Multicap focussed PMS funds, especially those having allocation to broader market, outperformed their respective benchmarks by wide margins in July thanks to massive rallies in some of the smaller names during the month.

Some schemes also benefited from buying in bank and financial names especially after their June quarter numbers surprised the Street positively.

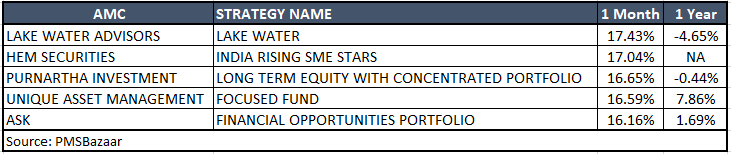

Lake Water Advisor’s Lake Water portfolio was the top performer with 17.43 percent returns in a month, data compiled by PMZbazaar showed. This also improved its 1-year return to negative 5 percent. The fund’s top five holdings are Bajaj Finance, Tata Motors, Sona BLW Precision Forgings, Aarti Industries and PI Industries.

It was followed by recently launched Hem Securities' managed India Rising SME Stars that invests in SME and smallcap scrips, which delivered 17 percent returns.

Mohit Nigam, Head - PMS, Hem Securities, said stock selection, allocation and ability to handle stressful times and taking opportunities in adversities were some of the key things that contributed to the outperformance.

“We were very selective and careful about the sectors and shares we were getting into. We kept a vigilant eye on various micro and macro developments and deployed funds in the best interest of our investors,” said Nigam.

Purnartha Investment’s Long Term Equity with Concentrated Portfolio, Unique Asset Management’s Focused Fund and ASK Investment Managers’ Financial Opportunities were next best performing funds delivering 16-17 percent returns. In the last one year, they have returned -0.44 percent, 7.86 percent and 1.69 percent respectively.

In comparison, Nifty 50 which represent largecap segment returned around 9 percent while Nifty Midcap 100 increased 12 percent. Nifty Smallcap advanced 9 percent and NSE 500 zoomed 10 percent.

The outperformance of most portfolios was expected given the overall market rally. Many fund managers now expect small and midcap names to lead the growth going ahead.

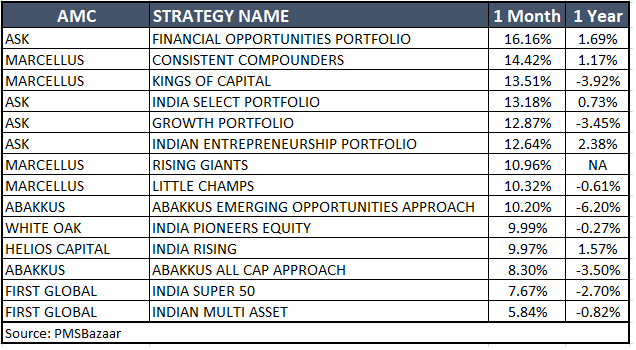

Portfolios managed by some of the star fund managers also shined during the month. Though a couple of them underperformed benchmarks, especially those run by Devina Mehra of First Global.

Saurabh Mukherjea-promoted Consistent Compounders and Kings of Capital shrugged off its string of bad months and delivered 14.42 percent and 13.51 percent, respectively, during the month. Similarly, ASK’s other schemes including India Select Portfolio, Growth Portfolio and Indian Entrepreneurship Portfolio also delivered 12-14 percent returns. Samir Arora's India Rising portfolio delivered 10 percent returns.

In the last one year period, however, their performance is not that strong -as reflected in the table above - with most of them delivering flat to negative returns as market took a breather.

Shankar Sharma, who was earlier associated with First Global, said growth opportunities for smaller company is larger than bigger companies and now market is going to recognise that.

“The clearest bull market I see is in the small-caps where (stocks are going to) take out the highs of January and going to go much much higher than that over the course of the next 12 months or so,” Sharma said in recent TV interaction.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.