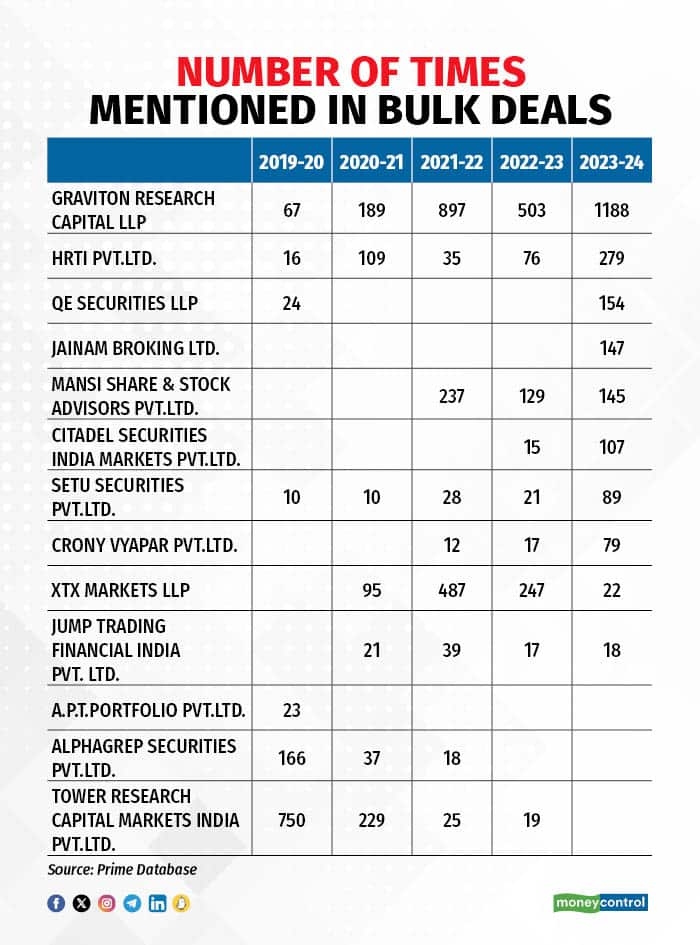

It is not just retail investors who have been smitten by small and micro-cap stocks. High-frequency trading (HFTs) firms and algorithmic trading firms, considered to be among the sophisticated set of market participants, have stepped up their activity in these stocks over the last couple of months, as can be seen from the bulk deal disclosures on the stock exchanges.

All HFTs are algo driven but not all algo trading firms follow a high-frequency trading strategy.

