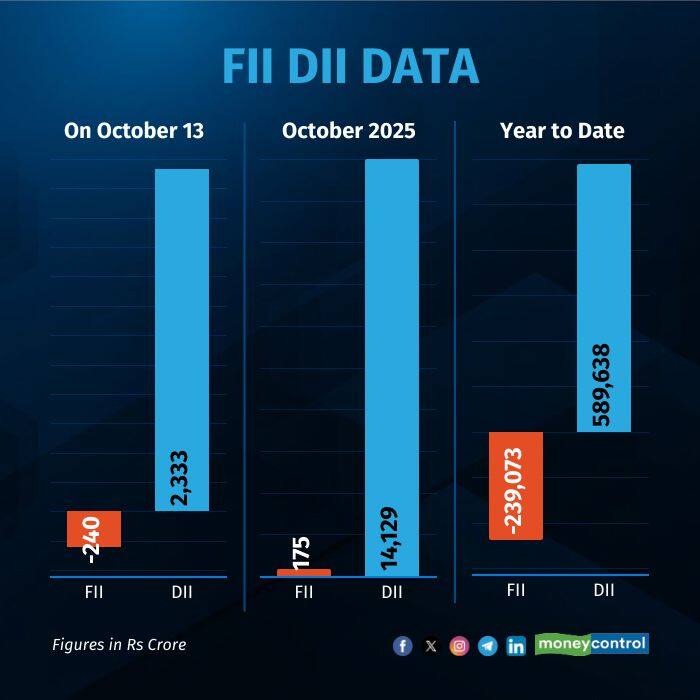

Foreign investors (FIIs/FPIs) net sold Rs 240 crore worth of Indian equities on Monday. At the same time, domestic institutional investors (DIIs) net bought shares worth Rs 2333 crore, according to provisional exchange data.

DIIs purchased shares worth Rs 14,961 crore and sold shares worth Rs 12,627 crore. In contrast, FIIs bought shares worth Rs 8,085 crore but sold shares totalling Rs 8,326 crore.

For the year so far, FIIs have been net sellers of shares worth Rs 2.39 lakh crore, while DIIs have net bought shares worth Rs 5.90 lakh crore.

At close, the Sensex was down 173.77 points or 0.21 percent at 82,327.05, and the Nifty was down 58 points or 0.23 percent at 25,227.35. BSE Midcap index was down 0.2 percent and small-cap indices shed 0.4 percent.

Among sectors, metal, telecom, IT, FMCG, capital goods, consumer durables slipped between 0.5-1%.

Tata Motors, Infosys, Wipro, Nestle, HUL were among major losers on the Nifty, while gainers were Bharti Airtel, Bajaj Auto, Adani Ports, Shriram Finance and Bajaj Finance.

On today's market, Ajit Mishra – SVP, Research, Religare Broking Ltd noted that markets opened on a weak note and ended marginally lower, taking a breather after the recent rebound. "Tariff escalation concerns—particularly after the U.S. President’s statement on the possibility of imposing an additional 100% duty on Chinese goods—triggered risk aversion across global equities, which in turn dampened domestic sentiment," he said.

Mishra added that looking ahead, earnings will remain the key focus, though global developments may continue to induce volatility. "We suggest maintaining a positive bias as long as the Nifty holds above the 25,000 mark, and adopting a strategy of buying quality stocks on dips rather than taking aggressive leveraged positions," he added.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.