Indian equities have undergone a sharp valuation reset since their September highs, with widespread market cap erosion triggering significant de-rating of stocks. The NSE 500, Nifty 50, and Sensex 30 indices have seen steep declines, wiping out investor wealth and dragging price-to-earnings (P/E) ratios lower across the board.

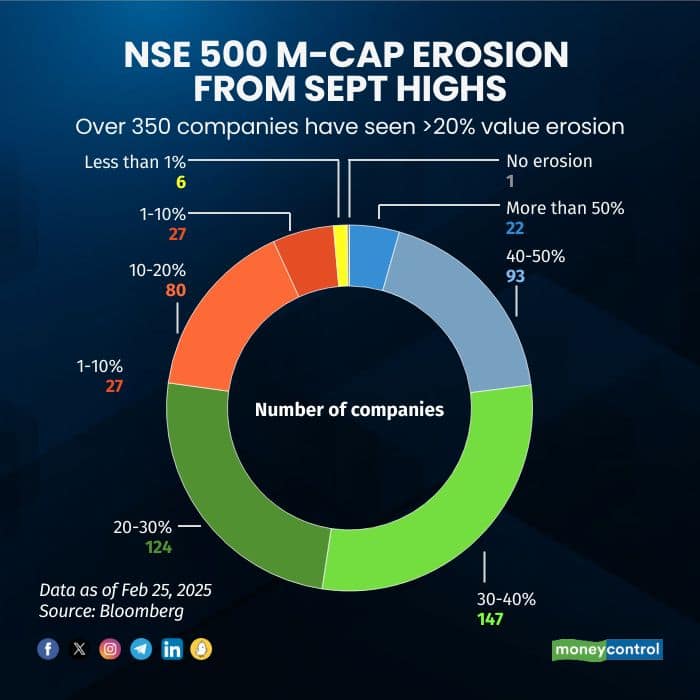

The mid-and-small-cap-heavy NSE 500 index has been hit the hardest, with over 350 stocks witnessing a market cap erosion of more than 20 percent. Notably, 22 companies have lost over 50 percent of their value, while another 93 have fallen by 40-50 percent. The pain isn’t limited to smaller names—blue-chip stocks in the Nifty 50 and Sensex 30 have also suffered.

The mid-and-small-cap-heavy NSE 500 index has been hit the hardest, with over 350 stocks witnessing a market cap erosion of more than 20 percent. Notably, 22 companies have lost over 50 percent of their value, while another 93 have fallen by 40-50 percent. The pain isn’t limited to smaller names—blue-chip stocks in the Nifty 50 and Sensex 30 have also suffered.

