The market traded with some gains on June 8, though it was not enough for the benchmark indices to reach their all-time highs that the Street had been waiting for since a couple of months.

The Nifty 50 index traded with gains of 0.24 percent or 45 points to 18,771.05 as of 11am. The Bank Nifty edged up 0.36 percent to 44,435, close to its all-time high levels.

Traders don’t expect the market to do much today. However, they are expecting indices to hit all-time high levels in the next week or so.

“For today, I'm not expecting much of a rally. If Bank Nifty spot breaks 44,350, we may see a good selloff,” said Shijumon Antony, a Kochi-based trader. “For the next series, I'm bullish.”

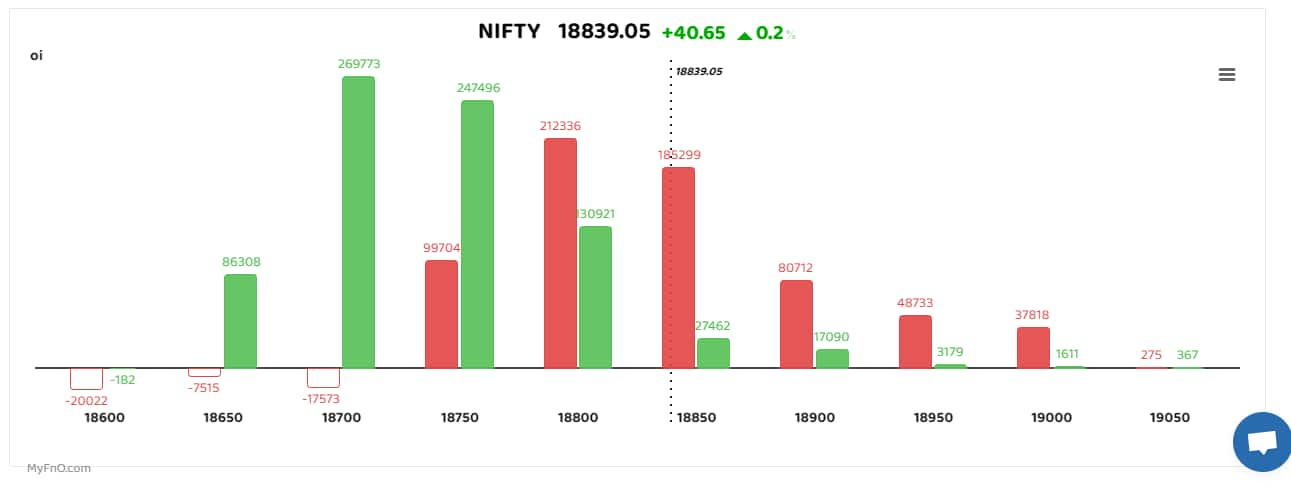

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

On the expiry day of weekly options, data shows that traders have written Puts at 18,7000 and 18,750. On the other hand, 18,800 and 18,850 levels are where Call writers are accumulating positions. This signals a narrow trading range for the day.

In the monthly series, 18,800 is seeing heavy Straddle trades, a neutral strategy.

There was no sharp reaction in market due to RBI policy meet outcome as the central bank announcement were on expected lines.

“Patterns and some of the momentum indicators point to further strength, encouraging us to enter the 18,750-18,887 region with a positive frame of mind, despite pencilling it as a potential consolidation region yesterday. For downside protection, 18,660 would certainly be enough as the marker, but should Nifty show reluctance to float above 18,700 today, the vulnerability of 18,660 would increase manifold in the coming days,” said Anand James, Chief Market Strategist at Geojit Financial Services.

Among individual stocks, JSW Steel, MCX and NTPC were among those that saw long addition by traders. On the other hand, HPCL continued to see traders adding short positions. Mphasis, Persistent and Systems also saw no respite.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.