Weak sentiment in the market due to concerns over the health of the economy hit listed funds as well, as they witnessed outflows of $1.5 billion in August, a Kotak Institutional Equities report said on September 26.

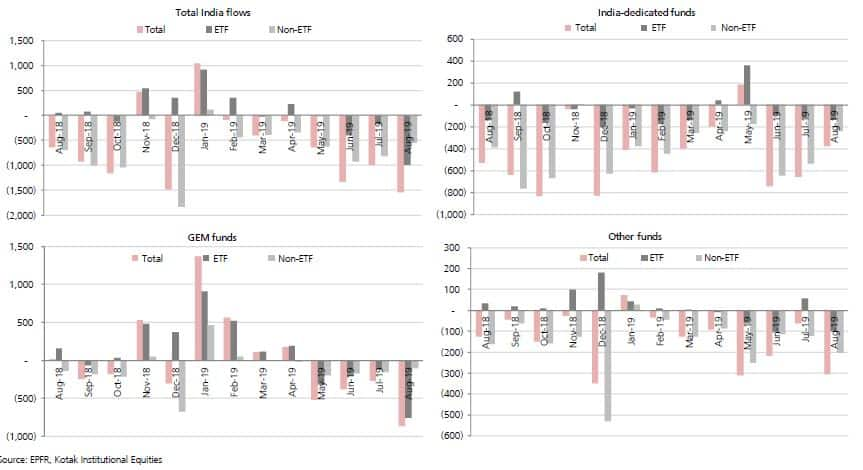

Total India funds have been consistently falling since May 2019.

"Listed funds witnessed outflows of $1.5 billion in August, broken down into $997 million of ETF outflows and $550 million of non-ETF outflows. India-dedicated funds saw outflows of $375 million, led by non-ETF outflows of $239 million," said the report from the brokerage.

The trend was similar in all emerging markets.

"Listed emerging market funds saw redemptions for all countries. China, Taiwan and India saw outflows of $7.3 billion, $1.8 billion and $1.5 billion, respectively. Total FPI activity and EPFR activity showed similar trends for all countries," the report from Kotak added.

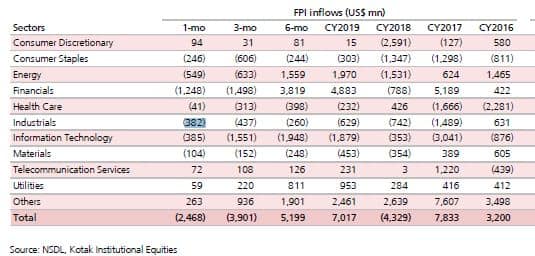

The FPI activity also remained disappointing as most sectors witnessed selling by FPI in August.

Financials emerged as the top loser as it saw the outflow of about $1,248 million by FPIs. It was followed by energy ($549 million), information technology ($385 million) and industrials ($382 million).

Global, as well as domestic factors, triggered a strong outflow of foreign funds since July. According to data available with NSDL, foreign investors have sold about 32,939 crore in Indian equities since July to September so far.

The recent measures by the government in the direction of reviving the economy and restoring investors' confidence are expected to revert the trend.

However, analysts believe much will depend on how the macroeconomic environment of the country remains in the coming months.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.