The rate hike by Bank of Japan tipped a sharp spike in the Japanese. That, coupled with concerns over the possibility of a US recession early next year acted as a double whammy for global markets, taking them by a stranglehold. Consequently, markets across the globe saw a sharp selloff, demanding an immediate response from major economies.

Japan's equity market took the biggest dive, triggered by the rate hike from the Bank of Japan, also casting shadows across other global markets. Japan's benchmark indices—the Topix and Nikkei 225—fell over 7 percent on August 5, marking a sharp three-day decline not seen since the Fukushima nuclear disaster in 2011. The three-day selloff has pushed both indices into bear market territory, leading to a 10-minute circuit breaker halt on Topix futures trading.

Taking notice of the sharp slump in the stock market, Japan's Finance Minister Shun'ichi Suzuki said that the government is cooperating with the Bank of Japan and the Financial Services Agency, closely monitoring the market with a sense of urgency, Reuters reported.

The recent rate hike by the Bank of Japan, combined with fears of a US recession, triggered a spike in the Japanese yen, which has further put pressure on Japan's equity market.

Also Read | Risk of a US recession real, say experts, second half of 2024 unlikely to be as smooth

Similar to Japan, South Korea's Kospi also faced intense selling pressure, experiencing its worst session since the global financial crisis of 2008. The market meltdown triggered trading curbs for the first time in four years, as tech stocks were hit by US recession fears.

The benchmark Kospi ended the session 9 percent lower, marking its largest percentage drop since October 2008. During the session, the index plummeted as much as 11 percent, activating circuit breakers for the first time since March 2020. These trading curbs, triggered when the index moves more than 8 percent, halt trading of stocks and derivatives for 20 minutes.

Following the market crash, Yonhap News Agency reported that South Korea will hold a meeting later in the day to address the recent sell-off. The meeting will focus on analyzing the causes and effects of the downturn while exploring measures to stabilize the market amid increased global volatility and investor uncertainty.

The same trend was observed in Taiwan, with the benchmark Taiex closing the session with an 8.4 percent loss, driven by concerns over a weak US economic outlook. In response to the sharp decline, the Taiwan Stock Exchange announced it would hold a media conference to "explain recent market movements and contingency response plans" later in the day but did not provide further details.

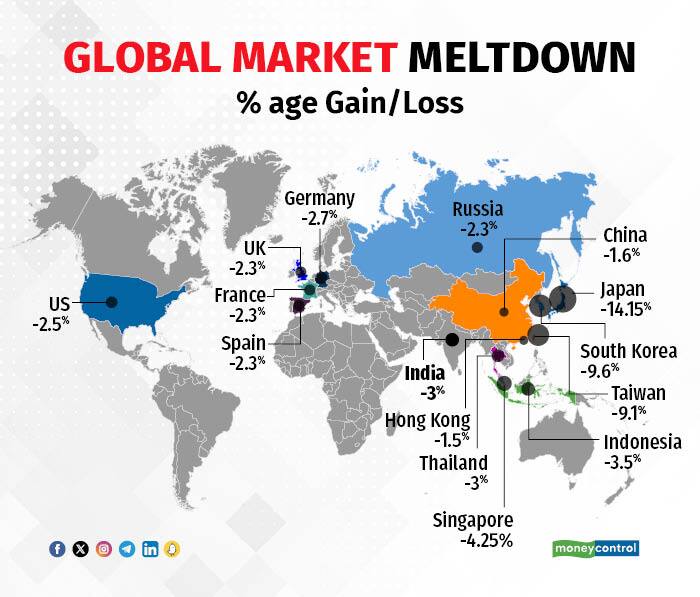

Other Asian markets in Singapore, Indonesia, China, Hong Kong and Thailand also fell 1.5-4 percent. The Indian benchmark index, the Nifty 50 also slumped around 3 percent.

Elsewhere, major equity indices, including the UK's FTSE 100, Russia's MOEX, France's CAC 40, Germany's DAX all fell by 2-3 percent. Futures tied to the US Dow Jones, Nasdaq 100, and S&P 500 were also down 1-3 percent, suggesting a weak opening for US equities.

Meanwhile, the grappling losses across global market have also sparked expectations of an off cycle rate cut from the US Federal Reserve. Along with that, several economists are also anticipating the Fed to cut rates more aggressively in an attempt to safeguard the world's largest economy from slipping into a recession.

Concerns about elevated inflation have largely faded, giving rise to speculation that economic growth could stall unless the central bank starts lowering interest rates from their highest level in over two decades.

Also Read | Nifty, Sensex bleed amid weak global cues: Here are 5 factors that dampen sentiment

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.