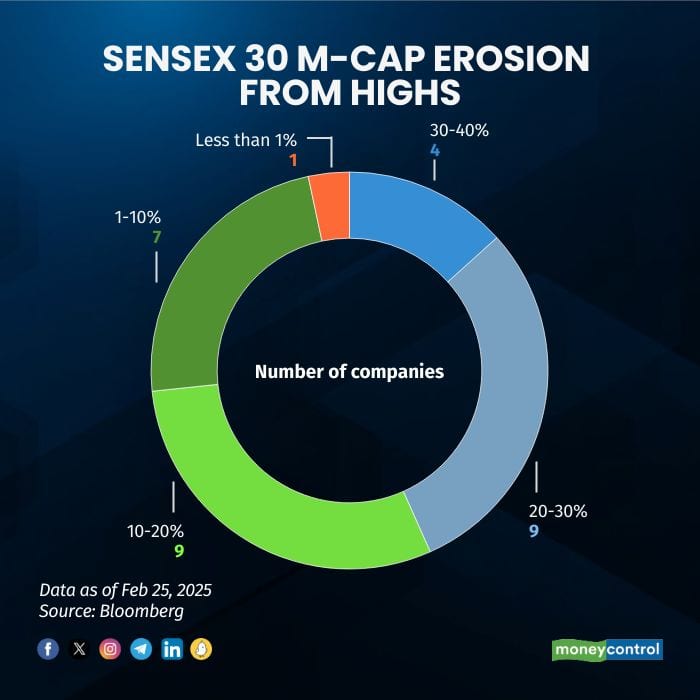

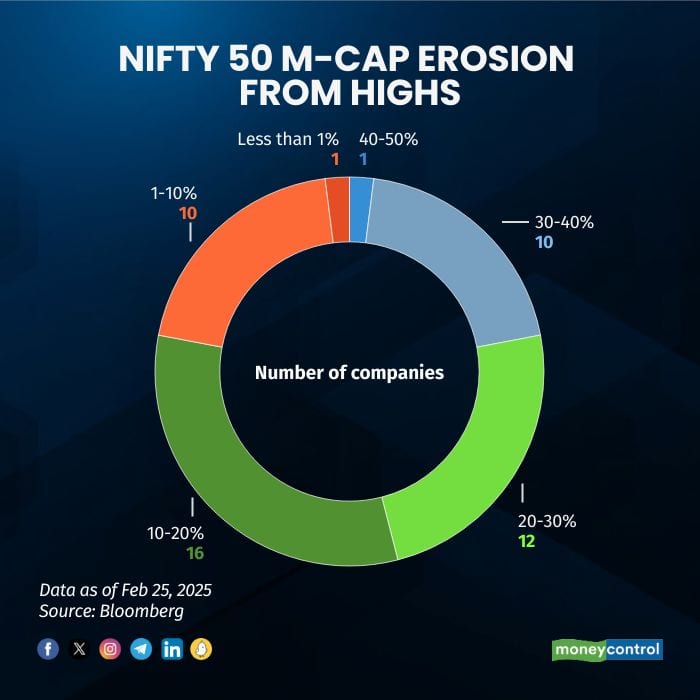

In the Nifty 50, 23 companies have lost over 20 percent from their highs, including one that has plunged over 40 percent. The Sensex 30 paints a similar picture, with over half of its constituents down more than 10 percent.

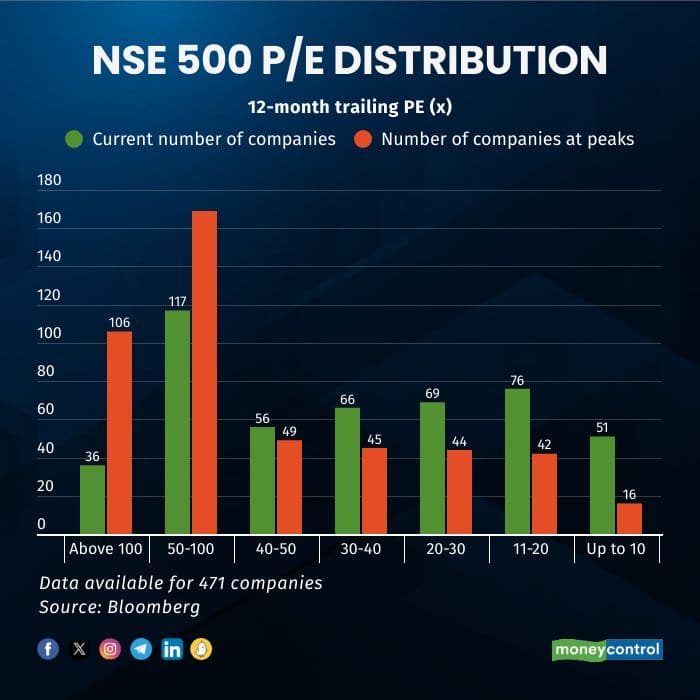

As m-cap shrinks, earnings multiples have compressed dramatically. The NSE 500, which previously had 106 companies trading at a P/E above 100, now has just 36 in that range. Similarly, the number of stocks trading in the 50-100 P/E range has dropped from 169 to 117, signaling a revaluation of high-growth, momentum-driven stocks.

