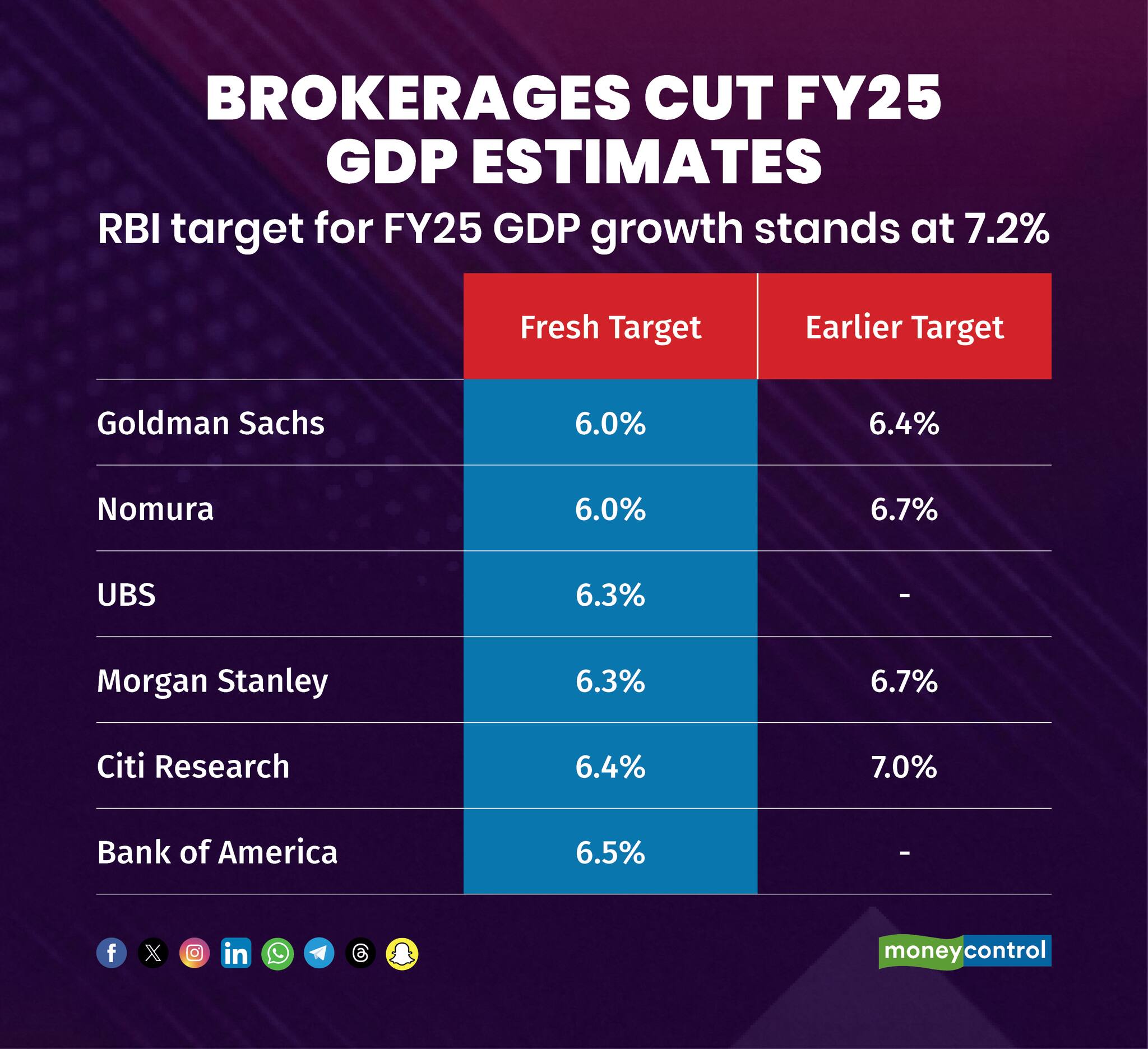

Broking firms rushed to trim their estimates on India's gross domestic product (GDP) for the financial year 2024-25 after GDP growth moderated to 5.4 percent for the quarter ended September. Experts pointed to slowing consumption, weak government capital expenditure (capex), coupled with a slowdown in industrial growth.

According to Morgan Stanley, GPD growth has bottomed out, and will see a rebound from the second half of the year. However, the brokerage cut its expectation for FY25 to 6.3 percent, down from 6.7 percent earlier.

Bank of America also lowered its FY25 GDP growth estimates to 6.5 percent. On a sectoral basis, agriculture remained in the green, but weaker than estimates. However, the brokerage said that Services, along with public capex flashes amber, while Industry has 'gone red'.

During the quarter gone by, there was a broad-based slowdown in industrial growth, while the services remained more resilient in comparison. Citi Research posited that the part of the industrial slowdown could be a result of one-offs along with an unfavourable base.

The lower GDP growth will spur the urgency on public capex, even if it remains below the FY25 target. Expectations that the central government will not meet the entire budgeted target of Rs 11.11 lakh crore are running high.

Japanese brokerage Nomura noted that slowing consumption and investment suggest that the domestic growth engines are sputtering. The moderation reflects a mix of transient factors, which would reverse going ahead. Further, the moderation is a signal of post-pandemic pent-up demand easing. Slowing income growth, RBI's macro-prudential tightening and weak private capex are all factors that could have contributed to the slowdown.

Also Read | Tale of two halves: GDP growth moderates in Q2, but early signs of rebound seen in second half

What will RBI do?

The consensus among experts remains that the Reserve Bank of India (RBI) will not slash the benchmark lending rate in its upcoming MPC meeting. Instead, the central bank could consider a cut in the cash reserve ratio (CRR), which would help ease pressures on liquidity, according to Citi Research.

Experts suggest that the headline CPI inflation for the quarter ended December is likely to exceed the RBI's forecast, as there are many upside risks to inflation. This adds to the expectations that the underwhelming GPD data is not likely to sway the central bank's focus away from bringing the headline inflation figure within its band.

"This is likely to result in the RBI moderating its FY25 GDP growth forecast of 7.2 percent. The backdrop warrants a policy action from RBI, but a rate cut is most likely to be delayed given the ongoing USD strength and markets pricing out Fed rate cuts," said domestic brokerage Nuvama Institutional Equities.

However, Japan-based brokering house Nomura was an outlier, expecting rate cuts to the tune of 100 basis points during the monetary policy easing cycle, with cuts starting in December.

Impact on markets

According to international brokerage Bernstein, the projections by equity markets and earnings estimates for FY25, market participants are pricing in a GDP over 7 percent for FY25. Retail investors don't look at PE ratios or spend time discussing GDP data, added the brokerage. Thus, flows will continue to chase themes and 200x PE will become the new norm.

Bernstein said it remained neutral on the Nifty 50 index, but believes that a wider acceptance of the slowdown would be the first sign of bottoming.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.