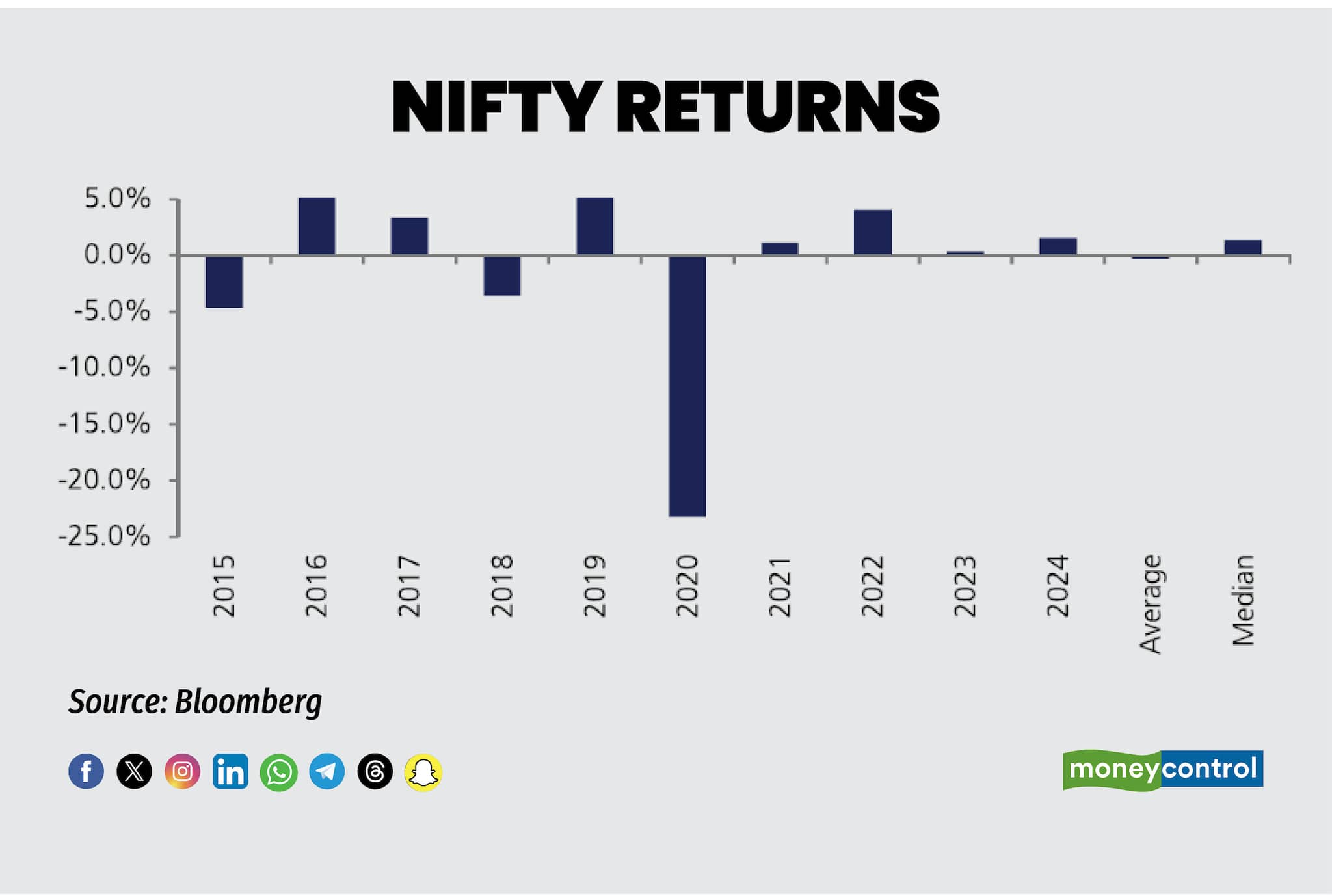

After nursing deep wounds for the past five months, the fate of the Nifty 50 might change in March. According to a seasonality analysis by domestic brokerage JM Financial, the benchmark index ended on a positive note for seven of the past ten years, showing one of the strongest positive price seasonality.

Seasonality refers to the tendency of an index to perform better during certain periods of the year and worse during others.

The Nifty 50's average return and a median return for March are -0.3 percent and 1.3 percent respectively. Ignoring the steep negative return of 23 percent in the year 2020 (as a result of the Covid-19 pandemic), the average return stands at 2.3 percent.

On the broader markets front, the Nifty Midcap 100 index has exhibited a relatively weaker price seasonality in the month of March. JM Financial noted that in the last 10 years, the index has closed in the green on 5 occasions with an average return and a median return of -0.6 percent and 0.8 percent respectively. Ignoring the steep negative return of 30 percent in 2020, the average return stands at 2.7 percent.

The Nifty Midcap 100 gauge underperformed the Nifty 50 on five occasions with an average inline performance.

On the sectoral front, some sectors do exhibit strong seasonality in different months in a year. For the month of March, JM Financial found that the Nifty Auto index has settled in the red for 7 occasions over the past decade, indicating negative seasonality.

The average return for the NSE Auto index during March is -2.6 percent. Excluding the negative return of 32 percent in the year 2020, the average return stands at 0.6 percent. The median return stands at -2.7 percent.

Given the seasonality in monthly returns, JM Financial analysed the relative performance of a sector over the Nifty for the month.

The Nifty MNC index outperformed the Nifty on seven occasions in the past ten years in March with an average outperformance and a median outperformance of 0.2 percent and 0.3 percent respectively.

On the flip side, the Nifty CPSE index underperformed the benchmark on seven occasions with an average underperformance and a median underperformance of 0.8 percent and 1.2 percent respectively.

Not just sectors, but stocks too have a strong seasonality depending on the month. These are the stocks that closed in the green seven or more times, with an average positive return of over four percent in March:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.