A perfect cocktail of foreign and domestic flows, coupled with attractive valuations, and a pretty earnings picture, can propel the markets to new highs. The first two of these three ingredients are in place at the moment. The third one – the earnings picture – is blinking red.

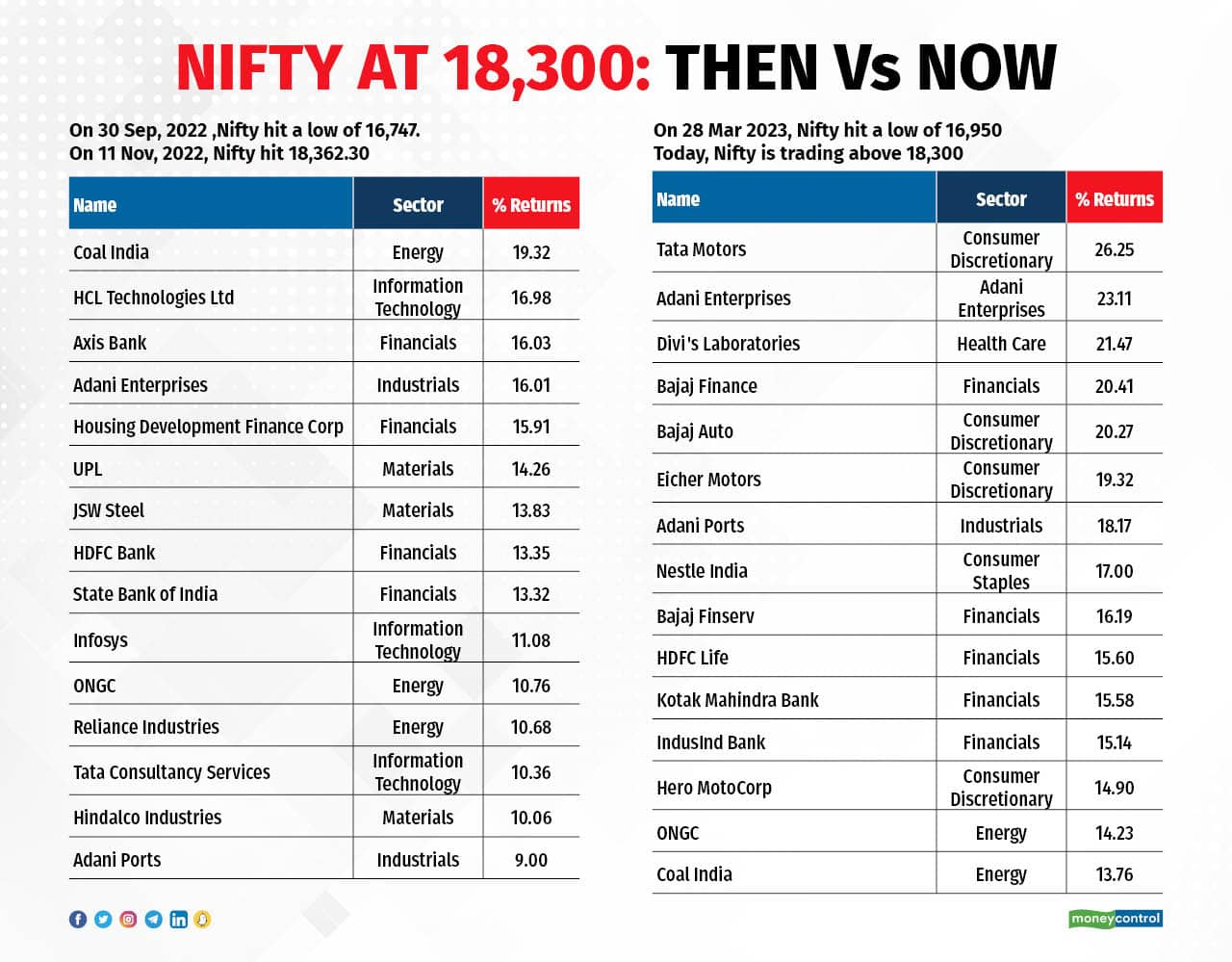

Let’s dial the clock back. In September 2022, the Nifty hit a low of 16,747 and started its upmove. It hit the 18,300 mark on November 11, before touching an all-time high of 18,887.

At the time, the July-September quarter earnings were in full swing. Robust credit growth was driving the financial sector story, and IT companies were showing no signs of a slowdown. Consumer companies were basking in the glory of price hikes.

HDFC Bank, Axis Bank, HCL Tech, Tata Consultancy Services and ITC, as well as the industrials and energy space, powered by the government’s capex push, all participated in the rally.

The earnings story was powering the index. The price-to-earnings (PE) ratio for Nifty was 15 percent higher than its long-term average. Foreign institutional investors (FIIs) had sold over $18 billion in equities in the first 10 months of 2022, with nervousness about rising Fed rates looming large, triggering a run towards safety (read the dollar). But, domestic investors were still betting big on the earnings story.

