September 08, 2022 / 16:39 IST

Ajit Mishra, VP - Research, Religare Broking

Markets were upbeat on the weekly derivatives expiry day and gained nearly a percent, tracking firm global cues. Nifty has again reached the upper band of the prevailing consolidation range (17,300-17,800) and a decisive breakout would fuel the next leg of the up move towards the 18,100+ zone. Importantly, rotational buying across sectors combined with steady foreign flows has strengthened the possibility of a breakout. Participants should align their positions accordingly and avoid contrarian trades.

September 08, 2022 / 16:17 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

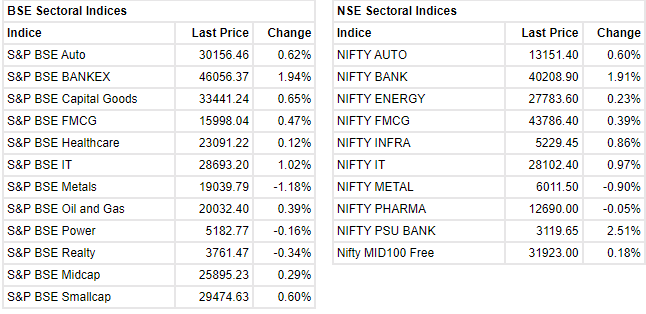

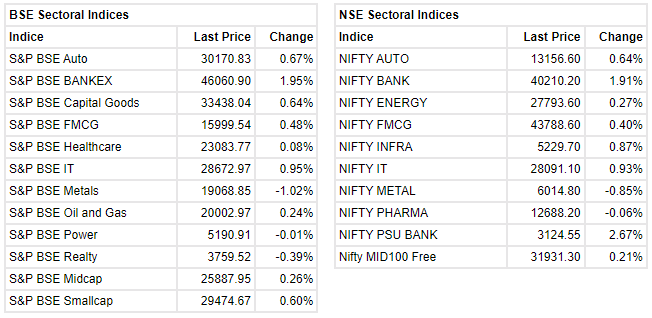

Nifty rose on September 08 after a two day fall. It opened gap up and then remained in a 102 point range through the day. At close, Nifty was up 0.99 percent or 174.35 points at 17,798.75. Among sectors, banks and IT gained the most, while metals and realty fell the most. Advance decline ratio was positive at 1.56:1.

Nifty broke above the recent high of 17,777 easily. Now the next tough resistance is 17,992. On falls, 17,651 could be the support.

September 08, 2022 / 16:06 IST

Vinod Nair, Head of Research, Geojit Financial Services

The domestic financial market experienced a wave of optimism tracking strength across global markets as oil prices eased. Despite premium valuations, consistent FII inflows are aiding Indian bourses to stay resilient. On the sectoral front, auto stocks were in focus as retail sales of automobiles grew 8.31 percent YoY in August while banking stocks moved in sync.

September 08, 2022 / 15:51 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

Nifty had taken support near the psychological mark of 17,500 on September 7 and had started moving higher. The up move extended on September 8 as well. Consequently, the index is approaching upper end of the consolidation range. 18,000-17,200 has been the short term consolidation range. Thus, the index is likely to stumble as it approaches the 18,000 mark. The overall structure suggests that we are likely to see further consolidation before the index resumes the larger uptrend.

September 08, 2022 / 15:49 IST

Markets at close

It was a good day for markets as benchmark indices ended the session in green with Sensex jumping over 650 points or 1.12percentat 59,688.22. Nifty added 174 points or 0.199 percent and ended the day at 17,798.40. About 2073 shares have advanced, 1289 shares declined, and 121 shares are unchanged.

Among the sectors, financials led the rally with Nifty Bank ending above 40,200. While Nifty Metal shed about a percent, Nifty Pharma too ended the day in red. Buying was also seen in IT, autos and infrastructure stocks.

September 08, 2022 / 15:33 IST

Rupee At Close | Rupee ends at 79.71/$ versus Wednesday’s close of 79.90/$

September 08, 2022 / 15:23 IST

Tata Power to set up 100 MW captive Solar Power Plant for Viraj Profile in Nashik. Plant will provide power to Viraj Profile’s stainless steel manufacturing plant at Tarapur

