Nandish Shah, Senior Derivative & Technical Analyst, HDFC Securities

Nifty recovered more than 200 points from the low to end the day with gains of 28 points to 17,054. Short-term trend in the Nifty remains weak as it makes a lower top lower bottom formation on the daily chart. The Nifty is also trading below its all-important short-term moving averages.

In the derivatives, we have seen aggressive Call writing at 17,000-17,300 levels. Moreover, falling 5-day EMA (exponential moving average) is currently placed at 17,295 levels. Therefore, unless the Nifty closes above 17,000 level, the short-term trend will remain bearish.

The Nifty made an intraday low of 16,782 and bounced back. This level coincides with the previous top resistance of 16,700 which will interchange its role as a support. Therefore, we believe that on the lower side, 16,700-16,800 level will act as an immediate support.

To sum it up, we believe that, the short-term trend of the Nifty is weak. Therefore, our advice is to remain cautious till it closes above the 17,300 levels. On the lower side, we expect the Nifty to find an immediate support in the vicinity of 16,700-16,800.

The support for the Nifty is seen around 16,000 levels which is 23.6 percent retracement of the entire rally seen from the low of March 2020 to the all-time high of 18,604.

Here are two buy and one sell recommendations for the next 2-3 weeks:

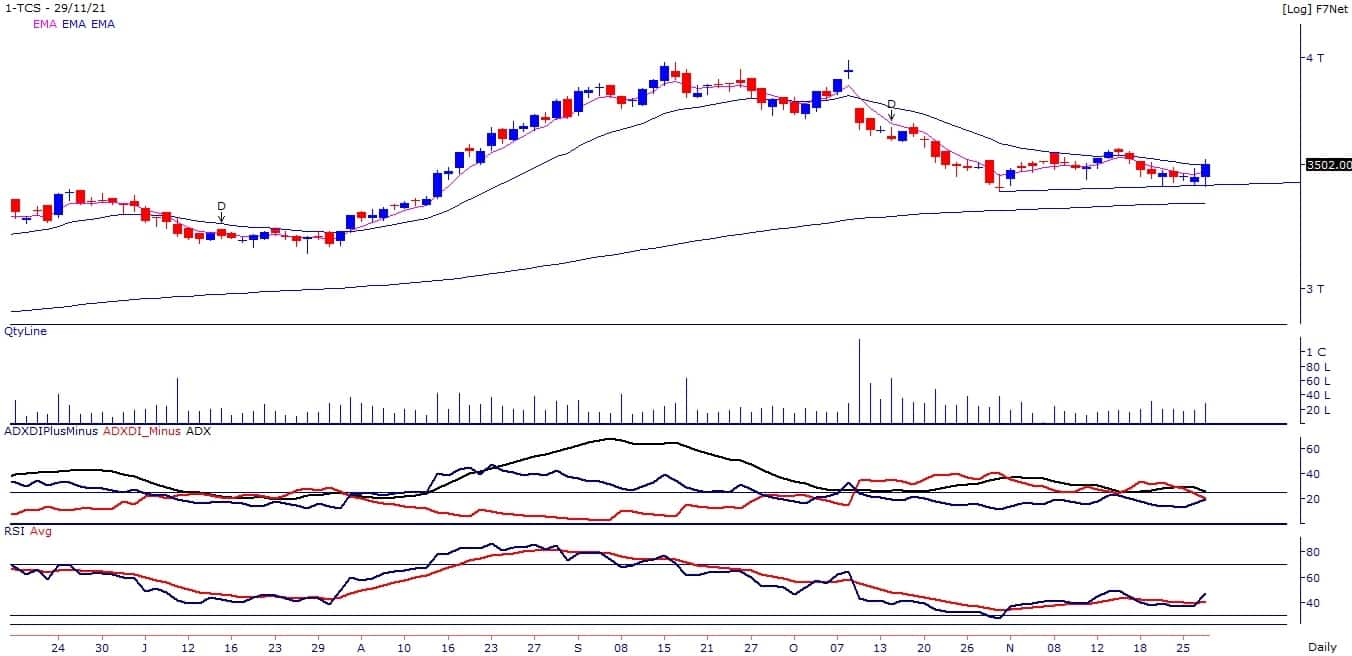

Tata Consultancy Services: Buy | LTP: Rs 3,502 | Stop Loss: Rs 3,400 | Target: Rs 3,750 | Return: 7.1 percent

After forming multiple bottoms around Rs 3,400 levels, the stock price reversed northwards to close above its 5 and 20-day EMA. The primary trend of the stock is positive as it trades above its 200-day EMA. The daily RSI (relative strength index) line is placed above 50 and sloping upwards, indicating strength in the current uptrend.

Finolex Cables: Buy | LTP: Rs 557.9 | Stop Loss: Rs 530 | Target: Rs 620 | Return: 11.1 percent

The stock price has broken out on the monthly chart from the downward sloping trendline, adjoining the highs of February 2018 and July 2021. The stock closed at highest level since July 2018.

Weekly RSI and MFI (money flow index) lines are placed above 60 and sloping upwards, indicating strength in the current uptrend.

Piramal Enterprises: Sell | LTP: Rs 2,384.70 | Stop Loss: Rs 2,500 | Target: Rs 2,200 | Return: 7.7 percent

The stock price has broken down on the daily chart with higher volumes. The short-term trend of the stock is weak as it is trading below its 5 and 20-day EMA.

The daily RSI and MFI lines are sloping downwards and placed below 40, indicating weakness in the stock. Minus ADI line is placed above Plus ADI while ADX is placed above 25, indicating momentum in the current downtrend.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.