Even as the stock market remains nervous about succession at one of India’s most admired banks, and regulators deliberate over whether the next leader should be an insider or outsider, a look at its track record versus other frontline banks may be useful to understand what gives Kotak Bank the edge.

Management guru Peter Drucker said, "Culture eats strategy for breakfast.” If that is true for companies worldwide, it can not be untrue for banks. Actually, most will argue it is far more important for banks than for companies. That’s because of the nature of business that banks engage in.

By design, banks are built on borrowed capital. They have a small net worth or equity capital; most of the capital is borrowed from savers in the form of deposits, and it is lent to those in need, be it individual borrowers or businesses. Money is thus the raw material for banks, and the interest they earn from the borrowers over the interest they pay their lenders (depositors), after accounting for the expenses incurred by the bank in doing this operation, is the profit they make for themselves. That’s what shareholders lay claim over.

Also Read: The Uday Kotak Playbook: A peek into the veteran banker's management style

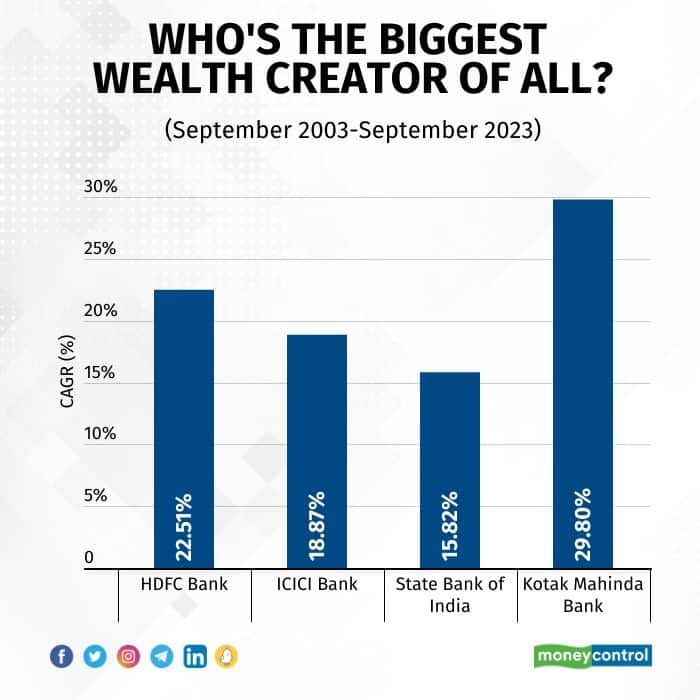

Over the past two decades, after Kotak transitioned from being a non-bank to a bank in 2003, the bank has pipped every single private sector bank rising right to the top of the table in terms of wealth creation. Kotak Bank was listed on the bourses in February 2003. So, over the past 20 years and seven months, among the frontline banks, Kotak emerged on top in terms of stock price returns with a compounded annual growth rate of 29 percent. That beats HDFC Bank which delivered a 22 percent annualised return during the period.

HDFC Bank stock has been flat over the past two years on account of nervousness over succession as well as its merger with its parent HDFC Limited, but barring this period, it has been the darling of stock markets for a good part of the past two decades. State Bank of India, the biggest and the best-run state-owned bank, delivered a 15.8 percent annualised return during the same period.

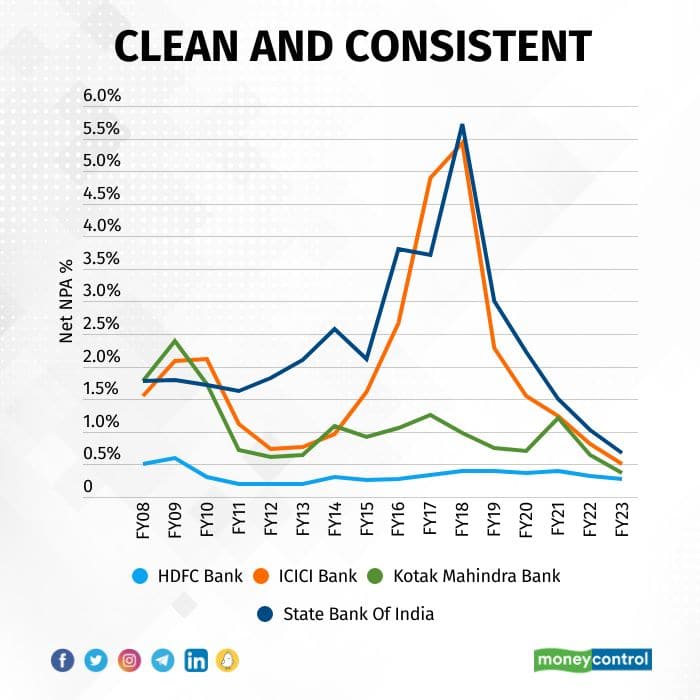

A 20-year track record is not a flash in the pan. In fact, if one were to calculate the annualised stock price returns at any time over the past 10 years, the contrast in performance would have been starker, as other wholesale banks were still in clean-up mode and Kotak was in the pink of health. HDFC Bank has been the best of the lot having maintained pristine asset quality - under 1 percent net NPA (non-performing assets) at all times, without exception. Kotak Bank has had periods of mildly higher NPAs but nowhere near that of any other bank.

