Investors have warmed up to public sector bank stocks after the Bharatiya Janata Party’s sweeping victory in three of the five state elections, sending the Nifty PSU Bank Index soaring 4 percent in the two days since the poll results were declared on December 3.

Heavyweight shares such as State Bank of India, Punjab National Bank, Bank of Baroda, and Bank of India surged in the range of 3 percent to 6 percent.

While the key driver for PSU bank shares is their ability to expand their loan books and shore up profitability, continuation of the BJP-led regime after the 2024 elections may help narrow their valuation gap with private peers.

Experts said public sector banks’ governance standards have improved under the current regime and they have also upgraded their technology to improve their efficiencies, setting themselves for stronger growth.

ALSO READ: Of polls and punters: Decoding the D-St dynamics in a year of elections

Asset quality, governance, technology

"PSU bank stocks have done exceptionally well, and there is also a belief that governance standards for PSUs are in a better shape today than it was in the previous regime," Nilesh Shah, MD of Kotak AMC, said in a post-election interview with Moneycontrol.

The triggers for PSU bank shares are better asset quality, governance and technology, Vikas Khemani, founder of Carnelian Capital Advisors, said during a Moneycontrol Diwali party interaction.

“The PSU banking space now boasts of stable asset quality and is functioning with minimal interference from the government," said Khemani.

ALSO READ: Forget elections, India growth story will carry equity markets over the next decade

Narrowing the gap

The banking sector is set to recover and catch up with the overall market, Andrew Holland, CEO of Avendus Capital Public Markets Alternate Strategies LLP, said in a post-election interview.

"Now, you can see that big catch-up for the banking sector. Given its weightage, that would lead to good strong performance for the Nifty," said Holland.

PSU banks are also at a significant valuation gap against private peers, N Jayakumar, MD of Prime Securities, said during the Diwali party.

"While private banks are quoting over 3x book value, certain PSU banks are struggling to even come up to 1x because gains are difficult to digest," he said, noting the similar business mix of retail-focussed lending across public and private banks.

Khemani of Carnelian highlighted the attractive return on equity of public sector banks.

"Most PSU banks are at 17-18 percent RoE, which many private lenders have not been able to achieve. Ultimately, those who believe in the sector and the transformations that are taking place will make money, while others will lose out," he said.

ALSO READ: Primary market to remain buoyant, riding on D-St bulls until elections

Loan growth

Improving asset quality and better capital adequacy levels will support lending opportunities for PSU lenders in the near-to-medium term, said Chokkalingam G, founder of Equinomics Research. However, a high base and inflation trends could spiral trouble for PSU banks in the long-term.

In the past five years, the aggregate credit growth of PSU lenders was 10-12 percent, said analysts. It hit a low of 5 percent in FY21, weighed down by the pandemic.

PSU lenders managed to grow at 15-16 percent so far in 2023. This improvement came on the back of better management of non-performing assets that led to lower provisioning requirements and a resilient capital base.

“As things panned out well despite low credit growth during Covid times, PSU banks could lend in an efficient manner,” added Chokkalingam.

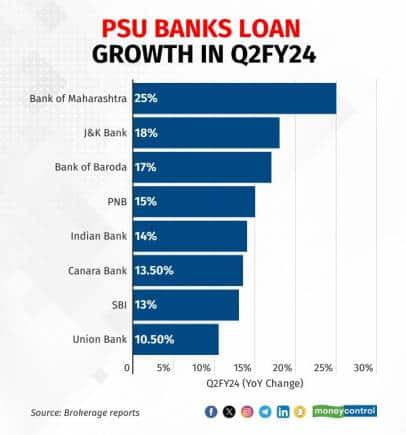

In the September-ended quarter, state-owned Bank of Maharashtra retained the top spot among PSU lenders in loan growth, which was about 25 percent. It was followed by J&K Bank with 18 percent, Bank of Baroda with 17 percent, and PNB with 15 percent.

Analysts said Bank of Maharashtra’s credit growth was due to the government’s massive fund infusion in tranches. Advances by SBI, India’s largest lender, rose 13 percent in the July-September quarter.

The said key headwinds to watch for are elevated interest rates, inflation, and global uncertainties.

ALSO READ: 2024 General Elections: Does it make sense to pause your SIPs till the results?

UPA vs NDA governments

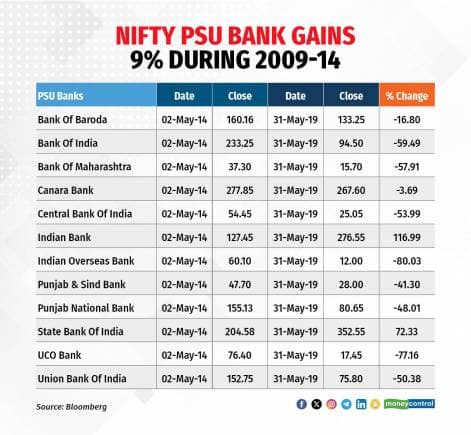

The PSU Bank Index remained sluggish under both Manmohan Singh’s Congress-led UPA government during 2009-2014, and Prime Minister Narendra Modi’s BJP-led NDA government during 2014-2019, rising 9-10 percent in each period.

In 2009-14, there was modest growth in the aftermath of the global financial crisis and the infrastructure story coming unstuck with policy issues. The problem of bad loans took centre stage after 2014, denting bank balance sheets heavily and pushing banks into losses.

After the BJP retained power in May 2019, the Nifty Bank PSU Index continued to slide until April 2020. The index has surged over 66 percent since May 2019. From May 2019 to April 2020, the index fell 65 percent and since then has risen over four-fold. All constituents of the index have given positive returns since May 2019. And the index has been the best performer in the market.

The rally came through as the provisioning cycle bottomed-out for banks after COVID, with most of them reporting the cleanest balance sheets in 15 years. According to India Ratings, the overall net non-performing assets of banks dropped to 1 percent by FY23, while gross NPAs were at 4 percent.

The last time net NPAs were at 1 percent was in 2008, when the economy was galloping, credit growth was strong, and the bad loan cycle had not started.

“The current improvement in asset quality comes on the back of the massive clean-up by banks through asset quality review by the Reserve Bank of India, which was followed by years of provisioning and insolvency proceedings. The improvement comes despite the COVID-19 shock to businesses as banks and regulators had learnt from the experience,” analysts at India Ratings said.

Specific to PSU banks, gross NPAs dropped to 5 percent in FY23 from 14.1 percent in FY18. Over the years, banks have strengthened their asset quality, resolved governance issues, leveraged technology, and rule-based credit approaches, said analysts.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.