The Board of Directors of the Company, at its meeting approved raising offunds by way of issuance of Non-Convertible Debentures (NCDs) aggregating to Rs. 2,500 crore in one or more tranches, on private placement basis.

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,363.37 | 411.18 | +0.49% |

| Nifty 50 | 25,843.15 | 0.00 | +0.00% |

| Nifty Bank | 58,033.20 | 0.00 | +0.00% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Cipla | 1,639.10 | 61.50 | +3.90% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| ICICI Bank | 1,390.30 | -46.30 | -3.22% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 7857.85 | 219.10 | +2.87% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Auto | 27185.50 | -43.10 | -0.16% |

The Board of Directors of the Company, at its meeting approved raising offunds by way of issuance of Non-Convertible Debentures (NCDs) aggregating to Rs. 2,500 crore in one or more tranches, on private placement basis.

:

Markets traded lackluster and ended almost unchanged amid mixed cues. The start was muted on the back of weak global cues however recovery in metals and selective buying in financials pared all the losses. Consequently, the Nifty ended flat at 16,569.55 levels. On the sector front, a mixed trend was witnessed wherein realty, media and PSU banks were the top losers. The broader indices too witnessed a similar trend and traded mixed.

The prevailing uncertainty on the global front combined with caution ahead of the MPC meet outcome is keeping the participants on the edge. Indications are in the favour of further consolidation in the index so the focus should be on identifying the sectors/stocks and maintaining positions on both sides.

:

Market has been exercising caution ahead of the credit policy announcement this week, and hence investors trimmed their position in rate-sensitive sectors such as realty. Technically, the Nifty found support near 16450 but failed to capitalise on it. The texture of the chart is indicating that a range bound activity is likely to continue in the near future. For day traders, 16500 would be the key support level to watch out, and above which the index could move up to 16650-16750. On the flip side, a fresh round of selling pressure is possible if the index trades below 16500. Any further decline could see the index retest the level of 16400-16350.

:

Nifty remained volatile during the session. On the lower end, bulls have protected the crucial support of 16400, which led to a rally towards 16600. The trend is likely to remain positive for the near term as long as 16400 is held on a sustained basis. On the higher end, resistance is seen at 16800.

Bank Nifty has remained below the 50-EMA throughout the session. The momentum oscillator is a bullish crossover. Going forward, Bank Nifty may remain sideward to positive as long as it holds the crucial support of 35000. On the higher end, resistance is visible at 36000.;

Indian benchmark indices made a gap down opening and recovered in the noon session but were not able to sustain due to global cues and closed in red. Nifty50 closed at 16569.50 (+0.09%) and Sensex closed at 55675.32 (-0.17%).

On the technical front, the key resistance levels for Nifty50 are 16700 and on the downside 16400 can act as strong support. Key resistance and support levels for Bank Nifty are 35600 and 35000 respectively.

:

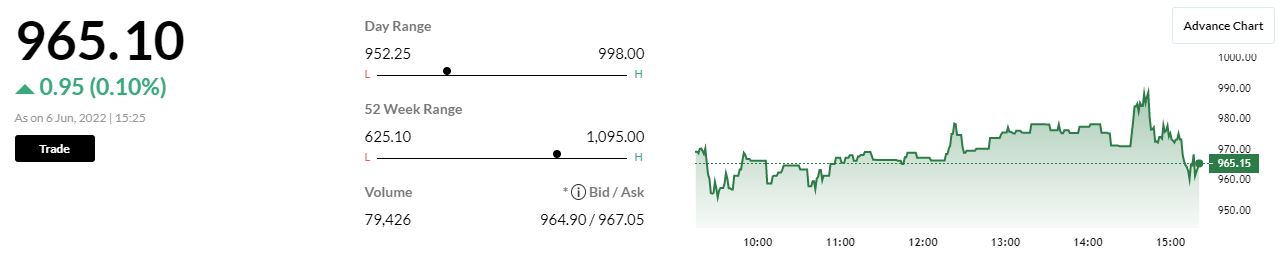

Nifty opened flat on June 6 and fell early to make an intra day low at 09:30 Hrs. It rose gradually to make an intra day high at 14:10 Hrs and later went sideways. At close, Nifty was down 0.13% or 21 points at 16563.3.

Volumes on the NSE were much below the recent average. Trading ahead of the RBI MPC meet outcome on June 08th, ECB meet on June 09 and US inflation data on June 10 remains subdued. Among sectors, Oil & Gas and Metals indices rose the most while Realty, Capital Goods and Consumer Durables indices fell the most. Smallcap index ended lower by 0.55% suggesting pressure on broader markets. This is also reflected in the negative Advance decline ratio for the day.

Nifty has consolidated on Monday after falling from higher levels on Friday. Having taken support from 16443, Nifty rose and closed higher than the low, though minorly in the negative. We think Nifty could remain in the 16353-16696 band for the next few sessions.

PSP Projects is in receipt of new work orders worth Rs 154.89 crore in Institutional, residential and precast segment. We have emerged as Lowest Bidder for a Government Medical college and hospital in Gujarat with bid value worth Rs 615.18 crore, the company said in an exchange filing.

Rupee ends at 77.63 per Us dollar against June 3 close of 77.62 per US dollar.

Among the sectors, selling was seen in realty and capital goods while the midcap and smallcap indices also ended in the red.

Indices stuck in a range, Sensex trading lower by around 25 points, Nifty nearing 16,600

The Sensex was down 33.63 points or 0.06% at 55,735 and the Nifty was up 6.9 points or 0.04% at 16591.2. About 1299 shares have advanced, 1961 shares declined, and 180 shares are unchanged.

Source: BSE

Source: NSE