The Indian equity market plunged 2 percent in the holiday-shortened week as investors turned cautious ahead of the Union Budget 2023-24, which will be presented on February 1, and the US Federal Reserve meeting whose outcome will be shared the same day.

For the week, the BSE Sensex shed 1,290.87 points, or 2.12 percent, to close at 59,330.9 and the Nifty fell 423.3 points, or 2.34 percent, to end at 17,604.35. The fall in small and mid-cap indices, however, was sharper.

Small and mid-caps hammeredDuring the week, BSE smallcap, midcap and largecap indices fell 3.5 percent, 2.6 percent and 3 percent, respectively.

"The fall in BSE smallcap and the BSE midcap indices saw sharper correction vis-à-vis key benchmark indices like Sensex 30 and Nifty 50. On a sectoral basis, multiple indices declined this week in excess of 5 percent," Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities, said.

The BSE auto index, however, showed, partly supported by positive market reaction to Bajaj Auto and Tata Motors Q3FY23 earnings, he said.

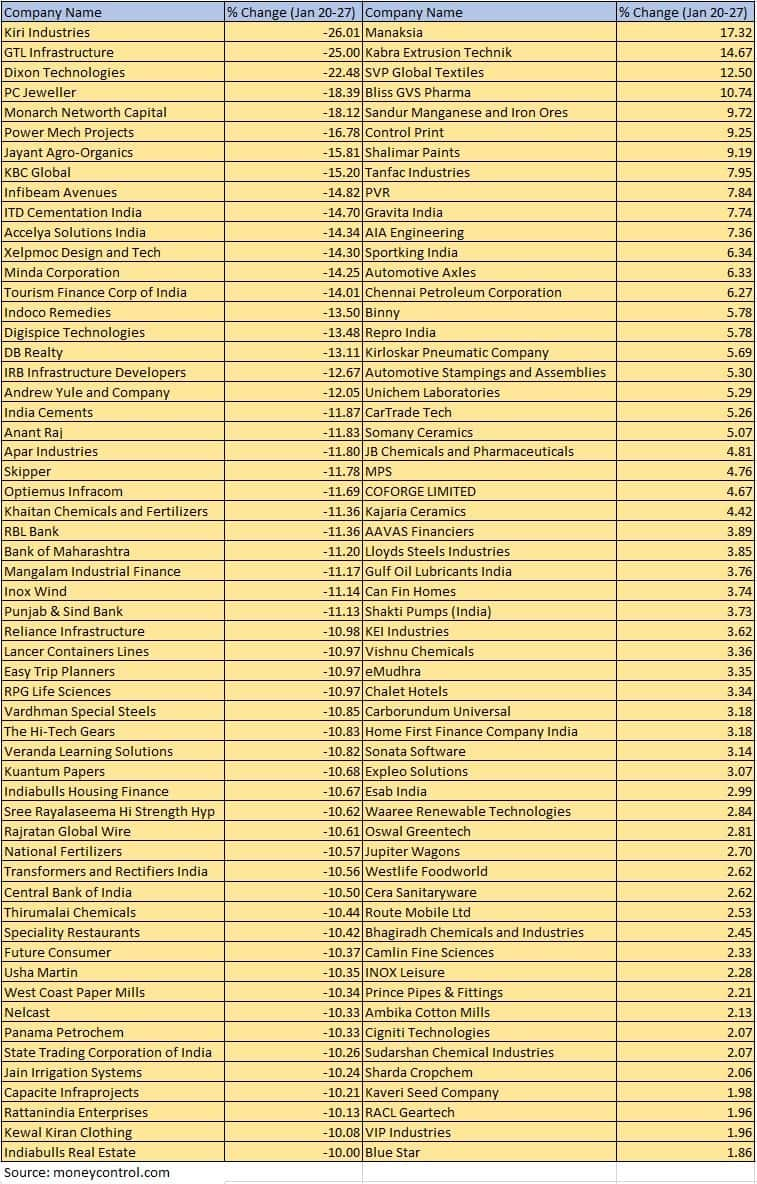

The BSE smallcap index declined 3.5 percent. Kiri Industries, GTL Infrastructure, Dixon Technologies, PC Jeweller, Monarch Networth Capital, Power Mech Projects, Jayant Agro-Organics and KBC Global slipped 15-26 percent.

