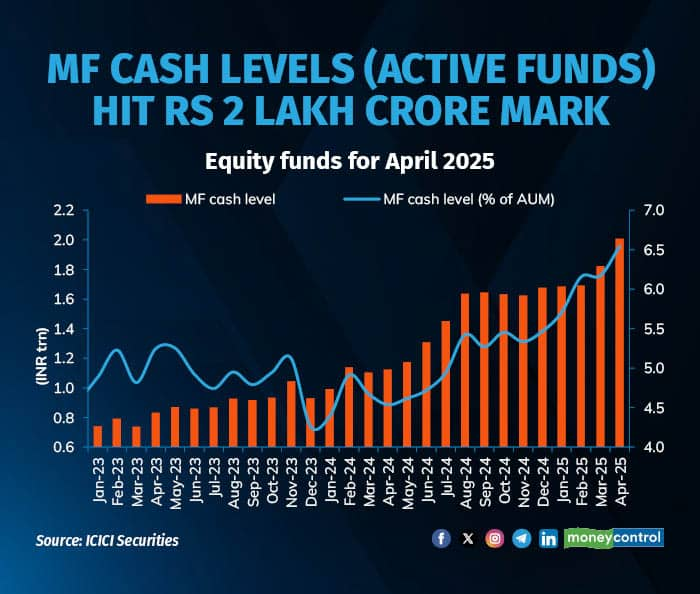

In April 2025, cash holdings in equity mutual fund schemes continued to see an increase, with 22 out of 43 fund houses (53 percent) increasing their cash allocations compared to March, according to data from Prime MF, signalling a cautious stance by fund managers amid market uncertainty.

The overall cash holding rose by Rs 20,834 crore to touch Rs 1.73 lakh crore. Among equity mutual fund scheme categories, flexi-cap funds held the highest aggregate cash, followed by mid-cap and small-cap funds, as per data from Prime MF.

Several large fund houses saw substantial increased in their cash positions. ICICI Prudential Mutual Fund added Rs 3,987 crore, an increase of 22.26 percent. HDFC Mutual Fund raised its cash holding by Rs 3,154 crore (17.28%), and SBI Mutual Fund followed closely with a Rs 2,443 crore increase (9.25%).

