Even though Indian markets have tumbled up to 20 percent from their record highs, unsettling investors, history suggests that this decline is far from the most severe in the past three decades. Economic downturns, political upheavals, and global financial crises have, at times, erased more than half of market valuations, proving that Indian markets have weathered far harsher storms before.

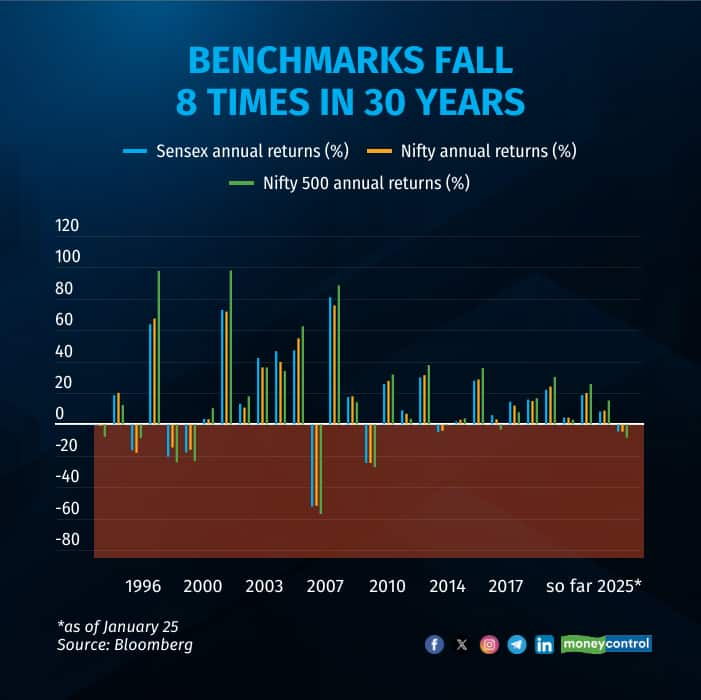

Over the past 30 years, the three key indices—Nifty, Sensex, and Nifty 500—have endured significant corrections eight times, or in eight years. In contrast, they have demonstrated resilience on 22 out of 30 years, continuing their upward trajectory.

