Until recently, the broad view in the Indian stock market was that it had run up much ahead of fundamentals, making it look quite expensive and hence the correction was not surprising.

The latest Moneycontrol Market Poll has now revealed that a majority of experts believe that the current valuation of the market is “reasonable” though they also expect the markets to fall another 10 percent from the current levels.

These are some of the key findings of the latest Moneycontrol Market Poll, which saw the participation of nearly 45 respondents across categories including broking firms, mutual funds, AIFs, PMS and independent experts.

Interestingly, the latest majority view comes at a time when the benchmarks have already fallen more than 11% when compared to their all-time highs. For instance, the Sensex is already down nearly 10,000 points or 11.5 percent from its all-time high touched in September last year.

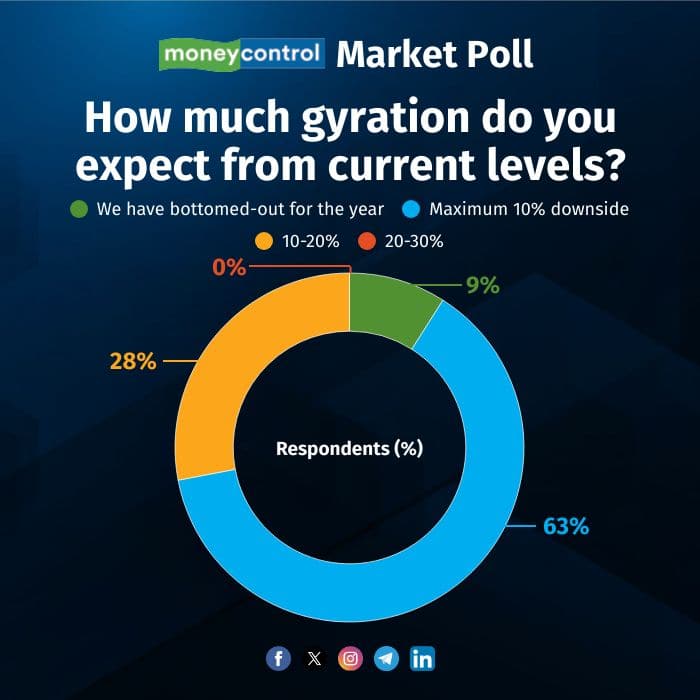

As per the poll, 63 percent of the respondents said that they expect another 10 percent fall from current levels with another 28 percent saying the fall could be in the range of 10-20 percent. The balance nine percent believe that the markets have bottomed out.

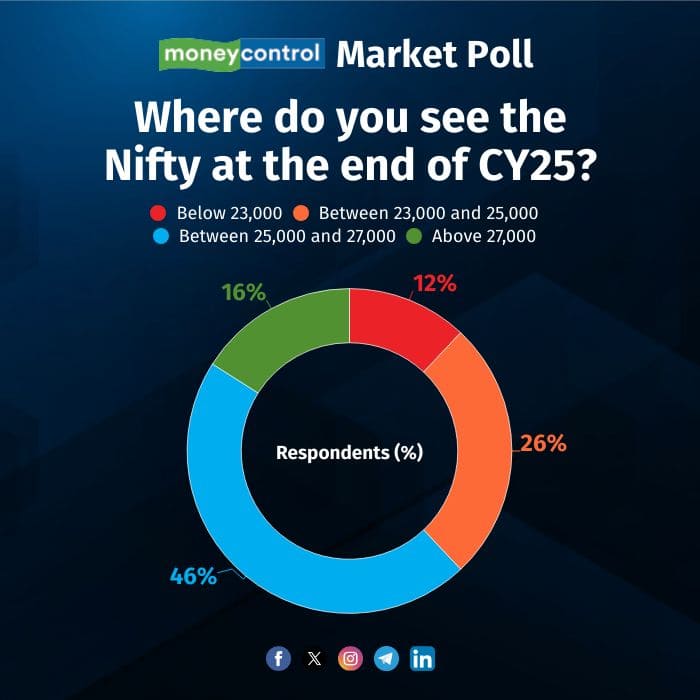

Regarding the index levels, 46 percent of the respondents said they expect the Nifty 50 to end the current calendar year (CY25) between 25,000 and 27,000, which denotes a 17 percent gain from the current levels.

But 26 percent of the respondents were comparatively more bearish as they said the Nifty could end CY25 between 23,000 and 25,000. While 16 percent said the Nifty would be above 27,000 by the end of this year, 12 percent were extremely bearish, pegging the year-end target at below 23,000.

Regarding valuations, 58 percent of the respondents said that Indian markets are currently “reasonable” with the balance opting for “expensive”. Interestingly, not a single respondent preferred to choose “attractive”.

Key risks for the Indian markets

There are a lot of headwinds facing equity markets globally and India is no different. Domestic and global concerns have pulled down the Indian markets from record levels touched just four months ago.

As per the poll, earnings disappointment is the key risk for the Indian markets, followed by valuations and deterioration in India's macros.

.

.

Incidentally, brokerages forecast continued slow growth for companies in the December quarter, with only a few sectors expected to report robust earnings. Brokerages predict that top-line growth for the listed firms will remain subdued for the seventh consecutive quarter. Further, year-on-year (YoY) margins are expected to face pressure, resulting in the third consecutive quarter of sub-10% profit growth.

Meanwhile, global risks arising out of US President Donald Trump's policies and continued selling by foreign portfolio investors (FIIs) also feature among the key risks for Indian equities. FIIs are already net sellers over $6 billion in the current month with last year’s net buying pegged at a paltry $124 million.

The poll also revealed that 30 percent of the respondents are holding cash over 20 percent in their portfolio, clearly reflecting the pessimism and bearish outlook. Another 26 percent said that the cash portion in their portfolio is between 10-20 percent. While 23% are holding less than 5 percent cash in their portfolio, the balance 21 percent said that their cash portion was in the range of 5-10 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.