September 08, 2022 / 15:16 IST

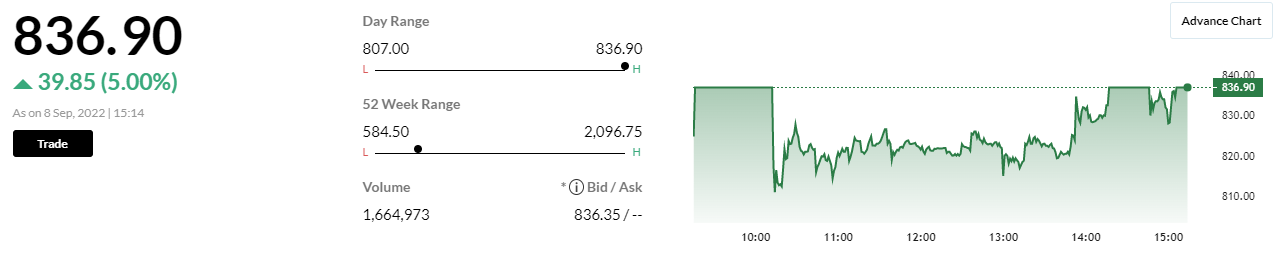

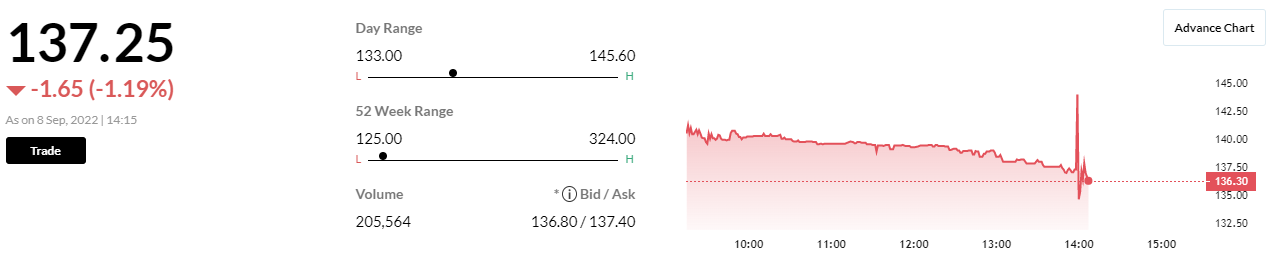

Tanla Platforms up 5%

Board approves Rs 170 cr share buyback at Rs 1200 per share via tender offer

September 08, 2022 / 15:04 IST

Tapan Patel, Senior Analyst (Commodities), HDFC Securities

Crude oil prices traded steady with benchmark NYMEX WTI crude oil prices were trading near $81.94 per barrel on Thursday. Crude oil prices pared early gains resumed downtrend on weaker demand. Prices slumped to their lowest levels since January on Wednesday, after weak economic prints from China, interest rate hikes and a surprise rise in US inventories brewed concerns over slowing demand. The US energy watchdog forecast slightly higher demand and tighter supply going into 2023.

We expect crude oil prices to trade sideways to down with resistance at $84 per barrel with support at $80 per barrel. MCX Crude oil September contract has important support at Rs 6450 and resistance at Rs 6650 per barrel.

September 08, 2022 / 15:00 IST

Market update at 3 PM: Sensex is up 647.46 points or 1.10% at 59676.37, and the Nifty jumped 170.40 points or 0.97% at 17794.80.

September 08, 2022 / 14:38 IST

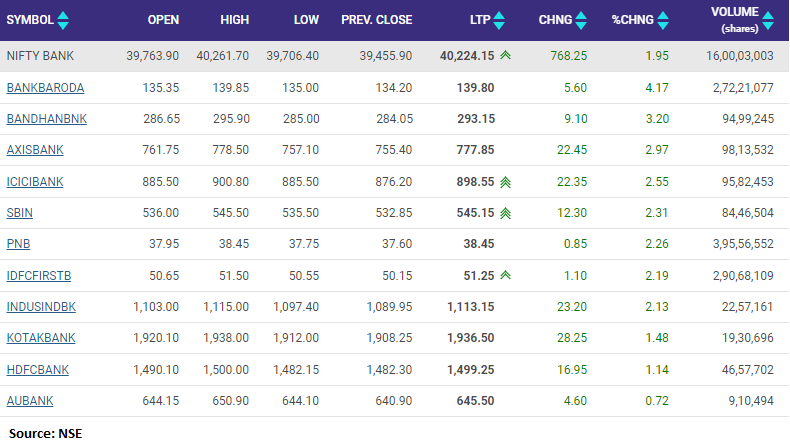

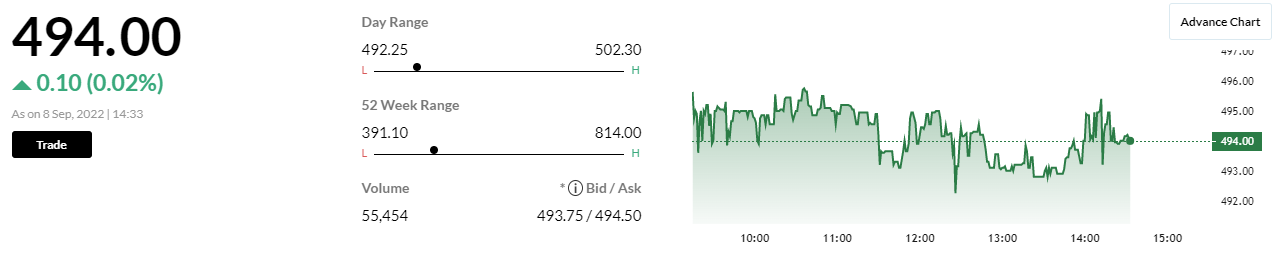

Bank Nifty added 2 percent led by Bank of Baroda, Bandhan Bank, Axis Bank, ICICI Bank and SBI

September 08, 2022 / 14:34 IST

Mahindra Logistics unveils 1 lakh square feet multi-client warehouse in Nashik:

September 08, 2022 / 14:19 IST

Panacea Biotec Pharma receives ‘Official Action Indicated’ classification on Baddi unit after USFDA inspection

In an exchange filing, the company informed “Panacea Biotec Pharma has received a communication from the USFDA indicating the inspection classification as Official Action Indicated (OAI). This implies that the USFDA expects further corrective actions.”