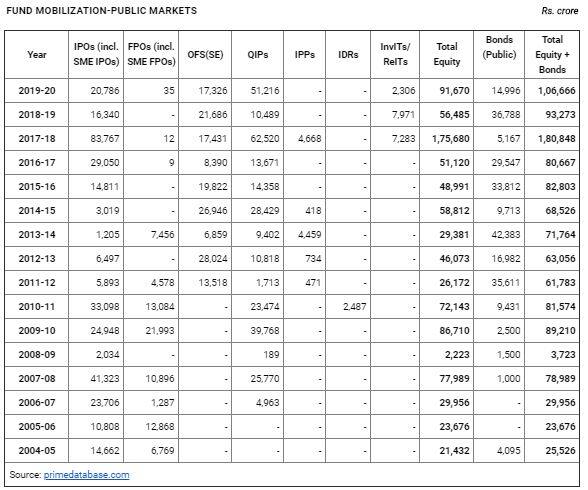

Fundraising through equity markets saw a 62 percent year-on-year (YoY) rise in the financial year 2019-20, a report from PRIME Database says.

"The financial year 2019-20 witnessed raising of Rs 91,670 crore through the public equity markets, 62 percent higher than Rs 56,485 crore that was raised in 2018-19," said Pranav Haldea, Managing Director, PRIME Database Group, which runs primedatabase.com.

The mobilisation, however, was still 48 percent lower than the all-time high amount of Rs 1,75,680 crore in the 2017-18.

Besides, some 13 companies mobilised Rs 51,216 crore through qualified institutional placement (QIPs). This is 388 percent higher than Rs 10,489 crore raised in the previous year, the report says.

The largest QIP of 2019-20 was from Bharti Airtel, which raised Rs 14,400 crore, accounting for 28 percent of the total amount.

Banks, non-banking financial companies and telecommunication firms dominated the QIP space, accounting for 79 percent (Rs 40,256 crore) of the overall amount, the report says.

According to Haldea, 13 main-board IPOs came to the market, collectively raising Rs 20,350 crore during the year, which was 38 percent higher from Rs 14,719 crore raised through 14 IPOs in 2018-19.

The largest IPO in 2019-20 was from SBI Cards & Payment Services for Rs 10,341 crore. The average deal size was Rs 1,565 crore.

Out of the 13 IPOs, 11 companies had anchor investors, which collectively subscribed to 32 percent of the total public issue amount. Foreign portfolio investment (FPIs) was 21 percent while from domestic institutional investors contributed 11 percent of the amount, the report says.

On the other hand, activities in the small and medium enterprises segment declined for the first time since the launch of the SME platform. There were only 45 SME IPOs, which collected Rs 436 crore in comparison to 106 such offerings in 2018-19 that mopped up Rs 1,620 crore, the report says.

According to primedatabase.com, Offers for Sale through Stock Exchanges (OFS), which is for dilution of promoters’ holdings, saw a decrease, from Rs 21,686 crore in 2018-19 to Rs 17,326 crore in 2019-20.

"Of this, the government’s divestment accounted for Rs 1,134 crore or just 7 percent of the overall amount. The largest OFS was that of SBI Life Insurance in September (Rs 3,524 crore) followed by Avenue Supermarts (Rs 3,428 crore) and HDFC Asset Management (Rs 2,039 crore). OFS accounted for 19 percent of the total year’s public equity markets amount," the report says.

The amount raised through InvITs and ReITs dropped 71 percent from the previous year, from Rs 7,971 crore in 2018-19 to Rs 2,306 crore in 2019-20.

As far as fresh capital is concerned, of the total Rs 91,670 crore, the fresh capital amount was Rs 55,932 crore (61 percent); the remaining Rs 35,738 crore being offered for sale, the report says.

The year 2019-20 was a mediocre year for divestments with Rs 49,823 crore being raised by the government.

ETFs at Rs 30,869 crore (62 percent) constituted the lion’s share of divestment followed by CPSE sale at Rs 13,883 crore (28 percent), enemy share sales at Rs 1,881 crore (4 percent), public offers (IPO of IRCTC and OFS of RITES) at Rs 1,768 crore (4 percent) and buybacks (MOIL, MDL and SPMCIL) at Rs 822 crore (2 percent), the report said.

Public bonds market saw a near 59 percent decrease with 35 issues raising Rs 14,996 crore (Sakthi Finance Ltd. and Kosamattam Finance Ltd.Debt Public Issues base issue amount considered) in comparison to 20 issues raising Rs 36,788 crore last year, the report said.

On the front of rights issues, mobilisation of resources recorded a huge increase in 2019-20. Some Rs 55,998 crore was raised through rights issues, which was 2,700 percent higher than Rs 1,999 crore raised in 2018-19, according to primedatabase.com.

This was primarily on account of two large issues-- Vodafone Idea (Rs 25,000 crore) and Bharti Airtel (Rs 24,939 crore). By number, the year saw 13 companies using the rights route in comparison to eight in the previous year, the report by primedatabase.com says.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.