What has worked wonders for Kotak is conservatism, which should actually make the regulators more confident of the bank’s ability to protect depositors’ money. The fact is, a significant portion of bankruptcies in India, and in fact, the world over, can be traced back to unbridled optimism that made managements take on high debt which proved to be their death knell as businesses did not turn out as they were expected to. While managements cannot be always trusted to make the “right” decisions –decisions are largely proved to be right or wrong only in hindsight – the only thing that investors as well as regulators can count on is their track record of decision-making and the incentive structure.

Kotak is one of the handful of private sector banks that has survived several financial storms including the very first non-banking crisis in the country in the mid-nineties which washed away 99 percent of the non-banks. If anything, Kotak can be accused of being a very unlikely, ultra-conservative banker. That again is because Kotak has been deeply cognisant of the risks in banking. “Cognisant” may be a bit of an understatement, some would term it “paranoid.” In fact, it is one of the common refrain analysts, perhaps even the central bank, have with the bank’s strategy. As they say, a harbour is a safe place but that does not mean a ship must forever be parked there.

Kotak’s way of looking at things is more like what Warren Buffett’s partner Charlie Munger maintains, “Tell me where I’ll die, and I won’t go there.” Having seen what kills banks, his actions are wiser.

In an earlier conversation with this author, Kotak remarked thus: “As a bank, we have Rs 10 as capital and borrow Rs 100. If we lose Rs 5 out of Rs 110, we have lost 50 percent of our money. If you lost Rs 10, it’s time to go home. Bankers start believing they have control and ownership; they don’t, it’s other people’s money. If you go back globally, and see the kind of lifestyles bankers lived, they lived 50:1 leverage. They were living on borrowed money and borrowed time. That arrogance comes from believing that you own all that leverage as your own money.”

Also Read: I was sad when I resigned, but more pained about his resignation: Kotak veteran on Uday Kotak

Kotak has walked the high talk emerging unscathed from 2008 financial crisis when other private sector banks floundered. Along with HDFC Bank, Kotak Bank also stood out for escaping the glut of bad loans that paralysed the entire banking system in the country.

