After a year of relentless outflows, foreign institutional investors might return to the Indian markets in 2026, as several catalysts signal a turnaround for Dalal Street in the year ahead. An increase in growth, both economic and earnings, coupled with an easing monetary policy and rising likelihood of a trade deal are likely to bring foreign inflows back to domestic equities.

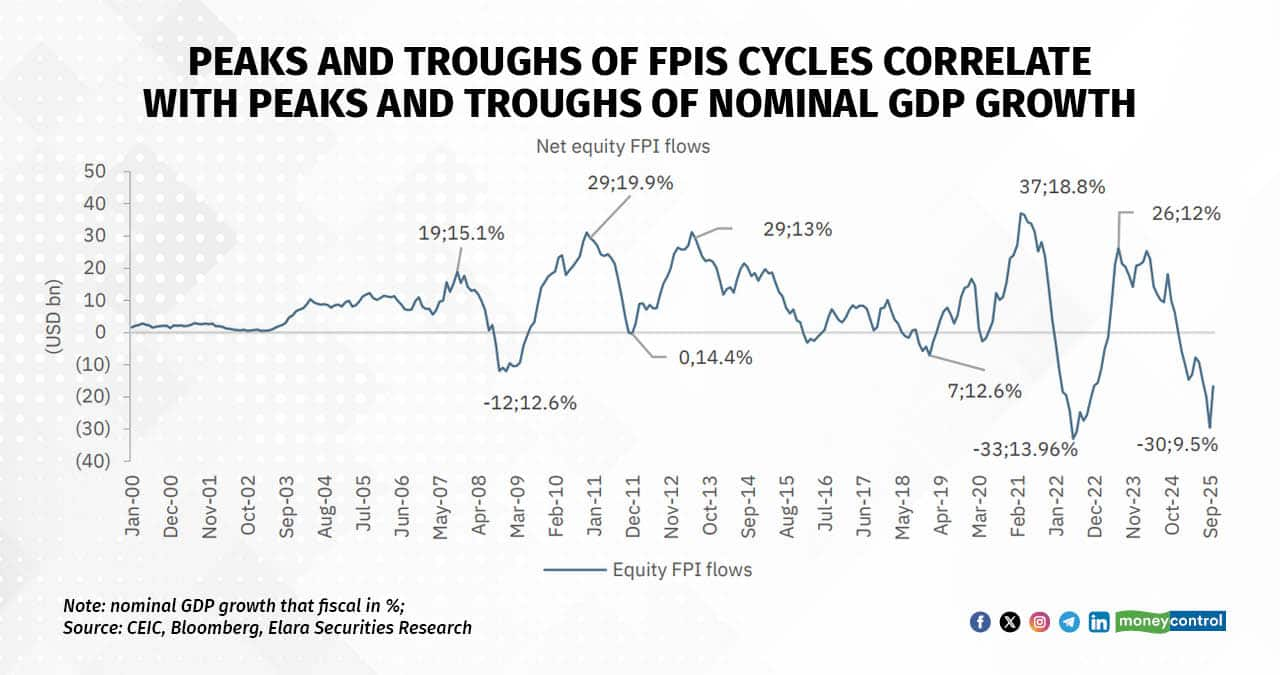

According to recent commentary, a large portion of the recent FPI outflow is a result of India’s limited pure-AI plays and geopolitical risks, However, according to an analysis by Elara Securities, 15 years of data shows nominal GDP growth is the strongest driver of FPI appetite.

"Our analysis suggests that the single most important factor impacting FPI appetite in Indian equity markets is nominal growth," emphasized the analysts at the brokerage. Five peak-to-trough FPI cycles since 2010 closely track India’s nominal GDP cycles.

On the currency front, Elara noted that a weak USD or US rate cuts boost flows only when nominal growth is strong and/or India’s relative P/E is below 1.6x versus EM peers.

When nominal growth falls below the long-term 12 percent average, inflows come only if valuations are under 1.6x. In the past 15 years, FPIs have meaningfully bought India at P/E multiples above 1.6x only once.

This signals that Indian equities can command a higher premium only when growth is robust, especially when compared with its peers. India’s robust growth outlook versus peers was one of the key factors that made Indian equities attractive up until Covid-19.

In the past two years, sluggish growth underpinned by lower public capex (due to elections) and tighter financial conditions dented India’s growth advantage versus EM peers, lowering appeal of Indian equities to FIIs.

As such, a turn in domestic growth dynamics should aid FPI inflows as valuations have turned less expensive and outlook for USD (DXY Index) remains benign. "We expect India’s growth drivers to turn incrementally supportive, with nominal GDP growth expected to recover to 10 percent in FY27 from ~8 percent in FY26. The real GDP would however be 7 percent for both years," said the report.

But the outlook for the year ahead is positive. Here's a look at the key factors that could drive foreign capital back to India.

India’s policy backdrop has turned growth supportive. Fiscal measures like personal income tax and GST cuts are lifting demand, with early Q3 data showing stronger consumer spending. Public capex at both the Centre and states is also gaining momentum.

A trade deal with the US looks increasingly likely in 2025. If Russia-related tariffs are rolled back, India’s effective tariff rate could fall sharply from the current 32–33 percent to around 17–18 percent, and even lower if IEEPA tariffs are fully withdrawn. Our base case assumes an effective rate of about 9–10 percent.

Monetary conditions are easing. The US Fed has resumed rate cuts, pulling down yields and keeping the dollar stable, creating room for emerging markets to loosen policy. With domestic inflation benign, the RBI has space for up to 50 basis points of cuts over the next two meetings in FY26.

Corporate earnings are improving. This quarter marks the start of a new upcycle, with PAT expected to rise 12.5 percent year-on-year — the first double-digit print in six quarters. Results so far show sales up 8 percent, EBITDA up 15 percent and PAT up 16 percent, with roughly two companies beating estimates for every miss.

When FIIs' capital is routed towards India, the banking and financial services pack is set to gain. Elara noted that an analysis of trough-to-peak fund flow FPI cycles shows that financials have led the sectoral fund flow in every cycle.

This amid a robust recovery in domestic demand dynamics owing to GST rate cuts, income tax rebate and easing inflation has led some banks such as SBI to revise its guidance from 11-12 percent to 12-14 percent for FY26 credit growth.

Elara conducted an analysis on fund flows into large-, mid-, and small-cap funds, which has indicated that the recovery in growth has been more strongly correlated with inflows into mid- and small-cap funds than into large-caps, reflecting a higher risk appetite in these segments. Large-caps, by contrast, have remained more resilient to slowing global cycles.

"With nominal growth showing signs of bottoming out, the recovery in nominal GDP growth hereon along with a likelihood of lower policy uncertainty amid impending India-US trade deal," said the brokerage, "supportive global financial conditions led by rate cuts from major global central banks and supportive oil/USD increases our near-term bias for SMIDs."

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.