Prime Minister Narendra Modi’s third-term government marks the return of a coalition government after a 10-year hiatus of a single-party majority in the Lok Sabha. Previous coalition governments had their priorities shaped by managing multi-party interests. How did India’s share markets respond during previous coalitions? Here is a lowdown.

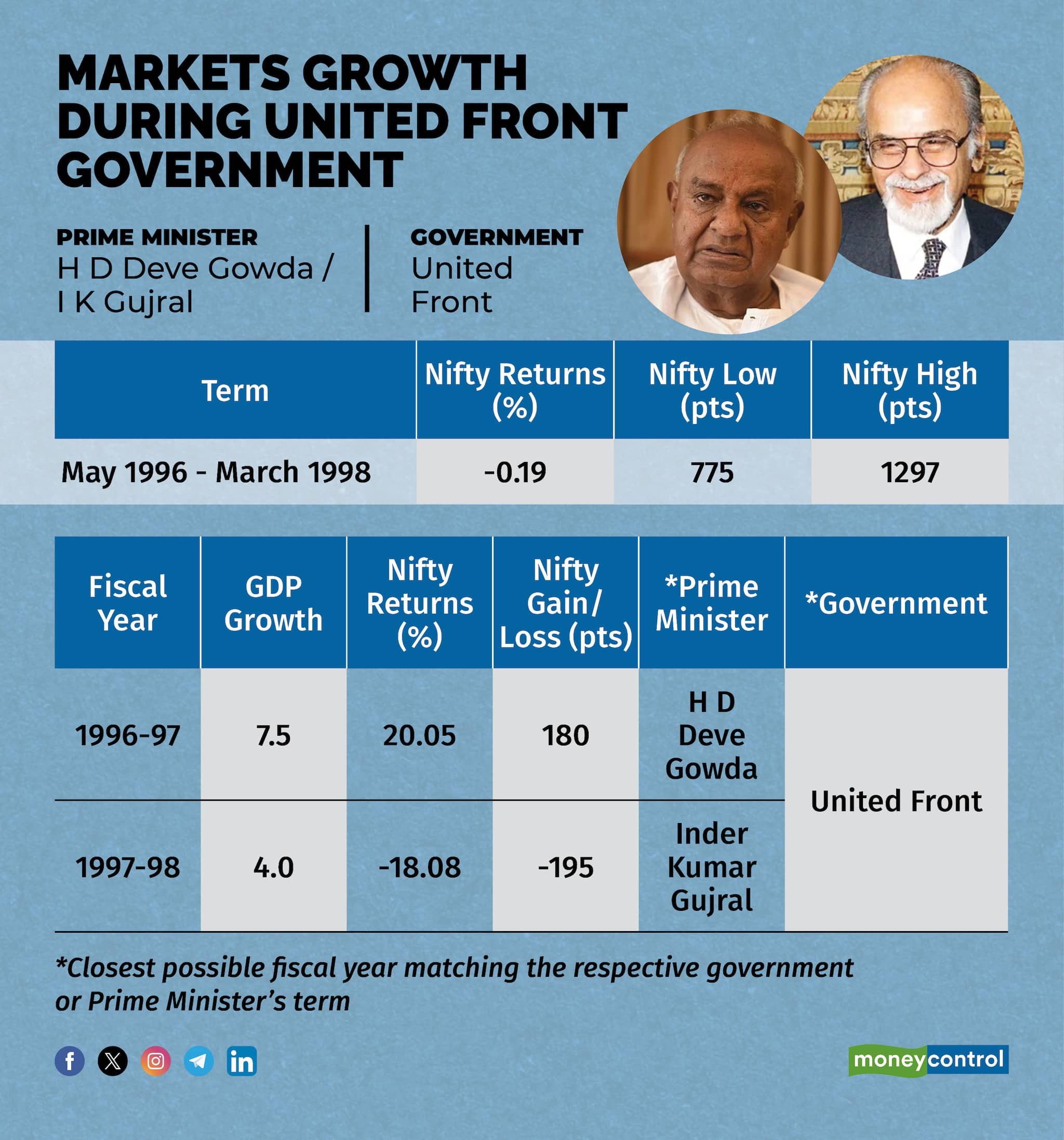

During this period, the United Front Coalition formed the government with support from 332 members, led by Prime Ministers H D Deve Gowda and Inder Kumar Gujral. This was when P Chidambaram presented the ‘Dream Budget’ which laid out a road map for economic reforms in India and included lowering of both corporate and income tax. Stocks markets went euphoric only to be weighed down by political uncertainty. The period was uneventful for stock markets, otherwise. Key factors included:

Political Instability: Frequent changes in the coalition government led to political uncertainty. Attempts to continue economic reforms, such as liberalisation for foreign investments and discussions on PSU disinvestment, were hindered by the coalition dynamics.