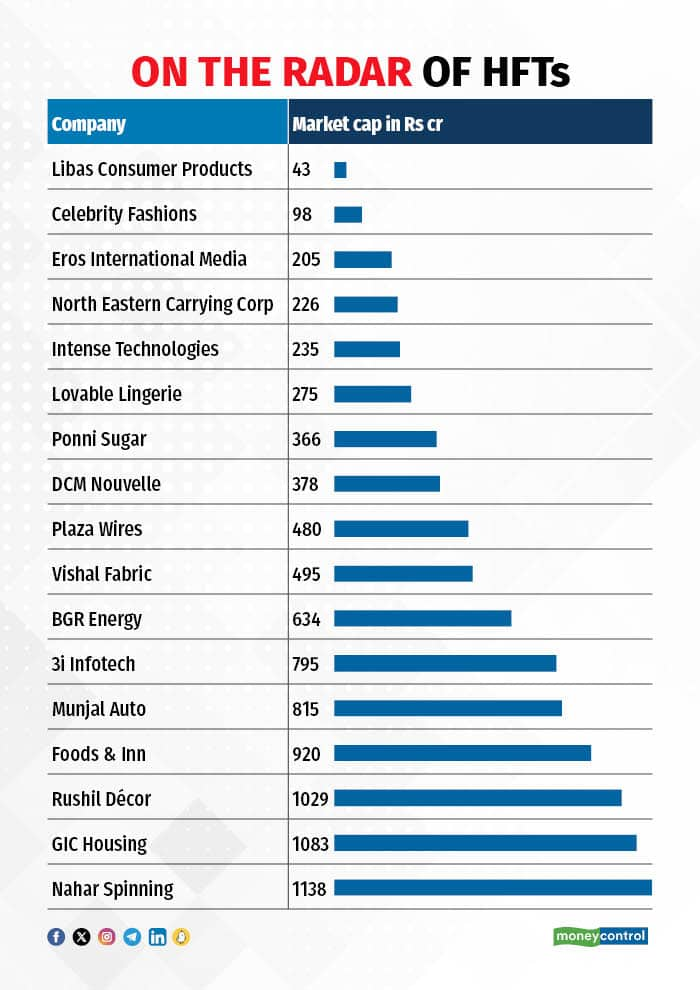

What’s caught the attention of many market observers is that many HFTs are now active in shares with a market capitalisation of less than Rs 500 crore.

That’s out of character for the majority of the HFTs. These firms typically hunt for profits in stocks that are eligible for derivatives trading; capturing the spread between the spot and futures prices is a common strategy.

If the stocks are ineligible for derivatives trading, they must be highly liquid. That is crucial to the strategy of most HFTs because they move in and out of positions very quickly, and don’t hold positions overnight.

Race to the bottom

In some cases, HFTs and algo firms have been going for stocks with a market capitalisation of less than Rs 100 crore. Take Libas Consumer Products for instance. The company with a market cap of Rs 43 crore has seen interest from three reputed HFT Firms—Graviton Research, QE Securities, and HRTI—since October. As a result, daily trading volumes in the stock have skyrocketed from a few tens of thousands to a few million shares. Similarly, Celebrity Fashions, having a market cap of Rs 98 crore, has been in the crosshairs of Graviton, Citadel Market Securities, and QE Securities.

While HFTs don’t carry positions overnight, some of the algo firms do not square off all their positions on the same day. They may wind down the remaining position the following day or may hold it in their inventory for a suitable opportunity.

Chicken or egg?

A question many market players are asking is whether HFT and algo firms are sparking the action in these stocks or are merely diving in after the volumes have begun to pick up.

“That HFTs would be active in some of these names is really surprising,” said an algo trader who has developed algo strategies for institutional players.

“Usually, the stocks need to have ample liquidity and enough history for an algo strategy to analyze the order book patterns well enough. A few days or even weeks of high volumes may not be enough to give a scenario of what is likely to happen next ” the trader said.

“The sudden surge in trading volumes often gives false signals to retail traders, who mostly base their decisions based on the trading volumes in a stock,” the trader said.

Algo wars

And it may not just be retail traders who are attracted by the surge in trading volumes, other algo firms join in too. For instance, 3i Infotech has been seeing interest from multiple HFT/algo firms over the last couple of trading sessions.

And it is not that Algos wins all the time. In quite a few trades analysed by Moneycontrol, HFTs/algo firms have lost money and in some others, they have barely managed to break even.

That’s making many wonder why these firms are getting into illiquid stocks.

But some of the algo specialists counter by saying that these trades can be profitable enough if the margins are thin.

“There are strategies for which you do not need a long history, some of them get activated based on the sudden shifts in the order book,” another algo trader told Moneycontrol.

“Also, the breakeven level on a trade like this is around 4 bps, to offset the statutory charges (exchange charges and government taxes),” the trader said. This means if an HFT has bought a stock at Rs 100, and is able to square off at Rs 100.04, that is enough to ensure there is no loss

“A small spread on a very high volume and done consistently day after day earns good profits. Again, a single stock arbitrage is just one of the many strategies of an HFT or algo firm. Even if you lose money on some of the trades there are plenty of other profitable trades that will not be known publicly,” the trader said.

A helping hand

And yet, there is chatter in the market that some companies may at times be enlisting the help of algo firms to generate interest in their stock or act as a layer for certain transactions.

“In many of the small cap names, promoters own anywhere between 60-75 percent officially and much more unofficially,” said the first trader. “And then you see almost one third or one fourth of the floating stock being traded in a single session. Usually that kind of volumes are good enough to send the stock to the upper or lower circuit. But you still see prices remaining stable. Sometimes when traders (algo firms) are able to move in and out of large positions in an illiquid stock, there are grounds to believe that they may have some tacit assurance.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.