If you are an investor, then chances are you created a fortune as India emerged as a stock pickers market after Modi-led government took charge on May 26, 2014.

The rally, which started with expectation of pro-growth reforms from the Modi-government is likely to stretch towards 2019 because most analysts and fund managers see Modi 2.0.

A Moneycontrol poll of 15 analysts earlier this month, highlighted that almost 92 percent of participants see Modi government coming back with a majority in general elections to be held in the year 2019. The reform process which the government started in the last 3 years is likely to bear fruits in the next two years of the government rule.

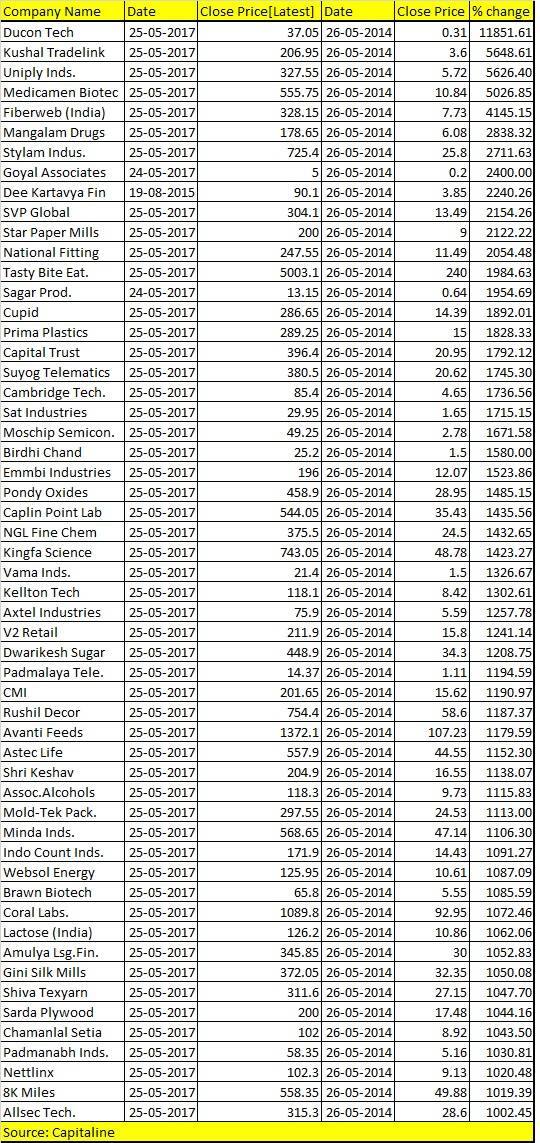

The rally has been swift in stocks which are likely to benefit the most from the policies implemented by the Modi-led government. As much as 55 stocks delivered over 1,000 percent return in the last 3 years with Ducon Tech gaining as much as 11,851 percent in the same period.

Stocks which gave over 1000 percent return include names like Kushal Tradelink, Uniply Industries, Mangalam Drugs, Cupid, Kellton Tech, V2 Retail, Dwarikesh Sugar, Rushil Décor, Avanti Feeds, Astec Life, Minda Industries, Indo Count, 8K Miles etc. among others.

Over 1,100 stocks more than doubled your wealth in the last three years which include names like Jay Bharat Maruti, Force Motors, MRF, Eicher Motors, Shree Cements, Page Industries, 3M India, Honeywell Auto, Maruti Suzuki, Wabco India, Tide Water Oil, etc among others.

The rally in the index was led by sharp improvement in fundamentals of the Indian economy, and strong pro-growth reforms initiated by the Modi-led government.

Since May 2014, it has been one way move for the S&P BSE Sensex and Nifty which is expected to reach greater highs in the next 2 years of the government.

Majority of market mavens expect the rally to stretch up to 14K in the next 2 years of Modi govt as the likely hood of Modi 2.0 keeps the bullish sentiment going.

Almost 76 percent of poll participants see Nifty scaling above 10K in the next two years and possibly hit mount 14K by 2019. Almost 38 percent of participants see Nifty above 10,000 while another 39 percent see Nifty in the range of 12,000-14,000.

Indian market is in a structural bull run and intermittent corrections cannot be ruled out. However, investors will be better off by investing in largecaps and selective midcaps as earnings recovery is likely to drive next leg of the rally.

“The trajectory of Nifty will be defined by earnings. The consensus in earnings seems to be that for the next two years that is FY18 and FY19, the general, compounded annual growth rate (CAGR) basis, the earnings could go up between 15 and 20 percent,” Piyush Garg, EVP & CIO, ICICI Securities told Moneycontrol.

“If there is earnings surprises then there is a huge potential in the market for the next one year. In the next two years, I would say a 12,500 kind of Nifty is possible in the next 24-30 month scenario provided earnings catch up, otherwise no,” he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.