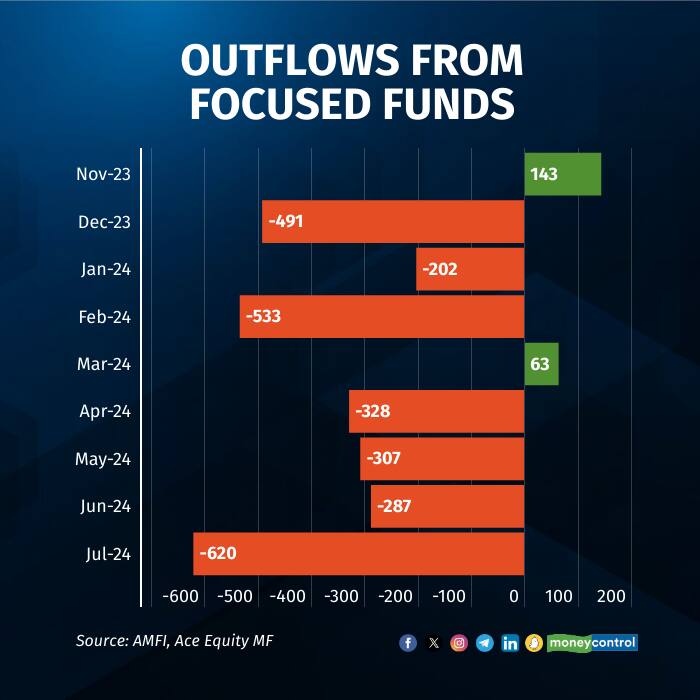

Focused funds, which typically have a small concentrated portfolio of stocks, appear to be going out of favour as they have seen outflows in seven of the past eight months with cumulative outflows pegged at nearly Rs 2,500 crore.

But while there has been an industry wide decline, not all fund managers are concerned. As per data from Ace Equity MF, focused funds have seen continuous outflows with maximum outflows seen in July 2024 (Rs 620.2 crore) and February 2024 (Rs 533 crore).

In August 2024, equity mutual fund AUM hit a record high of Rs 29.34 lakh crore, constituting 45 percent of the industry's AUM.

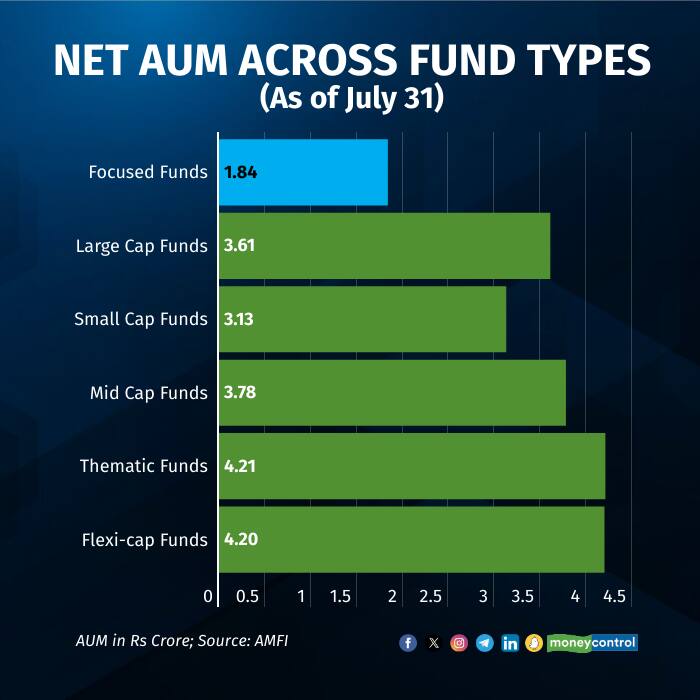

The net inflows for July were Rs 37,130 crore, slightly lower than June's Rs 40,608 crore. Sectoral and thematic funds led the segment with assets of Rs 4.21 lakh crore. On the other hand, focused funds outflows increased from Rs 286 crore in June to Rs 620 crore in July.

Experts said that the reason for the increase in outflows is due to multiple reasons, most notably an increase in flows towards flexicap funds and thematic and sector funds.

On the reason for the broader industry outflows, Meeta Shetty, Fund Manager, Tata AMC explained that it could be that in a broad-based market rally, like what we have been witnessing over the last couple of years, a focused fund, which is bounded by the mandates of holding only a certain number of stocks, tends to end up facing some challenges.

She also pointed out that many focused funds are heavily weighted toward large-cap stocks. “When I look around, I see that there is a lot of skew towards large-cap, which could be one of the reasons because, as an investor, you’re not seeing a lot of differentiation versus, say, a large-cap fund or a focused fund,” Shetty explained.

But while overall industry numbers are not positive, Shetty added that Tata AMC has not seen any outflows during this period due to their “balanced allocation”.

“We have a balance of around 50 to 60 percent large-cap, and the rest is split between mid and small caps."

Shetty added that a growing interest in thematic funds could be another possible factor contributing to the decline in focused fund inflows.

As per SEBI classification, while they can have stocks from across asset classes, focused funds cannot have more than 30 stocks. Flexi cap funds, on the other hand, usually have around 50 stocks.

Mixed performance

Chirag Muni, Executive Director, Anand Rathi Wealth explained that focused category of funds typically follow a concentrated portfolio strategy with high-conviction stocks.

“The majority of funds in this category adopt either a growth or blended approach. However, growth as an investment style has underperformed in recent years,” he said.

Among the top performers, the 360 ONE Focused Equity Fund-Reg(G) saw 1-year CAGR of 38.61 percent, a 3-year CAGR of 18.54 percent, and a 5-year CAGR of 24.46 percent.

Similarly, Aditya Birla SL Focused Fund(G), delivered a 1-year CAGR of 33.62 percent, a 3-year CAGR of 15.77 percent, and a 5-year CAGR of 18.95 percent and Motilal Oswal Focused 25 Fund-Reg(G) also delivered 1-year CAGR of 33.06 percent, a 3-year CAGR of 16.9 percent, and a 5-year CAGR of 16.83 percent.

As per Muni, the flows into this category have been inconsistent, with inflows skewed toward one or two funds.

“HDFC Focused Fund and ICICI Focused Fund have attracted the most investor attention over the past three months, with inflows of around Rs 1,111 crore and Rs 642 crore, respectively, even though the entire category has experienced net outflows,” he said, adding that HDFC Focused Fund recorded inflows exceeding Rs 100 crore in the last 10 days of August 2024, representing the largest inflow in this category.

ICICI Prudential Focused Fund, which saw the second-largest inflow, has consistently remained in the top quartile across the 1-year, 6-month, 3-month, and 1-month time frames, said Muni.

Optimism remains

Muni further said that while as a category, focused funds have not performed well over the past year amidst ranking of all diversified categories based on performance, this category has shown a turnaround in the last one month, moving up to 3rd from 9th place out of 10 categories, over the 1-year time frame.

"(Going ahead) the markets will probably become very bottom-up stock picking kind of market, and very stock-specific movement possibly we will see going ahead. And that kind of scenario actually plays out very well for a focused category," Shetty said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!