Renowned investor Jeffrey Gundlach has expressed concerns about the rapidly increasing US national debt, which has surged past $32 trillion and swiftly heading towards $33 trillion.

Gundlach, known for his expertise in the bond market, took to Twitter, drawing attention to the rising mountain of debt and interest expenses of the government, and the short-term debt issued at near-zero interest coming up for rollover.

The rollover of this debt will significantly increase the interest burden because of the Federal Reserve's 500 basis-point (bp) rate hikes.

Also Read: Fed unlikely to resume hikes in July as US payrolls and inflation slow: Jefferies

“US National Debt has blown through $32 Trillion and is already sprinting toward $33 Trillion. Interest expense on it is of course rising, with the 500 bp Fed hikes a major accelerant. A sizable short-term debt stock issued near zero interest a few years back is coming due. Uh oh,” he tweeted.

How much has the US national debt increased post pandemic?

In May 2023, the public debt of the US was around $31.46 trillion, about $1 trillion more than a year earlier, when it was around $30.49 trillion.

The single largest increase was that of government debt jumping from 102 percent of GDP before the pandemic to 124 percent in the first quarter of 2021. This increase was associated with a large fiscal response to the pandemic recession undertaken by the US federal government, notably through the $2.2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act of March 2020 and the $1.9 trillion American Rescue Plan of March 2021.

These were some of the largest fiscal packages ever deployed by the federal government, only comparable in magnitude to the American Recovery and Reinvestment Act of 2009 and the New Deal of the 1930s. The US public debt has risen quickly since 2000, and in 2022 was more than five times higher than in 2000.

Also Read: US stocks face downside risk amid frothy markets, may see a boil-the-frog recession: JP Morgan

How has been the interest rate trajectory?

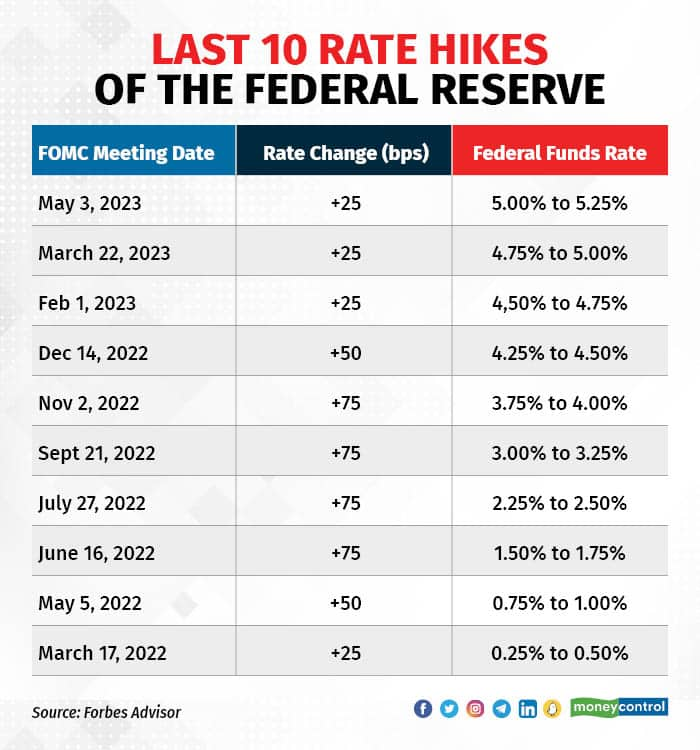

Thus far, in its effort to curb inflation, the Federal Reserve has been steadily raising interest rates since March 2022. The rates have already been hiked by 500 basis points in a very short period with two more hikes yet to be done by the end of this year, according to Federal Reserve chair Jerome Powell. It is also to be noted that the central bank did not hike rates in the most recent Federal Open Market Committee (FOMC) meeting held on June 14 after 10 consecutive hikes.

Last ten interest rate hikes by the federal reserve

Last ten interest rate hikes by the federal reserve

These hikes, as Gundlach points out, will further amplify the debt burden and add strain on the US economy. The combination of escalating debt levels and rising interest rates hence poses significant challenges for both the US government and the broader economy. Such a scenario can impede economic growth, hinder investment, and limit fiscal flexibility.

Who is Jeffery Gundlach?

Gundlach is the co-founder of mutual fund company, DoubleLine Capital, which manages more than $140 billion in assets. He has a net worth of $2.2 billion according to the Forbes Billionaire List. The bond-trader extraordinaire is known for his bold calls and correctly predicting the housing crash in 2007.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.