The benchmark indices remained under pressure amid volatility for the third consecutive week ending October 18, hitting multi-week lows, as consistent FII selling, muted quarterly earnings, and weak festival-season demand in the auto sector weighed on sentiment.

In the coming week, the market is expected to remain in consolidation mode with continued stock-specific action due to the ongoing September quarter earnings season, but there may be support from the banking and financial space, the outperformer of last week. Geopolitical tension and movement in gold prices ahead of US elections may also impact the markets, experts said.

The BSE Sensex declined 0.2 percent during the week to 81,225, and the Nifty 50 fell 0.44 percent to 24,854, the lowest closing level since the first week of September. In the broader markets, there was mixed action, with the Nifty Midcap 100 index falling nearly a percent, and the Smallcap 100 index rising 0.4 percent. Auto, FMCG, metals, pharma, oil & gas, and select tech stocks were under pressure.

On Monday, the market will first react to the quarterly earnings reported by HDFC Bank, Kotak Mahindra Bank, Tech Mahindra, and Tata Consumer Products after market hours on Friday and Saturday.

"We expect consolidation to continue in markets on account of mixed global cues and lack of domestic triggers. However, stock specific action will be seen, driven by quarterly results," said Siddhartha Khemka, Head - Research, Wealth Management, at Motilal Oswal Financial Services.

Buy-on-dips will be the strategy on a short to medium-term basis, said Vinod Nair, Head of Research at Geojit Financial Services. He added that the focus will be on largecaps and growth areas like staples, agriculture, FMCG, consumption, power, digital, and infra.

Here are 10 key factors to watch for next week:

Corporate earnings (July-September 2024 quarter)

All eyes will be on the September-quarter earnings reports as more than 400 corporates will deliver their numbers in the week starting October 21, including prominent names like ICICI Bank, Hindustan Unilever, ITC, UltraTech Cement, Bajaj Finance, Bajaj Finserv, Bharat Petroleum Corporation, Coal India, and JSW Steel.

Non-Nifty stocks like ACC, Union Bank of India, Bank of Baroda, Bajaj Housing Finance, M&M Financial Services, InterGlobe Aviation, One 97 Communications (Paytm), Zomato, Indus Towers, ICICI Prudential Life Insurance, SBI Life Insurance, Coforge, JSW Energy, TVS Motor Company, Persistent Systems, United Spirits, Colgate Palmolive, CG Power and Industrial Solutions, Varun Beverages, Godrej Properties, Karnataka Bank, Godrej Consumer Products, Indian Energy Exchange, Bharat Electronics, Hindustan Petroleum Corporation, IDBI Bank, Poonawalla Fincorp, Torrent Pharma, Yes Bank, and IDFC First Bank will also release their quarterly numbers.

Global economic data

Globally, investors will focus on weekly jobs, new home sales, and durable goods orders data from the United States, while manufacturing and services flash PMI numbers from several developed and developing nations for October will also be watched.

Additionally, the general elections in Japan will be held over the coming weekend, on October 27.

Domestic economic data

On the domestic front, market participants will keep an eye on the monetary policy meeting minutes on October 23. On October 9, the Monetary Policy Committee (MPC) maintained status quo on policy rates, while changing the policy stance from 'withdrawal of accommodation' to 'neutral.'

Further, the HSBC Manufacturing & Services PMI flash data for October will be disclosed on October 24. The Manufacturing PMI in September dropped to 56.5 from 57.5 in August, while the Services PMI stood at 57.7 in September, down from 60.9 in previous month.

Foreign exchange reserves for the week ending October 18 will also be released next week, on October 25.

There will also be focus on institutional flows as foreign institutional investors (FIIs) continued their heavy selling in India due to valuation concerns, and are shifting money to cheaper China, recording the biggest ever monthly outflow in October. But consistent fund inflows from domestic institutional investors (DIIs) continued to offset the FII outflows.

