Analysts expect a strong top-line performance supported by India and emerging markets (EMs) when Dr Reddy’s reports its June quarter results on July 23, but continued pricing pressure in US generics business and an unfavourable product mix may limit margin expansion.

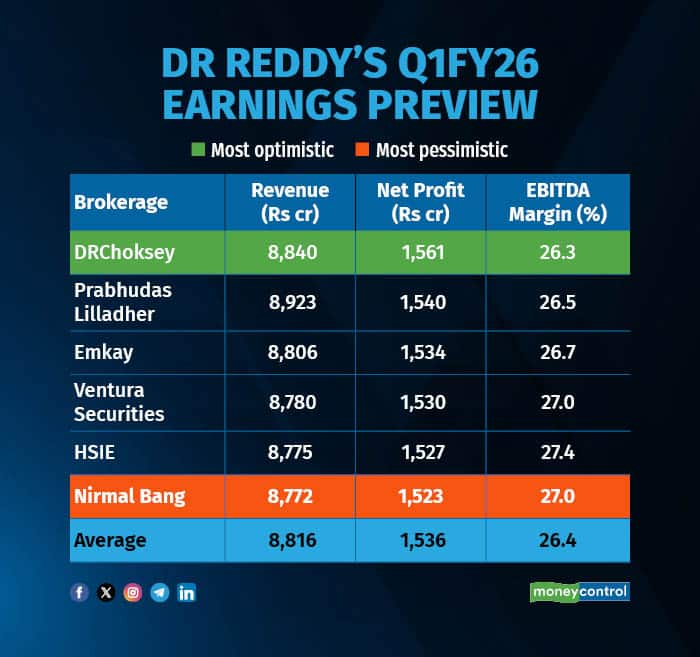

Earnings estimates of analysts polled by Moneycontrol are in a narrow range, and any deviation from expectations may prompt a sharp stock reaction.

Compared to the March quarter (Q4FY25), Dr Reddy’s topline is expected to rise modestly by around 1.6 percent in Q1FY26, supported by seasonal pickup in India and steady growth in emerging markets. However, net profit may decline by 3.5 percent sequentially, primarily due to pricing pressure in the US generics business and normalisation of other income, which was elevated last quarter.

Brokerages expect a sequential improvement of 100 bps in EBITDA margins, driven by improved operating leverage, better mix from India and EM businesses, and a partial recovery in gross margins.

Consolidated revenue is projected to rise 14-15 percent on-year to Rs 8,800-9,070 crore, according to estimates by HDFC Securities Institutional Equities (HSIE) and DRChoksey.

The revenue growth is expected to be driven by four key business segments - India, emerging markets, Europe, and partially, the US.

India: Chronic therapies and new launchesThe India business is expected to clock ~11 percent YoY growth, outperforming the Indian pharma market (IPM) growth of 7.2 percent during April–May. This outperformance is attributed to sustained momentum in chronic therapies, new launches, and improved coverage. DRChoksey highlights Dr Reddy’s strong brand presence and increased productivity of its field force as key drivers of domestic performance.

Analysts expect strong growth in emerging markets, led by a recovery in Mexico and continued traction in markets like South Africa, Brazil, and the Philippines. HSIE notes that EMs have become a meaningful offset to North America’s weakness, contributing to both top-line and margin stability.

Europe: Branded generics gain tractionThe European business is projected to post steady YoY growth, led by traction in dermatology and respiratory segments. The company’s push into complex generics and differentiated products is showing signs of traction in this geography.

US: Revlimid tailwind offset by base erosionThe North America business remains the key overhang. While gRevlimid sales may support sequential growth, analysts remain cautious due to continued price erosion and competition in the base portfolio. According to HSIE, the US revenue may decline 11 percent YoY and 6 percent sequentially, despite gRevlimid's contribution, as pressure builds on older molecules.

Product mix and higher operating expenses will likely limit margin upside, mentions a note by DRChoksey Research in its earnings preview. BNP Paribas also flags US generics pricing as a sector-wide concern, expecting only modest earnings growth across large Indian pharma players this quarter.

Margins: Mixed trends expectedEBITDA margins are expected to decline on a YoY basis due to rising input costs, lower gross margins, and unfavourable regional mix. However, HSIE expects sequential margin improvement of nearly 300 bps, aided by operating leverage and a better revenue base.

R&D and costsR&D spending is likely to stay elevated as the company continues investing in complex generics and biosimilars. DRChoksey estimates R&D intensity at 7.5 percent of sales for the quarter. Promotional spends may normalise sequentially, offering some operating relief.

What to watchInvestors will track commentary on:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.