At record high flows of over $35 billion, domestic flows were ‘more meaningful than FII flows’ was Credit Suisse’s verdict.

What is different now?

The tide is turning now. With Fed rates perceived to be peaking by a majority of market participants, risk-on trade is back. And India, meanwhile, is looking well poised to take a fair share of the foreign money that is flowing back to emerging markets.

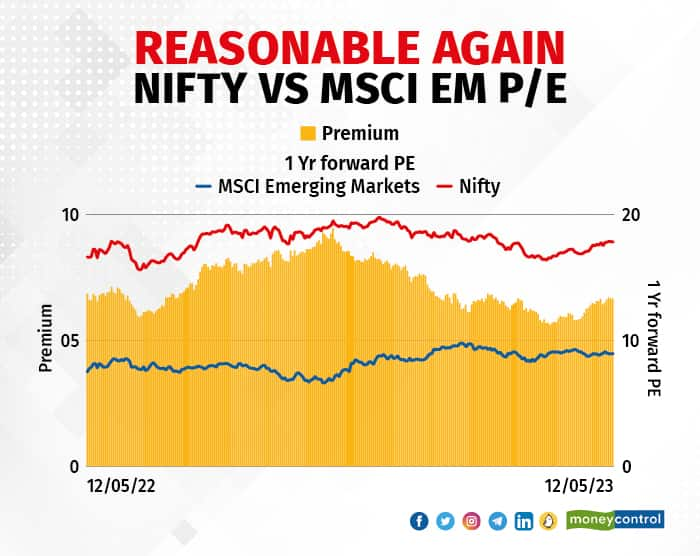

Currently, the Nifty is slightly below its long-term average. “Nifty trades at ~18x one-year forward P/E, which is at an 8 percent discount to the long-term average of 20x. This is a decent drop from the level of 21x, seen at the beginning of FY23,” Siddharth Khemka of Motilal Oswal Financial Services said.

Valuation premiums to both the emerging and world markets have also shrunk by a fourth since October, making it an opportune time for foreign investors to buy into India again. That’s exactly what the trend has been. FIIs have bought shares worth $1.7 billion so far in May alone.

“The domestic market structure looks positive,” adds Khemka. But is it enough to sustain the momentum?

Looks unlikely. Inflow from domestic investors, which was earlier acting as a floor, has reversed. They have sold equities worth $485 million (~Rs 3,997 crore) in the last fortnight. Demat (dematerialised) account openings were at the lowest level since December 2020 with only 1.60 million accounts opened in April.

“FIIs are buying, DIIs are selling. Only when we see both groups buying for a consistent period of three or four months, we can start becoming bullish on Indian markets. The right word now would be ‘constructive’ instead of ‘bullish’,” Rahul Bhuskute, chief investment officer at Bharti AXA Life Insurance said.

What about earnings?