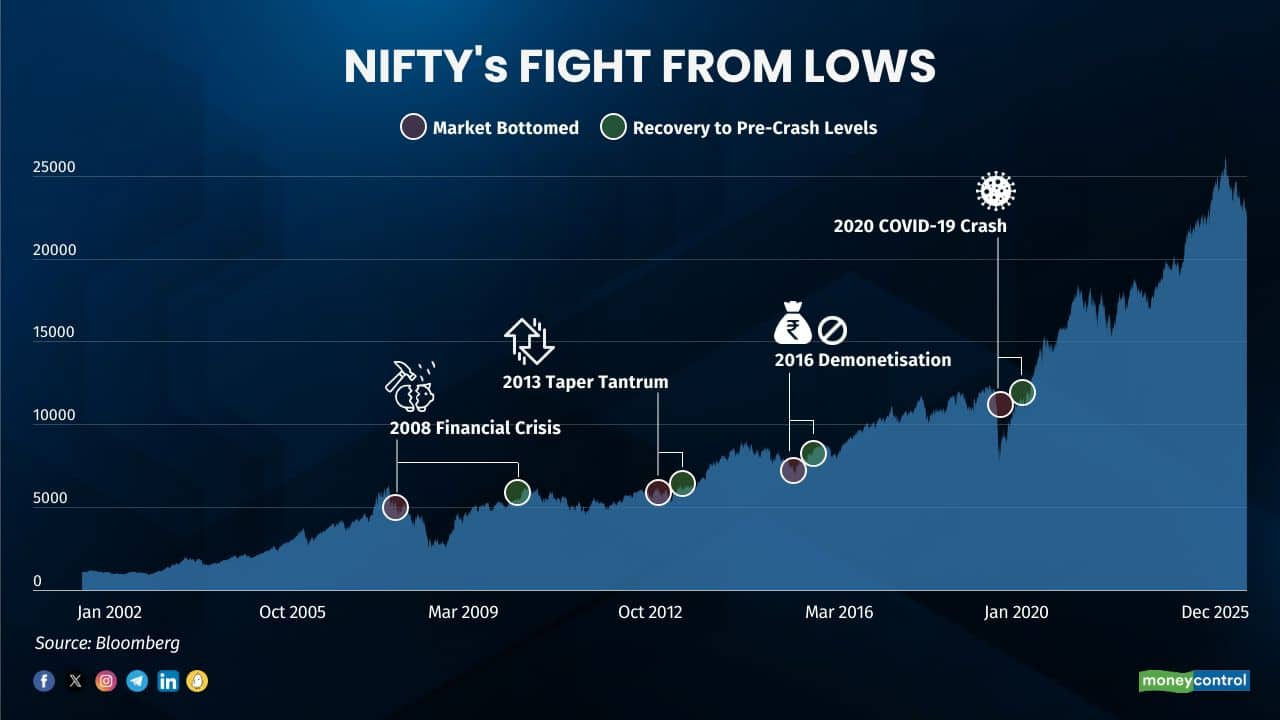

The most brutal crash occurred in 2008 when the collapse of US banking giant Lehman Brothers sent shockwaves across global financial systems. Confidence in banks and financial institutions plummeted, leading foreign investors to swiftly pull their funds from emerging markets like India. The result was a catastrophic selloff—Sensex, Nifty, and Nifty 500 each plunged over 60 percent from their yearly peaks.

The most brutal crash occurred in 2008 when the collapse of US banking giant Lehman Brothers sent shockwaves across global financial systems. Confidence in banks and financial institutions plummeted, leading foreign investors to swiftly pull their funds from emerging markets like India. The result was a catastrophic selloff—Sensex, Nifty, and Nifty 500 each plunged over 60 percent from their yearly peaks.

Yet, the market proved its ability to rebound. After nearly 3 years, in 2010, Indian equities staged a powerful recovery to post record-breaking returns. The resurgence was fueled by the tremendous liquidity injection, chiefly by the Federal Reserve in order to restore confidence in the US banking which resulted in surging asset prices across financially markets.

Yet, the market proved its ability to rebound. After nearly 3 years, in 2010, Indian equities staged a powerful recovery to post record-breaking returns. The resurgence was fueled by the tremendous liquidity injection, chiefly by the Federal Reserve in order to restore confidence in the US banking which resulted in surging asset prices across financially markets.

While the 2008 financial crisis required nearly three years for the Nifty to fully recover, other downturns have seen swifter rebounds. For instance, the 2013 US Federal Reserve's "taper tantrum," the 2016 demonetisation in India, and the 2020 COVID-19 pandemic witnessed recoveries within a year or less, bolstered by aggressive policy interventions and economic measures.

Fast forward to today, and the story appears to be unfolding in a familiar pattern. So far, the frontline indices, Nifty and Sensex, have shed up to 14 percent from their all-time highs, while the broader Nifty 500 index has tumbled by 20 percent, officially entering bear market territory.

This steep decline has triggered concerns among market experts due to a string of disappointing corporate earnings, stretched valuations, and a rapidly changing global economic landscape after the new US President Donald Trump took over. A stronger dollar, Trump's aggressive trade policies, and a hawkish Federal Reserve—are all adding to investor anxiety.

However, given the sharp selloff our markets have witnessed, brokerage firms are beginning to see glimmers of opportunity.

Jefferies, for instance, believes that Indian equities are approaching their long-term valuation averages, setting the stage for a short-term bounce. Meanwhile, Citigroup has turned bullish on the market, setting an ambitious Nifty target of 26,000. Even Emkay Global believes that the worst of earnings downgrade cycle may be over, raising hopes that FY26 could be better for Indian equities.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.