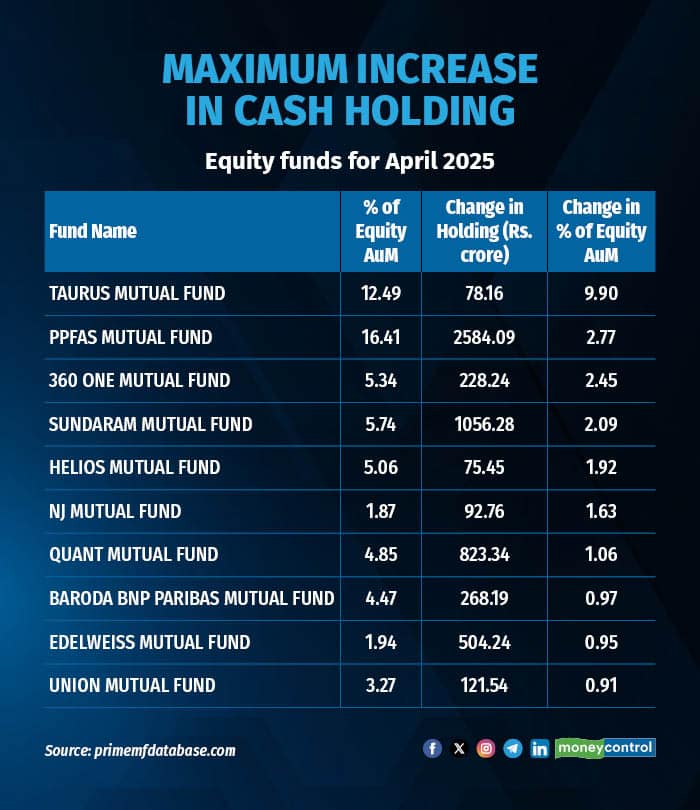

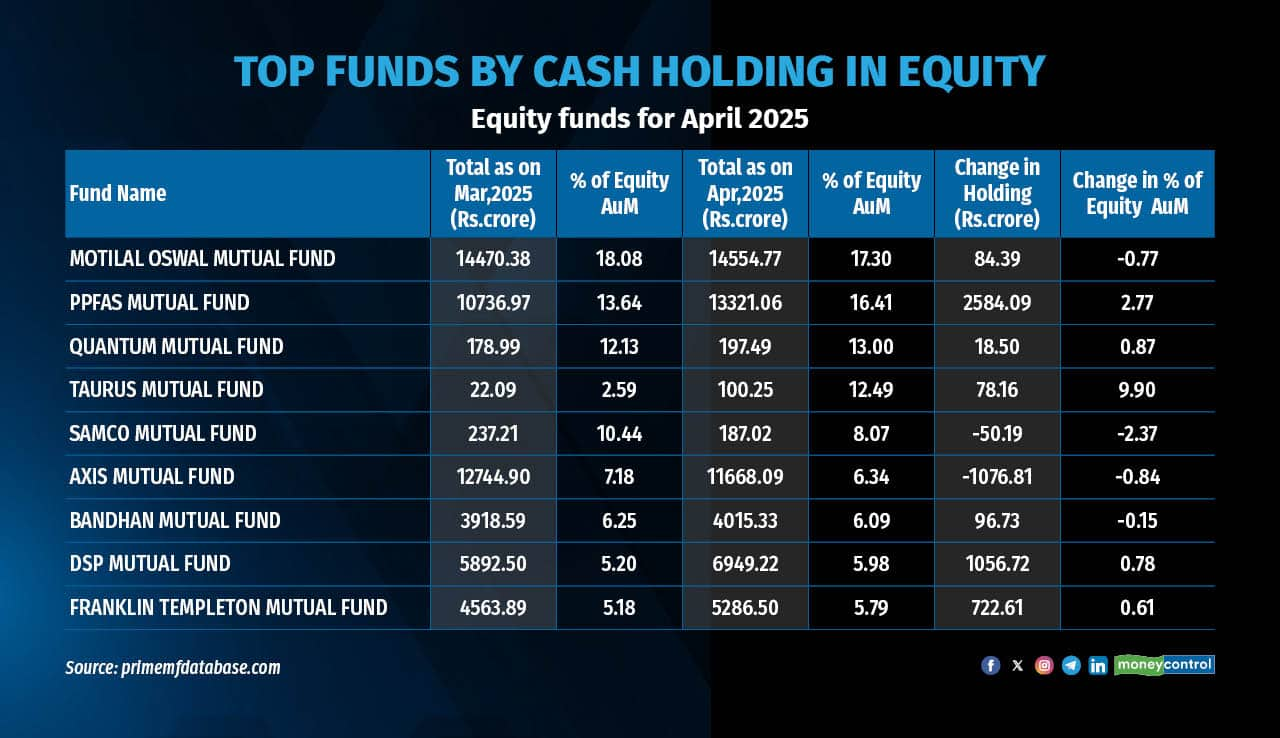

Further, DSP Mutual Fund also significantly increased its cash reserves from Rs 5,892 crore to Rs 6,949 crore, with its cash position increasing from 5.20% in March to 5.98% in April. PPFAS Mutual Fund also saw a substantial increase in cash allocation from 13.64% to 16.41%.

On the other hand, 21 mutual fund houses cut down on their cash positions.

Axis Mutual Fund reduced its cash holding by Rs 1,076 crore bringing down its allocation from 7.18% to 6.34%. Talking about their strategy on cash holdings, Shreyash Devalkar, Head Equity, Axis Mutual Fund told Moneycontrol that for them decisions on cash holdings are based on valuation and not specific market movement. He explained that cash is “an outcome of managing excessive valuation risk (in high growth themes and stocks) and low growth risk (in low valuation stocks)." He added that as they get right ideas, they continue to deploy in it. "More than cash holding, the stock holdings which forms bulk of the portfolio, determines the outcome," he added.

Mirae Asset Mutual Fund also trimmed its cash holding from Rs 1,702 crore to Rs 1,542 crore, with its cash holding dropping from 1.07% to 0.94%. Gaurav Misra, Head - Equity at Mirae Asset Investment Managers (India) noted that as a policy they do not take cash calls based on market direction.

"When an investor allocates capital to equities, they expect that money to be managed within the equity space. Decisions to hold cash or reduce market exposure are best made by the investor or their advisor at the asset allocation level, not within the equity portfolio," he said adding that while markets may go through uncertain phases, they prefer to adjust portfolios by changing sector or stock weights and not by moving into cash.

"Taking cash calls requires getting both exit and re-entry right, which adds timing risk and increases the chance of missing a recovery," he added.

JM Financial Mutual Fund reduced cash from 3.93% to 1.55% while Old Bridge Mutual Fund reduced its cash position from 9.51% to 3.53%. Currently, Motilal Oswal MF (17%), PPFAS (16%), Quantum MF (13%), Taurus MF (12%) and Samco MF (8%) held the largest cash holdings.

Among equity mutual fund categories, flexi-cap funds held the highest aggregate cash at Rs 20,195 crore, followed by mid-cap and small-cap funds at Rs 13,240 and Rs 11, 616 crore, respectively.

“Some thematics, have provision for high cash calls but we don’t have any fund with more than double digit cash call right now,” said Manish Gunwani, Head – Equities, Bandhan AMC, which reduced its cash holding from around 6.25% to 6.09%.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.