High Fiscal Deficit and Monsoon Dependence: High fiscal deficits and lack of substantial economic reforms kept economic growth moderate. Dependence on monsoon rains for agricultural output added uncertainty.

Global Factors: The Asian financial crisis broke out, leading to muted foreign investor interest.

This brief period saw a coalition government led by Prime Minister Atal Bihari Vajpayee, eventually toppled by one vote in 1999 after a key ally withdrew support. The stock market experienced volatility, with the NSE Nifty 50 swinging from about 1,100 points to as low as 800 points, ending down about 10 percent. Key factors included:

Economic Sanctions: Following India's nuclear tests in 1998, several countries imposed economic sanctions, creating market nervousness.

Political Instability: Frequent changes in government hurt investor confidence.

Asian Financial Crisis: The aftermath of the 1997 Asian financial crisis continued to weigh on emerging markets, including India.

This term marked a landmark as Vajpayee became the first non-Congress Prime Minister to serve a full term. The NDA coalition, supported by the Telugu Desam Party, completed its full term through May 2004. Key factors included:

Stable Governance and Reforms: The government initiated economic reforms, including disinvestment in public sector enterprises, telecom sector liberalisation, and infrastructure projects like the Golden Quadrilateral. Building on the telecom infrastructure initiated by the Rajiv Gandhi government, IT companies began to soar and gain global prominence, though they hadn't yet significantly impacted the economy.

Kargil War and Terrorist Attacks: The Kargil War (1999) and subsequent terrorist attacks, including the Parliament attack in 2001, created short-term market volatility.

Economic and Market Performance: The global dotcom boom and bust, followed by the Ketan Parekh scam, rocked the markets and bruised investor sentiment. Despite reforms, the economy saw three continuous years of sub-5% growth, keeping stock market investors underwhelmed. Markets went into extreme bearishness with the Sensex plunging to 2,600 points to the year's low in 2001, dragging back more than 10 years.

During Prime Minister Manmohan Singh’s tenure under the UPA government, the Indian stock market experienced a significant rise. Key factors included:

Economic Liberalisation and Infrastructure Growth: Economic liberalisation continued with FDI limits raised in telecom, retail, and insurance sectors. Focus on infrastructure projects across roads, ports, and power, including privatisation of airports.

Economic Growth and Corporate Earnings: High growth driven by public and private investment, creating a significant multiplier effect. Corporate earnings saw brisk growth due to a boom in the capex cycle and high credit growth.

Global Financial Crisis (2008): Despite the global financial crisis, RBI’s conservative policies ensured relative immunity. The crisis led to a market fall, but fiscal stimulus packages and monetary policy adjustments helped stabilize the market. Companies and certain big banks with unhedged foreign currency borrowings suffered from a steep rupee drawdown.

Other Economic Challenges: Rising inflation due to rapid economic growth and continuous interest rate hikes by the US Fed (from under 1% to 5.5% between 2004-2007), leading to the RBI tightening rates. High fiscal deficit driven by public spending on social programs and subsidies.

The UPA-II returning to power sent the stock market soaring, with the NSE Nifty hitting back-to-back upper circuits before halting trading for the day. Sensex and Nifty gained over 17 percent in a single day on May 18, 2009. Global gush of liquidity jacked up markets to the previous peak only to correct again amid policy paralysis in the government, corruption scandals and global factors.

Global economic conditions: An economically volatile period globally. Growth burst driven by global monetary and fiscal stimulus globally ended up exposing economic fragility in the western economies. Economic crisis in the Eurozone, the US debt ceiling crisis, and concerns over a global economic slowdown created uncertainties.

Economic growth slowdown: While the initial years saw robust growth, economic growth slowed significantly towards the latter part of UPA II’s tenure. GDP growth rates fell from around 8-9% in the early years to about 4.5% by 2012-2013. The Indian rupee also faced significant depreciation, especially in 2013 due to the ‘taper tantrum’ that led to flee of dollar flows back into the US.

Monetary policy, high inflation, fiscal deficit: Inflation ran amok due to the monetary and fiscal stimulus. Tighter rates started to thwart growth, which plunged to 5.3% in 2011-12. Fiscal deficit remained high due to subsidies and welfare schemes. A widespread policy paralysis hindered economic reforms.

The unravelling of ‘reforms’: High-profile corruption scandals such as the 3G spectrum scam, and coal allocation scam significantly dented investor sentiment.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.