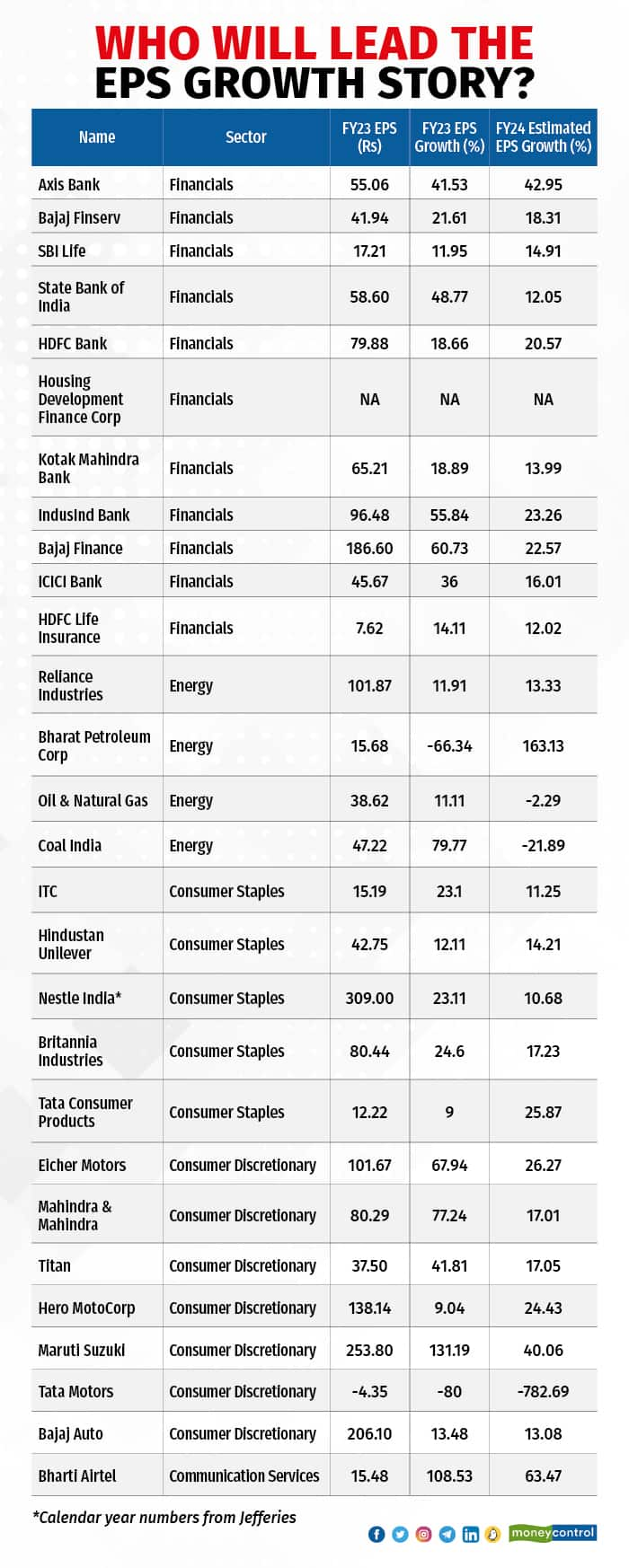

Most Nifty constituents recorded high double-digit EPS (earnings per share) growth in FY23, led by financials. The one sector that disappointed was metals. The rally came in 2022 but earnings did not.

It was a difficult time for the metals pack as a sharp rise in prices of raw materials, such as iron ore and fuel, as well as power expenses, dented their earnings significantly. But come 2023, the China reopening theme spurred another stock rally.

Foreign brokerages were quick to upgrade their ratings on metal stocks. “Weakening US and EU macro pose a risk to the global metal demand, but a potential improvement in China could provide an offset,” Jefferies said.

Analysts’ earnings estimates also reflect this optimism. JSW Steel, Tata Steel and Hindalco, which saw their EPS decline in FY23, could see EPS growth in FY24, as per current estimates.

But the fear of uncertainty is no stranger to markets. In April, China’s imports unexpectedly dropped 7.9 percent to $205 billion, raising concerns about a boost to global economy.

“Lingering US debt ceiling impasse, no clear signs of an uptick in Chinese consumption and slowdown concerns may continue to weigh on metal prices,” according to Ravindra Rao of Kotak Securities.

But metal stocks might be the least of the concerns when it comes to powering the index ahead. Metals and mining make for only 3 percent of the Nifty 50’s weightage.

Which sector matters the most?

It is the financials pack. It makes for more than 35 percent of the index. EPS growth for financials was a blockbuster in FY23 and the expectations for FY24 are also running though not as high as FY23.

Robust credit growth is all set to moderate, believe analysts. Nomura has projected credit growth at 10 percent in FY24 from 15 percent in FY23. It has cited diminishing levels of inflation, especially on the wholesale side which tends to lower working capital needs and an expected moderation in GDP growth to 5.3 percent in FY24 as the primary reasons for the lower bank credit growth.

Net interest margins (NIMs) are also set to come under pressure with the re-pricing of deposits kicking in.

According to Sunil Damania, chief investment officer at Marketsmojo, private capex will take a backseat in the coming months which will have a bigger impact on credit growth. “The IMF, as well as the World Bank, has declared that the world economy is going to slow down. Why would corporates put up capex at such a time,” he asks.

Kotak Mahindra Bank’s Whole-Time Director KVS Manian also hinted at this during the bank’s earnings call. “Overall corporate credit growth in the banking system has not been very strong currently as the capacity creation is yet to pick up,” he said.

For now, financials continue to be at the steering wheel. Profits of the Nifty pack that have declared Q4 results so far have risen 10 percent year on year, fuelled by financials. Excluding the pack, profits would have declined 1 percent year on year, according to Motilal Oswal Financial Services.

Information Technology, which has the second-biggest weightage on the index, of 12 percent, has already put up a poor show and the EPS estimates for FY24 do not suggest any fireworks either, amidst project deferrals, cancellations and delayed ramp-ups.

A global banking crisis has come as a surprise for the IT pack. Infosys has guided for a slow FY24 and Tech Mahindra’s margins are already down to single digits.

Could things get worse? Analysts believe so.

Jefferies says cracks are beginning to appear, slightly ahead of the imminent US recession. “The entire IT pack is precariously placed,” as per the firm. It has trimmed FY24 and FY25 consensus EPS estimates by 1-6 percent and further downside risks remain.

Just like IT, the consumer pack – commanding about 10 percent weightage on the index – is also precariously placed. Pent-up demand has faded out, double-digit volume growth remains elusive and inflation has burnt a deep hole in pockets. Demand in rural India - which makes for 40-45 percent of FMCG companies' topline - remains weak. The rate of volume decline has moderated but it remains in the negative zone.

This sector is set to see the highest moderation in EPS growth, as per Bloomberg estimates. Even discretionary names, like Titan and Eicher Motors, which stand on the winning side of the K-shaped recovery, will see EPS growth moderate from 40-50 percent in FY23 to 20 percent level in FY24.

All things considered, there’s little to cheer about Nifty at 18,400. The bears have enough reasons to keep new highs in check and the bulls might have to wait longer.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.