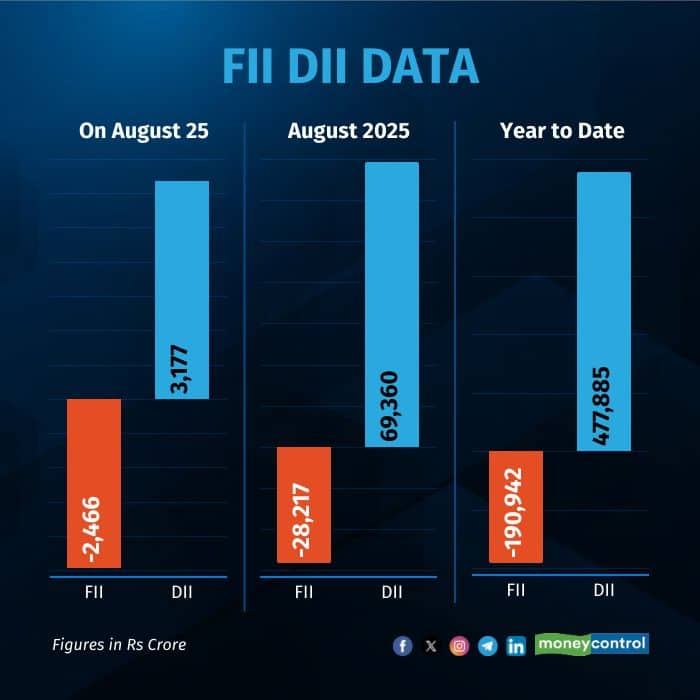

On August 25, Foreign Institutional Investors (FPI/FII) stood net sellers of Indian equities worth Rs 2,466 crore while Domestic Institutional Investors bounced back to buying after last week's sell off. Therefore, picking up shares worth Rs 3,178 crore, as per provisional data on NSE.

During the trading session, FIIs bought shares worth Rs 9,951 crore and sold shares worth Rs 12,418 crore. DIIs purchased equities worth Rs 13,371 crore while selling shares worth Rs 10,194 crore.

For the year so far, FIIs have been net sellers of shares worth Rs 1.90 lakh crore, while DIIs have net bought Rs 4.77 lakh crore worth of shares.

Market Performance

The Nifty ended today's trading session 98 points higher, while the Sensex was up by 329 points. Among sectors, the IT index outperformed, rallying 2.40 percent, whereas the media index lost the most, shedding 1.80 percent.

Reflecting on today's market performance, Shrikant Chouhan, Head of Equity Research at Kotak Securities said, "Technically, after an early morning intraday dip, the market took support near 24,900/81,400 and bounced back sharply. However, due to profit-taking at higher levels, it failed to close above the 25,000/81,800 mark."

IT stocks were the top performers, underlined by expectations of a 25 bps Fed rate cut next month. Nifty IT index therefore, climbed more than 2% with Infosys, TCS, HCL Tech, Mphasis, and Wipro gaining 2% to 4%.

Paper stocks rallied sharply after the government imposed a Minimum Import Price on Virgin Multi-layer Paper Board to protect domestic players from low-cost Indonesian imports, following a DGTR probe confirming dumping. JK Paper, West Coast Paper, and Emami Paper surged up to 20%.

The Nifty Realty index added nearly 1% on hopes that a lower GST rate on construction materials will benefit the sector. Stocks like Sobha, DLF, Oberoi Realty, and Raymond advanced 1 to 2%.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.