Dear Reader,

Indian markets continued to stay strong and closed in the green for the second straight week despite hawkish comments from Fed chair Jerome Powell. Global markets faced a volatile week with Powell's comment leading to a sharp fall on Thursday, which took away all the gains made during the week. Thursday's fall ended the longest winning streak in two years for S&P and Nasdaq. However, a sharp tech-led rally helped US indices close in positive territory.

Friday was also the last day of an eventful Samvat 2079, which saw Indian indices touch new highs. Sensex touched a high of 67,927.23 and Nifty50 reached a peak of 20,222.45. The Samvat will be remembered for the sharp rally in smaller indices, with SmallCaps gaining 34 percent, and MidCaps by 31 percent as against an 8 percent gain by LargeCap indices.

The market continues to defy data in its slow but steady rise. Despite strong short positions by FIIs, the market continued to move higher. The strength in the market shows that it can continue towards 19840 with support at 19350 in the coming week, unless there is weakness in the international market.

Markets To Remain Strong

Though the swing touched an overbought zone at 92 during the week, indicating a short-term pause, we only saw a small intra-week dip, suggesting a strong market. Prices are now diverging from the swing, which can happen if the trend is very strong in the short term.

Source: web.strike.money

Source: web.strike.money

The number of Nifty 500 stocks above the 20 DMA (Day Moving Average) is at 59 percent. The recent tops were when the reading was close to 90 percent. In a trending market, there will also be negative divergences before the final high. So far, we are in overbought territory, leaving room for the markets to go higher.

Source: web.strike.money

Source: web.strike.money

FIIs Maintain Their Shorts

FIIs have continued selling in the cash market, offloading Rs 3,105.27 crore of shares during the week. In the derivative market, FIIs remain short to a significant degree and only cover a small portion of their position. Though the short position has decreased from 176k to 156k contracts, it is still near the highs. Getting them to cover the shorts will take a bigger upside move in the Nifty.

History shows that the market goes higher first when there is a significant short position in the market. Usually, shorts will be reduced to near zero before the market falls again.

Source: web.strike.money

Source: web.strike.money

Options Data

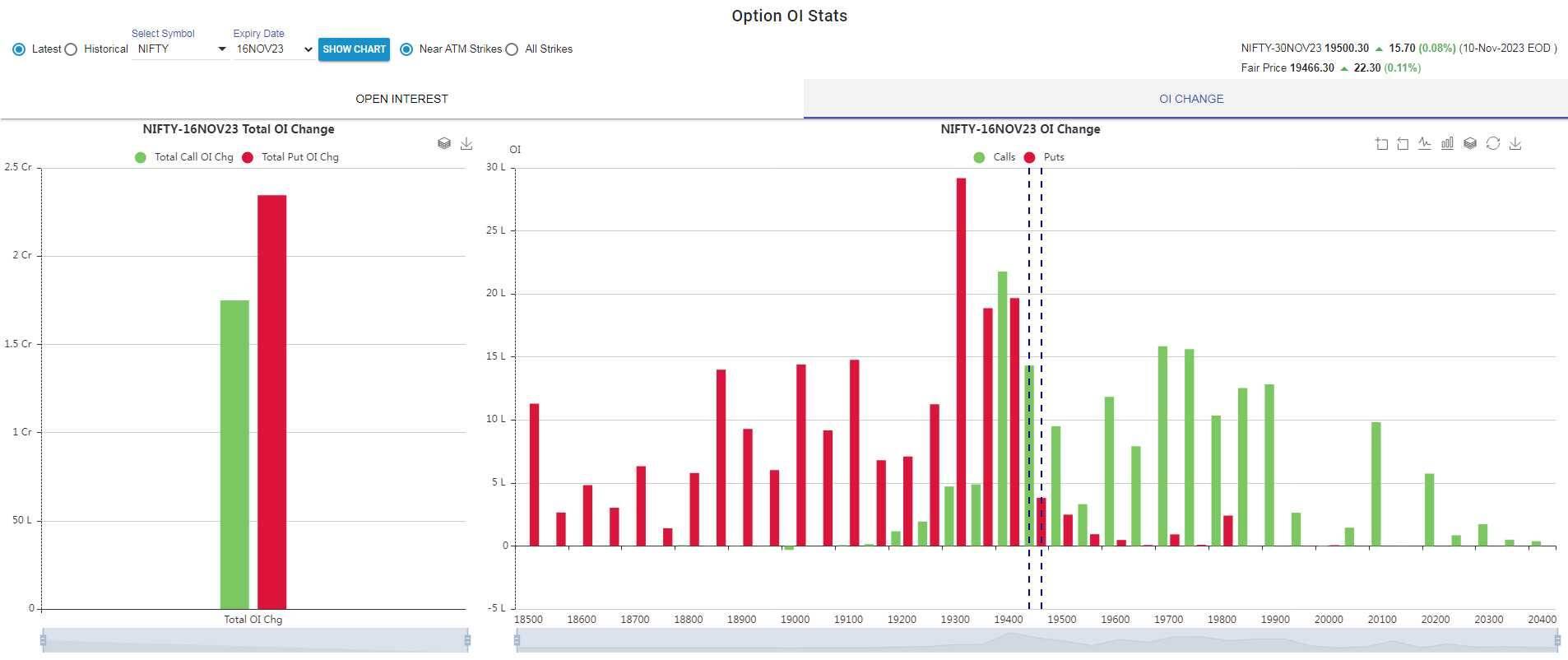

During the week, the market experienced a shift as it wound up short Call positions and created long positions by shorting puts, as shown in the chart below.