However, Manaksia, Kabra Extrusion Technik, SVP Global Textiles, Bliss GVS Pharma, Sandur Manganese and Iron Ores, Control Print and Shalimar Paints gained 9-17 percent.

"Despite the optimistic result announced by the blue chips, this week’s market sentiment suddenly got dampened by the unfavourable research report on Asia’s richest promoter Group companies. The same is obnoxiously affecting banking stocks (BSE Bank down by >5%), despite its positive results owing to high group lending; with PSU banks being the most impacted due to high exposure," said Vinod Nair, Head of Research at Geojit Financial services.

The Nifty PSU bank index shed 9.6 percent, the Nifty energy index lost 7.5 percent, oil & gas 7.4 percent and the metal index declined 6 percent. The Nifty auto index, however, added 3 percent.

Budget worries, FII selling spreeThe market appeared to be uneasy ahead of the Budget 2023 and the Fed meeting, Nair said. Foreign institutional investors were selling as funds were being shifted to other emerging markets because of attractive valuations.

Foreign institutional investors (FIIs) continued their selling spree and offloaded equities worth Rs 9,352.18 crore in the week. Domestic institutional investors (DIIs) provided support, as they bought equities worth of Rs 7,210.53 crore.

In January, so far, FIIs have sold equities worth Rs 29,232.29 crore and DIIs have bought Rs 23,392.91- crore worth of shares.

An increase in funding towards capital expenditure and rural areas within the constraints of the fiscal deficit controls would be favourable, he said.

“…Any unfavourable proposals, such as an increase in LTCG rates/ duration or populist measures due to the pre-election budget, could add to the bearish mood in the short term," he said.

The Fed was expected to raise rates by 50 basis points and any decrease from this level would be considered positive.

“The recent trend of an uptick in crude prices due to a rebound in demand from China may add pressure to the domestic market in the near term," Nair added.

Where is the Nifty headed?Apurva Sheth, Head of Market Perspectives & Research, SAMCO SecuritiesThe Nifty ended the truncated trading week 2.35 percent down. The index broke below an important support of 17,800, which it was holding for a month. It formed a reverse flag formation and broke the support.

This indicates that there could be further selling pressure. In that case, the index can drop to 16,750. Immediate support is placed at 17,500. Resistance for the index is at 17,800.

With the Budget 2023 to be unveiled on February 1, the following week will be packed with activity. Markets will remain erratic as all eyes will be on the finance minister's final comprehensive budget before the general elections. Quarterly earnings season will also have an impact on how stock moves.

The Fed meeting will catch market players' eyes on a global scale. Next week, the unemployment rate will be announced, and the markets will try to interpret the state of the world economy. Investors ought to exercise caution and put their money in companies with solid fundamentals.

Amol Athawale, Deputy Vice President - Technical Research at Kotak SecuritiesDuring the week, the Nifty traded below the 20-day simple moving average (SMA) mark and also breached the important support of 17,800. It formed a long bearish candle on the weekly charts.

Technically, a minor pullback rally is possible if the index trades above 17,650. On the flip side, selling pressure is likely to intensify if it breaches 17,550 and below it, the index can slide to 17,400. An extended correction can drag the index to the 200-day SMA or 17,300.

Ajit Mishra, VP - Technical Research, Religare BrokingParticipants were already facing challenges due to mixed global cues and caution ahead of the Union Budget and this breakdown has further added to worries.

We are now eyeing the 17,250-17,400 zone as the next support, while any rebound toward the 17,750 level will attract selling pressure. We thus reiterate our view to hedge positions and align trades according to the trend.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.