Interestingly, creating an inheritance for future generations is a striking common factor in investment preference in all generations prior to Generation Y or Gen Y or the Millennials.

It is, therefore, not just enough to pass on wealth to the next generation but also to align the wealth creation opportunity with the investment values that matter to the next generation.

Gen Y is the most media and technology savvy generation, which is rapidly shaping the values and principles of this generation. The Gen Y is realistic, conscious, and has integrated well with the global world.

The choices of this generation are influenced by domestic as well as international issues and therefore, they make responsible and value-based choices.

Several studies show that Gen Y is a super saver generation and start saving at an early age. Today’s millennials are going beyond money-making while choosing their investments.

The priority is towards investing in companies that provide solutions to the material world problems along with making monetary returns. The millennial activism is strongly influencing the investment preferences in favour of investing with values.

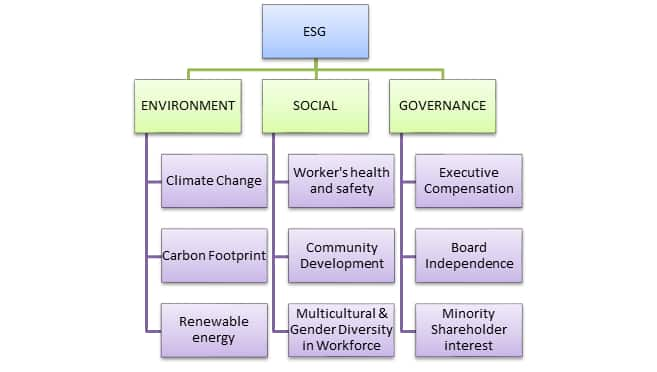

While assessing the investment avenues, the environmental, social, and governance (ESG) issues are at the top of the priority list for about 77 percent millennial investors. It is remarkably higher than the other generations.

The key findings from the reputed Morgan Stanley’s Third Sustainable Signals survey of individual investors are that 71 percent investors believed that their investment decision will influence the reduction in climate change caused by humans and businesses, 83 percent investors believed that their investment decision can create economic growth than can bring about social change, especially lift people out of poverty and 88 percent investors believed it is possible to balance financial gains with a focus on environment and social impact.

Hence, with great conviction, it can be expected that the sustainable investing will definitely continue to grow at all-time high levels in the future years to come with the growing enthusiasm and demand from the millennial investors.

With more than a quarter of the world population being Millennials, who will receive trillions of dollars of wealth transfer as an inheritance from their earlier generations, will be more satisfied when this wealth stack is created responsibly.

The millennials will want this wealth transfer to reflect the family value and belief system and ensure that these investments are sustainable in its true sense. This will in a real sense be a responsible and respectable wealth transfer.

Else, it would just be a matter of time when the millennials would invest the inherited wealth in something that matters most to them. The investment that is more sustainable, impactful and responsible.

The tide has already shifted towards sustainable investing and the Millennials will considerably deepen the dimensions of sustainable investing in years to come.

It is, therefore, an opportune time for all generations to embrace Sustainable and Responsible investing before it’s too late!

The author is Associate Fund Manager – Alternative Investments, Quantum AMC

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.