Source: Icharts.in

Source: Icharts.in

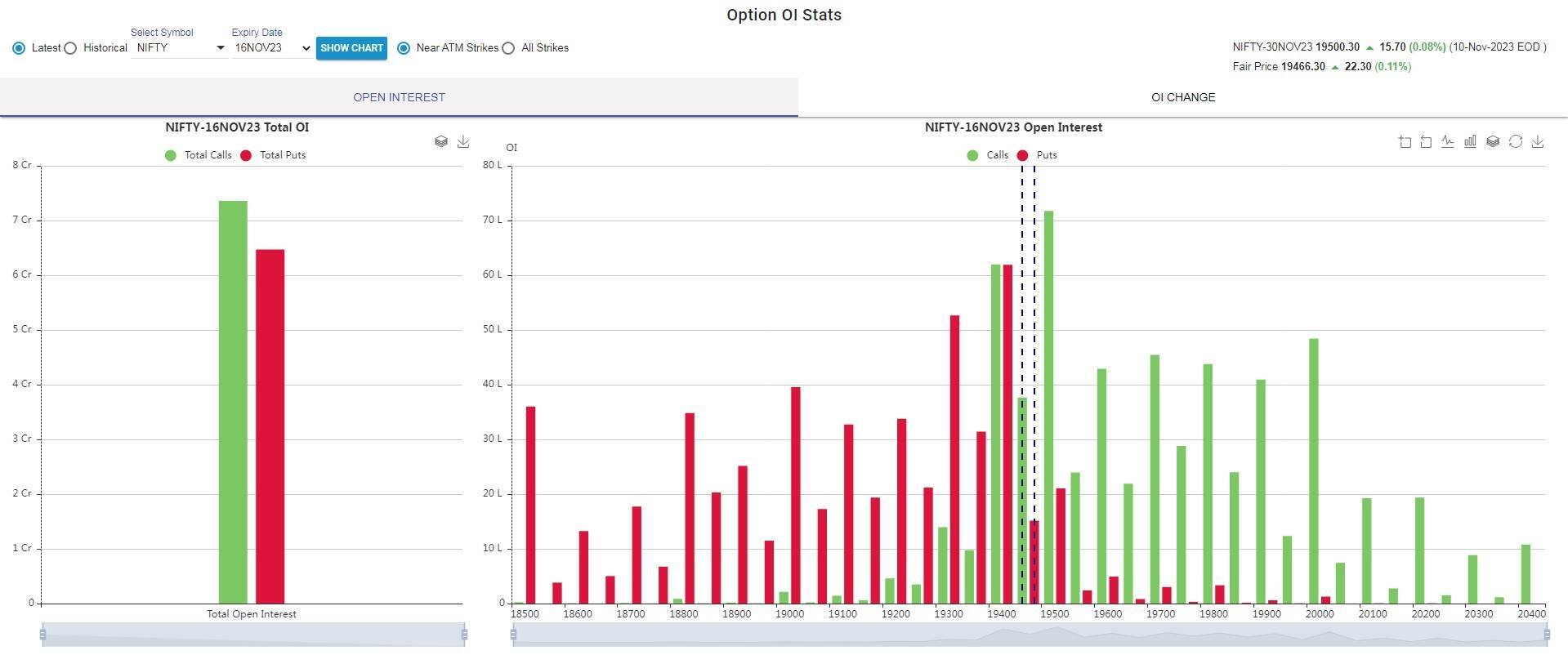

Despite the shift, overall, there are still more call writers in the market than put writers for the November 16th expiry, indicating that the upmove may still face some resistance.

Source: Icharts.in

Indices and Market Breadth

During the week, Sensex gained 0.84 percent while Nifty moved one percent higher. The smaller stocks continued outperforming the frontline stocks, with the MidCap index gaining 2.6 percent and the SmallCap index closing 2 percent higher.

Among the top-performing sector was Healthcare which rallied 4 percent, Capital Goods moved 3 percent higher, the Metal index gained 3 percent, and the Realty index closed 2.6 percent higher.

The top-performing stock during the week was Neuland Laboratories which saw a 39.73 percent move, IFGL Refractories increased by 29.13 percent and CarTrade Tech shot up by 25.59 percent.

The top losers were Gujarat Themis Biosyn which fell by 16.89 percent, Navneet Education, which dropped by 11.35 percent, and Best Agrolife fell by 11.01 percent during the week.

Global Markets

Powell stole the limelight during the week. He expressed reservations about the effectiveness of the current level of interest rates in addressing the inflationary pressure faced by the US central bank in reaching its 2 percent inflation target. His comment, “The fight to restore price stability has a long way to go’ did not go well with the market, which fell sharply on Thursday. However, by Friday, bond yields improved, signalling that the market is expecting next week’s inflation numbers to be positive for the market. Friday also saw the Nasdaq close 2.6 percent higher, the highest move since May 2023, on strong numbers from tech companies.

The Dow Jones closed the week 0.7 percent higher, while S&P 500 gained 1.3 percent and Nasdaq 2.4 percent. European markets were mixed, with the pan-European Stoxx 600 closing marginally lower during the week. Economic numbers from the continent stayed weak, with the UK recording zero growth in GDP compared to 0.2 percent in the previous quarter and Germany’s industrial production falling 1.4 percent in September.

In Asia, Hang Seng was the weakest, closing the weak with a 2.68 percent drop, while Shanghai managed to close in positive territory at a 0.27 percent gain. Nikkei was the strongest market, closing 1.93 percent higher after the Japanese government announced a $110 billion stimulus package to fight inflation.

Stocks To Watch

Among the stocks showing strong momentum are Aarti Industries, Alkem Labs, Apollo Hospitals, DLF, Godrej Properties, IPCA Labs, Metropolis, and Trent.

Ambuja Cements, Bajaj Finserve, Hindustan Unilever, and ITC offer good risk-reward trades.

Cheers,Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.