Germany’s Deutsche Bank has retained its forecast of an earlier and milder recession in the US economy later this year.

In a recent research note, Jim Reid, head of global economics and thematic research, and David Folkerts-Landau, chief economist and global head of research, said the US was "on track for its first genuine policy-led boom-bust cycle in four decades".

Reid and Folkerts-Landau said this had been brought on by the "significant increase in the money supply over 2020-21", which was rolled out in response to the coronavirus pandemic.

The US government's fiscal spending in the period ran to about $5 trillion and, according to Reid and Folkerts-Landau, unleashed “high inflation and an aggressive policy response".

They said the "next stage is the US recession," which Deutsche Bank has been forecasting since the second half of 2022.

According to the researchers, investors and consumers "are a long way from fully adjusting to the recent rate shock" after more than a decade of quantitative easing and said "accidents like we have seen with UK LDI, crypto, US regional banks and Credit Suisse remain a big risk to the outlook". LDI is short for Liability-Driven Investment.

US inflation has been steadily declining in 2023, which had caused some forecasts to begin to price out a recession but April's results still revealed high core inflation that doesn’t include food and fuel prices.

Last week's labour market report found the jobless rate hit 3.7 percent in May, a seven-month high, which caused a rally in the S&P 500, as moderating wage growth in the month caused speculation that the Fed would not raise rates at its monetary policy meeting next week.

Deutsche Bank maintained that the US is headed towards a recession, stating: "We always thought it would take until the latter part of 2023 for this to materialize and although there is a risk it is delayed until H1 2024, we continue to believe it starts in Q4 2023."

The economists said that since the initial prediction was made for the latter half of 2023, they had reduced their expectation to an "earlier and milder downturn".

They explained: "Our prediction is for a -1.25% peak to trough US GDP decline, milder than the average post-WWII recession, but aggressive versus the consensus."

Rate hike not over

Not only do the analysts believe "the rate hiking cycle is not over yet" in the US, they expected the UK and European central banks to raise rates.

"Core inflation is proving too high for comfort and recessionary conditions may be the only way of returning it to target."

Rate hike cycle trends

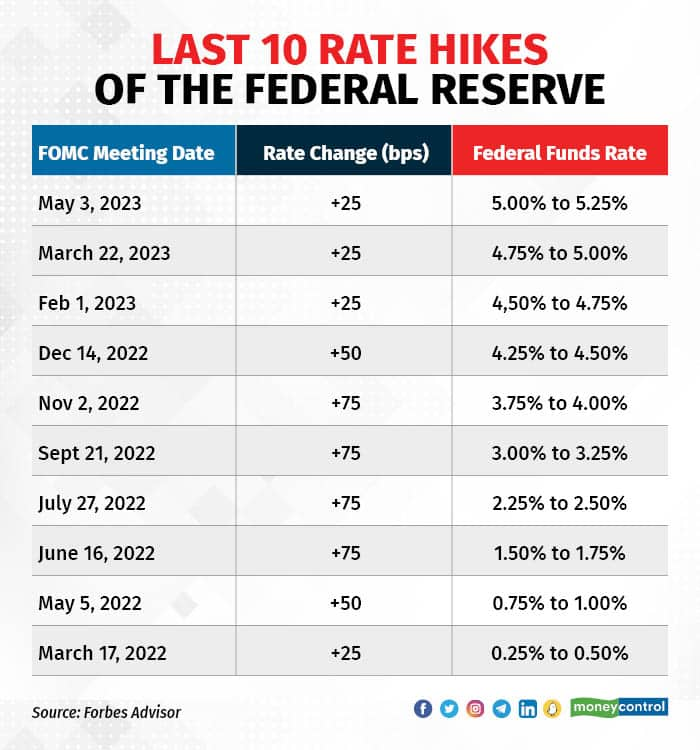

The US Federal Reserve has hiked interest rates 10 consecutive times since March 2022 to tame inflation. This is on record one of US central bank’s most aggressive rate hike cycles in recent history.

Last ten rate hikes by the US Federal Reserve

Last ten rate hikes by the US Federal Reserve

The next update on the Federal Reserve’s inflation and rate hike stance is going to be revealed at the Federal Open Market Committee meeting, which is due to commence on June 13, 2023.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.