Dear Reader,

Indian markets consolidated this week despite reaching new highs. The week was marked by short covering by Foreign Institutional Investors (FIIs) in the derivatives market and a resumption of buying in the cash market. However, these factors failed to push the markets significantly higher, resulting in a narrow trading range and ending the week with only a marginal gain.

Global markets continue to rise, especially the US markets, which touched new highs during the week. Michael Green, chief strategist at Simplify Asset Management in Philadelphia, captured the global market sentiment by saying, "It's Nvidia's game, and the rest of us are just pretending to be here." The US markets have been rising, driven by Nvidia and intense activity in the options market. With seven million call options on Nvidia, this activity is about four times higher than the volume of US options a few years ago.

While Indian markets have consolidated, data suggests there is still room for upward movement before a correction occurs. However, headwinds such as the delayed monsoon and global market conditions could expedite a downturn.

Short-term pullback likely

The Nifty closed flat for the week, which is typical as we approach the monthly expiration of stock options, particularly those that are delivery-settled. Once this period passes, the market is likely to move higher. Today's market rotation might be more evident in hindsight.

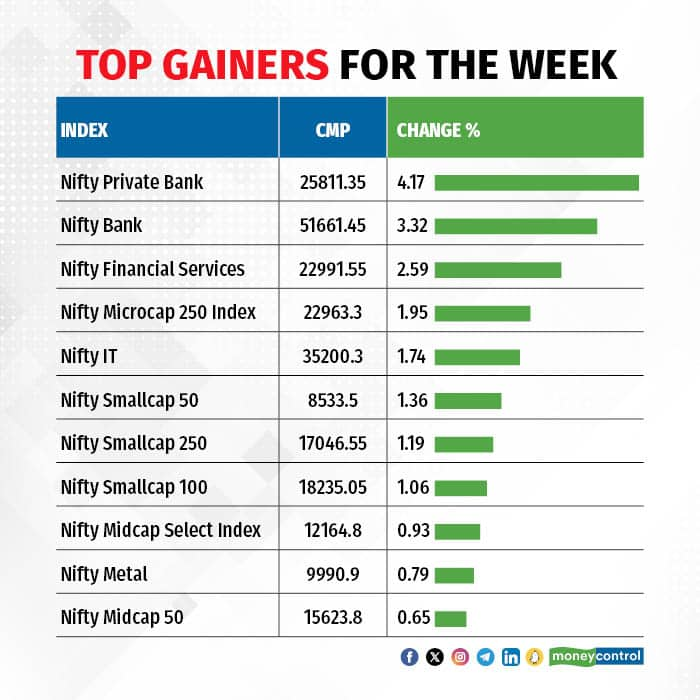

Below, we provide tables of sectoral gainers and losers. The winning sectors include Banking, IT, and Metals, along with mid and small-cap indices. There is reason to believe these trends will continue. Weekly momentum indicators remain bullish, suggesting a pre-budget rally could begin once the short-term correction is complete.

On the other hand, the sectors that are falling out of favour are Auto, Oil and Gas and PSE. The strong performers ahead of the elections could see correction due to overbought weekly charts and negative momentum divergences.

Source: web.strike.money

While Nifty is falling in the short term, it may not go much lower due to fresh leadership from new sectors. The near-term pressure may almost be over, as the daily swing at 28 has been falling for a while and can quickly get back to below <=20, where it would be oversold (see chart Daily Swing).

Source: web.strike.money

FIIs have covered all their shorts in the market and are now long with 73,991 contracts in index futures (see chart FII Net Index Futures). While this is a significant number, it is not anywhere near the highest in the range. A near-term market reaction may occur, but we are unlikely to see a market top until the number of long contracts exceeds 180,000. This expectation is based on historical patterns observed in recent years.

FII Net Index Futures

Source: web.strike.money

Sector rotationThe Relative Rotation Graphs (see RRG chart) show that Oil & Gas, PSE, CPSE, and Infrastructure sectors have moved into the "improving" quadrant, indicating an increase in Relative Momentum. The IT index is now in the "leading" quadrant, reflecting a rise in both Relative Strength and Relative Momentum. Consumer Durables, Auto, Media, and Realty sectors continue to exhibit high Relative Strength. Despite a sharp decline in Relative Momentum for the FMCG sector, the broader picture on the weekly RRG still suggests a potential comeback for FMCG.

In the coming week, interesting buying opportunities can be found in the FMCG and IT sectors. According to the RRG chart, the sectors expected to remain strong are Consumer Durables, Media, Realty, and Auto.

RRG Chart

RRG ChartSource: web.strike.money

The table below shows the strength of various sectors over various timeframes.

Source: Quant Lab

Short-Term Sector PotentialsNifty Realty: Over the past seven days, Nifty Realty has been the strongest-performing sector. However, its momentum has weakened compared to its performance over the last 14 days, indicating a potential cooling-off period or consolidation phase after a strong initial surge.

Nifty PSE (Public Sector Enterprises): This sector has shown the strongest pullback in the short term. Nifty PSE moved from underperformance to outperformance when comparing the last 14 days to its prior performance. This turnaround suggests a positive shift in investor sentiment and possibly new fundamental developments driving this sector higher.

Over a longer timeframe of up to 90 days, Nifty Financial Services, Nifty Private Bank, and Nifty Realty have consistently outperformed the broader market.In summary, while short-term dynamics can exhibit volatility and sector rotations, long-term trends indicate sustained strength in financial services, private banking, and realty sectors.Indices and Market BreadthIndian markets traded within a narrow range despite buying activity from Foreign Institutional Investors (FIIs). The Nifty gained 0.15% for the week, while the Sensex closed 0.28% higher. The Small-cap index rose 1.5%, whereas the Mid-cap index remained flat.

FIIs purchased equities worth Rs 2,030.83 crore during the week, but they still show a net outflow of Rs 2,584.72 crore for the month.In the derivatives segment, the top-performing stocks were Chambal Fertiliser, with a 21.19% gain, City Union Bank, up 7.70%, and Bandhan Bank, rising 7.66%. The biggest losers were ABB, down 6.88%, Hero MotoCorp, falling 6.07%, and Zee, dropping 5.94%.Global MarketsGlobal markets were strong during the week, with the MSCI World index closing 0.45% higher. Despite some weakness in the latter half of the week, the US market closed in the green, with the Dow Jones gaining 1.45% while the Nasdaq remained flat. Friday was particularly volatile in the US due to the triple expiry of derivative contracts: stock options, index options, and stock index futures.

The European market stabilized after a sharp decline the previous week due to political news. The Stoxx Euro 600 closed the week with a gain of 0.61%. The Bank of England kept rates unchanged at 5.25%, as expected. The FTSE 100 rose 1.12%, the CAC 40 increased by 1.67%, and the DAX gained 1.02%.Asian markets were mixed, with the Nikkei 225 losing 0.50% and the Shanghai Composite dropping 1.37%. In contrast, the Hang Seng closed 0.63% higher.Stocks to WatchAmong the stocks expected to perform well in the coming week are Exide, Shriram Finance, ICICI Bank, ICICI General Insurance, Cummins India, Sun TV, AB Capital, Grasim, and Divis Labs. ITC, on the other hand, may experience continued selling pressure.

Cheers,Shishir AsthanaDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.