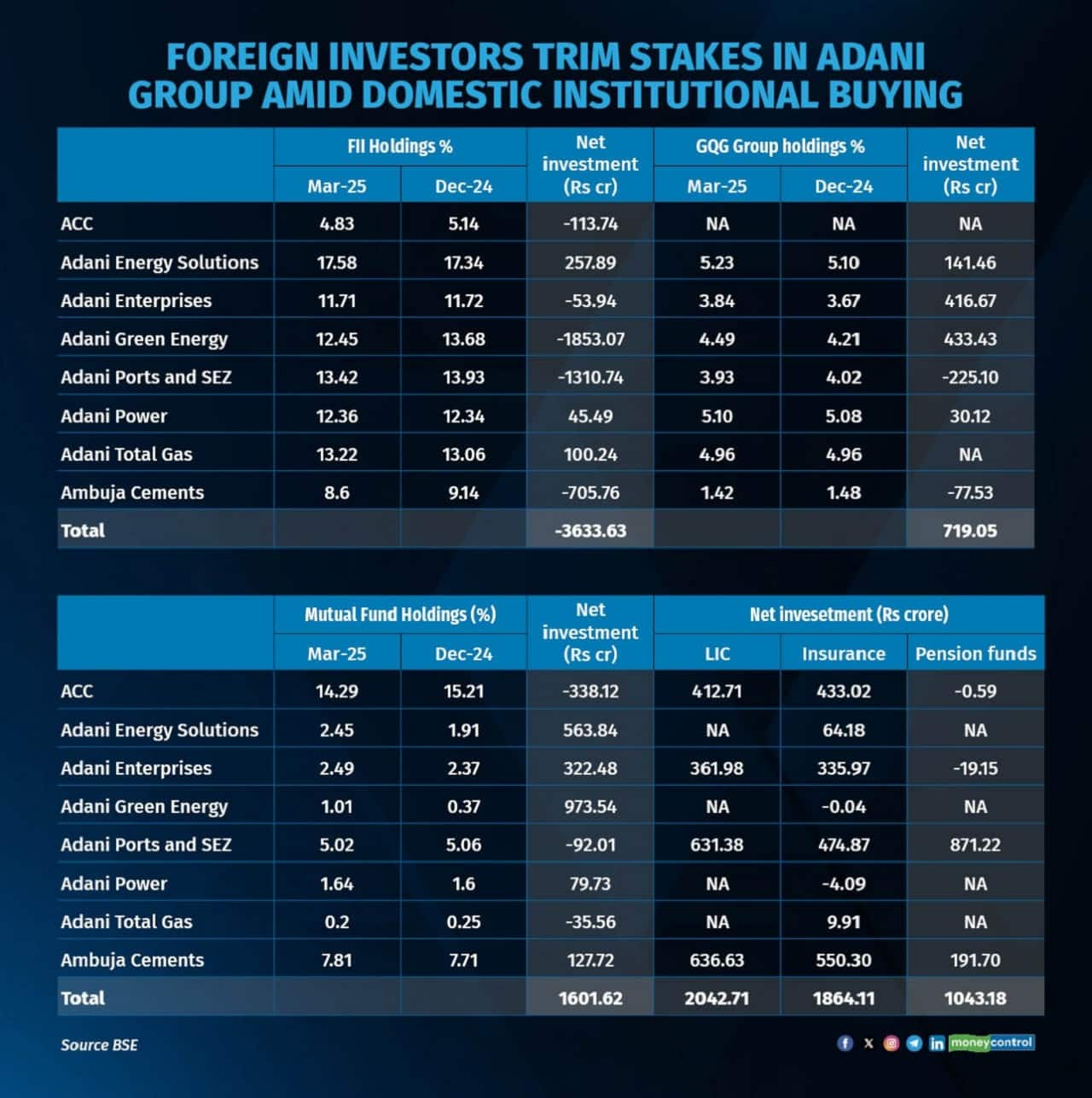

Foreign institutional investors (FIIs) reduced their holdings in Adani group companies by approximately Rs 3,600 crore during the March 2025 quarter. In contrast, domestic institutional investors—including Life Insurance Corporation of India (LIC), insurance companies, pension funds, and mutual funds—significantly increased their stakes across various group firms.