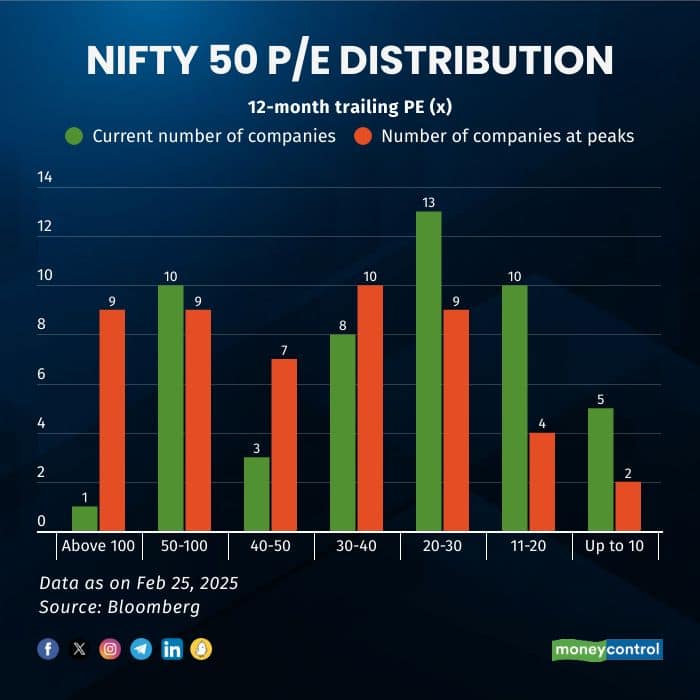

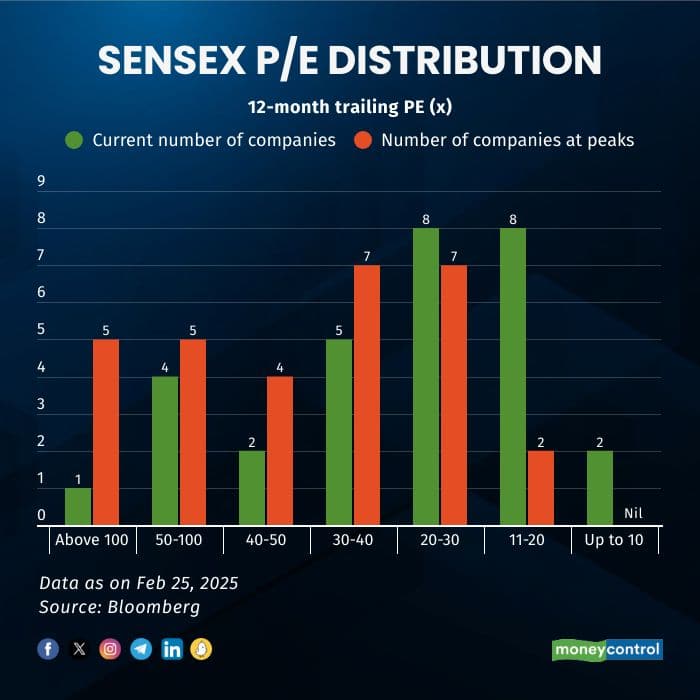

In the Nifty 50 and Sensex 30, stocks have migrated to lower valuation brackets. Only 1 stock in each index now trades above 100 P/E, compared to 9 in Nifty 50 and 5 in Sensex at their peaks. More companies have shifted into the 20-30 P/E and 11-20 P/E zones, indicating a broad-based cooling in investor sentiment.

In the Nifty 50 and Sensex 30, stocks have migrated to lower valuation brackets. Only 1 stock in each index now trades above 100 P/E, compared to 9 in Nifty 50 and 5 in Sensex at their peaks. More companies have shifted into the 20-30 P/E and 11-20 P/E zones, indicating a broad-based cooling in investor sentiment.

The correction follows a period of market exuberance that peaked in September 2024. Concerns over high valuations, elevated interest rates, back-to-back tepid quarterly results, and global economic uncertainty have weighed on sentiment. The sell-off intensified as investors rotated out of expensive stocks, leading to a sharp re-pricing of equities.

With market valuations now looking more reasonable, the question remains—is this the bottom, or is there more pain ahead.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.