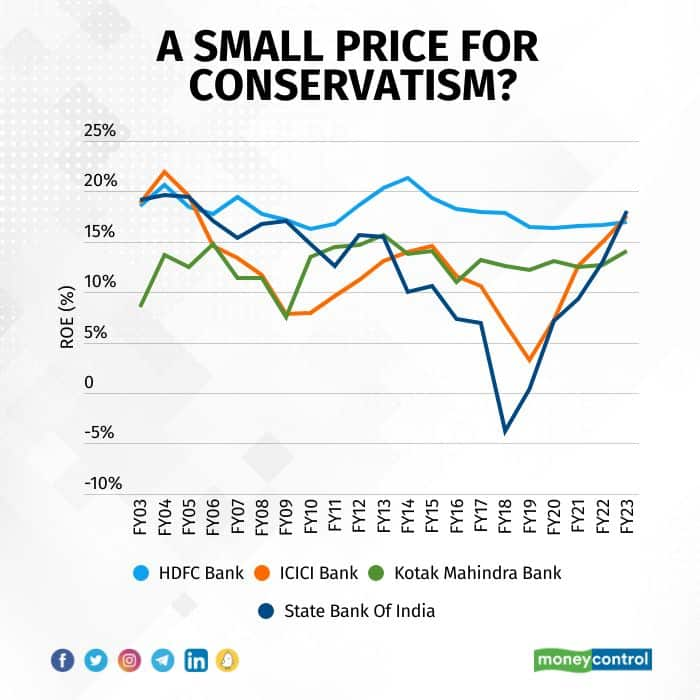

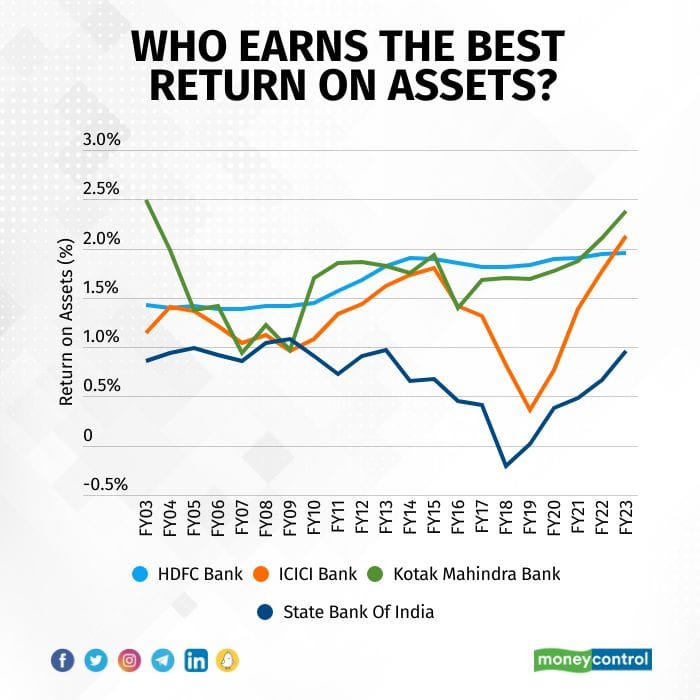

Post Covid, too, Kotak has been cautious in terms of growth. Compared to peers, it is overcapitalised, with the highest capital adequacy among leading banks. Its Tier I capital adequacy ratio (CAR) stands at 20.9 percent; including Tier II capital, CAR stands at 22 percent. This has dragged down its return on equity, which stands at 14 percent as opposed to other frontline banks at 16-17 percent despite having the highest return on assets. Simply put what this means is, that while the bank earns the highest return on its overall assets, equity and debt, its return on shareholders’ funds is a tad lower mainly because it has lower leverage.

From a stock market perspective, as we stand at the cusp of an uptick in the investment cycle and there is optimism in the air and a new wave of credit creation is unfolding, Kotak is most likely to get its fair share of growth. Apart from enough capital to fuel growth, as things stand now, Kotak also has the highest share of low-cost deposits or CASA (49 percent) which makes it truly competitive. For whoever is in the driver’s seat next, the least of the problems will be to grow. The key will be to maintain its profitable growth and avoid accidents along the way.

An insider is more likely to carry this forward, for it is decoded in their DNA. Even as the final decision on who will steer the bank next rests with the RBI, the two internal candidates, widely believed to be the bank’s recommended ones for the top job have been with the bank for the longest time. K V S Manian has been with the bank for 29 years, and Shanti Ekambaram has been there even longer than 30 years. It’s not just these two, there are a bunch of others in the senior management who have 20+ years with Kotak, so the philosophies of steer clear of “too-good-to-be-true deals” or refrain from unnecessary aggression in growth are well-entrenched in the institution. So much so that, one of the senior management once remarked, Kotak employees have a real problem. “We can’t fit elsewhere, others won’t survive here!”

Also Read: Uday Kotak’s success as a banker has overshadowed his entrepreneurial achievements

That could change a wee bit. First, even if the new chieftain were to be an insider, he or she may not be the exact replica of the promoter-manager. The leadership style may also be a bit different. Till a few years ago, Kotak long-timers say, every credit of over Rs 2 crore would go through Uday Kotak’s eyes. That may not be the style of a CEO as the group grows in size.

But more importantly, the banking ecosystem of today is different from the past. One of the reasons banks like Kotak Bank and HDFC Bank avoided wholesale lending in the past is because, if things went wrong, the institutional mechanism to recover was weak. With the bankruptcy laws getting tighter, that could provide some comfort, says a banker. On digital banking, too, Kotak is at the fore-front, investing in people and technology. In August 2022, Kotak hired Bhavnish Lathia, earlier with Amazon, as its chief of customer experience and head of technology, consumer banking.

Longer-term, the key for the bank will be to preserve the culture of conservatism and focus on profitability that has made it not just survive the troughs in Indian banking but rise right to the top in terms of value creation.

The market has been discounting Uday Kotak’s departure for a while now which is why the stock has underperformed. No matter what, when an iconic leader steps away, it is natural for all stakeholders to be circumspect about the ability of the newcomer to lead the way.

Two leadership qualities that Uday Kotak brought to the table were charisma and smarts. As one of the Kotak veterans puts it, Kotak Bank is like a Hindu Undivided Family of which Uday was the Kartha. He defined the values and aligned the family to those values and a shared future. Second, Uday’s ability to see the big picture and at the same time get into the minutest details set him miles ahead. From global headwinds and digital trends to credit and capital market pricing, he had the pulse of every little thing that could impact business. It would be unfair to make the same ask of the new CEO. More importantly, the bigger size makes things only harder. The ideal model for Kotak from hereon would be for the CEO to wear two hats: one, that of a manager of sorts, managing the expectations of multiple stakeholders – the regulator and the shareholders – and two, an arbitrator of sorts, with a bunch of veterans running the various pieces of the pie.

On a relative basis, Kotak is still expensive at 2.7 times adjusted book value, while both ICICI Bank and HDFC Bank are available at around 2.3 times the book. However, the gap between the valuation of Kotak Bank and HDFC Bank versus other banks has decreased significantly. That’s because in an environment where other banks had bad surprises in store in the form of bad loans and were therefore constrained for growth, good quality of book fetched a significant premium. Now, when bad debt concerns have gone away and markets are looking at growth, the “quality premium” stands diminished.

Notwithstanding the cycles, for Kotak Bank to continue to get the quality premium, the leader will have to keep the family connected, and keep the family’s “spice” levels in check.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.