The foreign investors divested from five Adani entities. In Adani Green Energy, FII holdings declined to 12.45 percent in the fourth quarter from 13.68 percent in the previous quarter—a reduction of 1.23 percent, amounting to Rs 1,850 crore.

In Adani Ports & SEZ, FII holdings fell to 13.42 percent from 13.93 percent, a drop of 0.5 percent or Rs 1,310 crore. FIIs also reduced their stake in Ambuja Cements by 0.54 percent to 8.6 percent, corresponding to a divestment of Rs 700 crore. In ACC, their holding declined by 0.31 percent to 4.83 percent, amounting to Rs 110 crore. Meanwhile, Adani Enterprises saw a smaller divestment worth Rs 54 crore.

GQG Group marginally increased its stake in select Adani group firms during the quarter. It invested around Rs 430 crore each in Adani Green Energy (raising its stake to 4.49 percent from 4.21 percent) and Adani Enterprises (to 3.84 percent from 3.67 percent). The group also increased its holdings in Adani Energy Solutions to 5.23 percent (from 5.10 percent), and in Adani Power to 5.10 percent (from 5.08 percent), investing Rs 141 crore and Rs 30 crore respectively. However, it reduced its stake in Adani Ports & SEZ, selling shares worth Rs 225 crore and lowering its holding to 3.93 percent from 4.02 percent.

LIC led the domestic institutional inflows, with net investments of Rs 2,050 crore across Adani Group firms. This was followed by insurance companies (Rs 1,865 crore), pension funds (Rs 1,050 crore) and mutual funds (Rs 1,600 crore).

LIC’s largest investment was in Ambuja Cements, increasing its stake by 0.48 percent to 5.55 percent from 5.07 percent—an investment of Rs 636 crore. It also raised its holding in Adani Ports & SEZ by 0.24 percent to 8.10 percent (Rs 631 crore), in ACC by 1.12 percent to 7.69 percent (Rs 412 crore), and in Adani Enterprises by 0.14 percent (Rs 362 crore).

Insurance companies also increased their exposure: they invested Rs 550 crore in Ambuja Cements (up 0.4 percent), Rs 475 crore in Adani Ports & SEZ (up 0.2 percent), Rs 433 crore in ACC (up 1.17 percent), and Rs 335 crore in Adani Enterprises (up 0.13 percent). Pension funds focused their investments on Adani Ports & SEZ (Rs 871 crore) and Ambuja Cements (Rs 192 crore).

Mutual funds added to their stakes in Adani Green Energy by 0.64 percent (Rs 973 crore), Adani Energy Solutions by 0.54 percent (Rs 563 crore), Adani Enterprises by 0.12 percent (Rs 322 crore), and Ambuja Cements by 0.10 percent (Rs 127 crore). However, they trimmed their holdings in ACC by 0.91 percent (Rs 338 crore), Adani Ports & SEZ by 0.04 percent (Rs 92 crore), and Adani Total Gas by 0.05 percent (Rs 127 crore).

In November 2024, US federal prosecutors in Brooklyn unsealed an indictment accusing the Adani Group of bribing Indian officials to secure electricity contracts through Adani Green Energy. The charges also allege the company misled U.S. investors about its anti-corruption policies. The U.S. Securities and Exchange Commission (SEC) has filed a separate civil suit in addition to the criminal charges brought by the Department of Justice.

The Adani Group has categorically denied the allegations, describing them as “baseless,” and has stated it will pursue “all possible legal recourse.” As of mid-February, the SEC sought assistance from India’s Ministry of Law and Justice to serve its complaint to Gautam Adani and Sagar Adani. The regulator informed the court that service efforts are ongoing, as both individuals are currently residing in India and are not in U.S. custody.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.