``For FIIs, `sell India, buy China' is most likely to be a short-term tactical trade; but it can run for some more time, given India’s elevated valuations," said V K Vijayakumar, Chief Investment Strategist, Geojit Financial Services.

FIIs remained net sellers on all days of October, offloading Rs 80,218 crore worth of shares in the cash segment, while DIIs bought Rs 74,176 crore worth of stock in the same period.

Oil and commodities

The equity markets also seem to be getting good support from the correction in crude oil prices as India is a net oil importer, hence any decline is always beneficial for the nation. Brent crude futures, the international benchmark for oil prices, closed sharply lower at $73.06 a barrel, falling 7.57 percent during the week, the biggest weekly decline since the first week of September. It was going for around $81 a barrel the previous week amid geopolitical tensions in the Middle East. Technically, the prices were far below all key moving averages, with a negative bias in momentum indicators.

Reports that Israel may strike Iranian military targets lowered demand growth forecasts from the OPEC and the IEA, leading to lower oil prices, say experts.

On other hand, demand for safe haven precious metals remained strong amid uncertainty ahead of the US presidential elections, the ongoing geopolitical tensions, and dovish policies from major central banks. The COMEX gold futures hit a record high of $2,737.80 per troy ounce on October 18, closing with 2.2 percent weekly gains, while MCX gold futures ended at Rs 77,749 per 10 grams, up 1.9 percent for the week after hitting an all-time high of Rs 77,839.

Commodity markets will focus on the upcoming IMF and World Bank annual meeting starting October 21 as they are set to address pressing global economic issues. The BRICS summit in Russia from October 22-24 will also be watched. President Putin may propose a new cross-border payments network to counter Western sanctions and promote national digital currencies, aiming to reduce reliance on the US dollar, said Kaynat Chainwala, AVP, Commodity Research, Kotak Securities.

The primary market schedule for the coming week will be tight, with nine new IPOs hitting Dalal Street including four in the mainboard segment. The Rs 4,321-crore Waaree Energies IPO, and the Rs 260-crore public issue by Deepak Builders & Engineers will open for subscription on October 21. Subscription for Godavari Biorefineries' Rs 555-crore initial share sale will start on October 23, and Afcons Infrastructure will launch its Rs 5,430-crore IPO on October 25.

In the SME segment, five companies — Premium Plast, Danish Power, United Heat Transfer, OBSC Perfection, and Usha Financial Services — will launch their public issues next week, while Freshara Agro Exports will close its IPO on October 21.

On the listing front, the much-awaited debut of Hyundai Motor India, after its mega IPO, will be on October 22, while Lakshya Powertech and Freshara Agro Exports will list on NSE Emerge on October 23 and 24, respectively.

Technical view

The Nifty 50 is likely to be volatile with crucial support at 24,500-24,550, which somewhat coincides with its 20-week EMA (Exponential Moving Average), and may see resistance at the 25,000-25,200 mark (the high of last week). The index needs to hold on to its 20-week EMA support on a closing basis for stability, as decisively breaking this level can open the doors for the lows of August.

The index continued its lower highs-lower lows formation for the third consecutive week, with a negative bias in momentum indicators. But there was a High Wave pattern formation in the last two weeks following a long bearish candle in the initial week of October, indicating the possibility of some upside amid volatility, according to experts.

F&O cues

The weekly options data suggests that the 24,500 mark may provide key support next week, while resistance lies at 25,000.

On the Call side, the maximum open interest was seen at 26,000 strike, followed by 25,000 and 25,500 strikes, with maximum writing at 25,400 strike, and then 25,500 and 24,900 strikes. On the Put front, we see the maximum open interest at 24,000 strike, followed by the 24,500, 24,800, and 24,700 strikes, with the maximum writing at 24,000 strike, and then the 24,700, 24,500 and 24,600 strikes.

India VIX

Volatility remained in the lower reaches as well as below all key moving averages, which is a favourable condition for bulls and may help increase buying interest in the market. The India VIX, the fear index, declined 1.38 percent during the week, to 13.04.

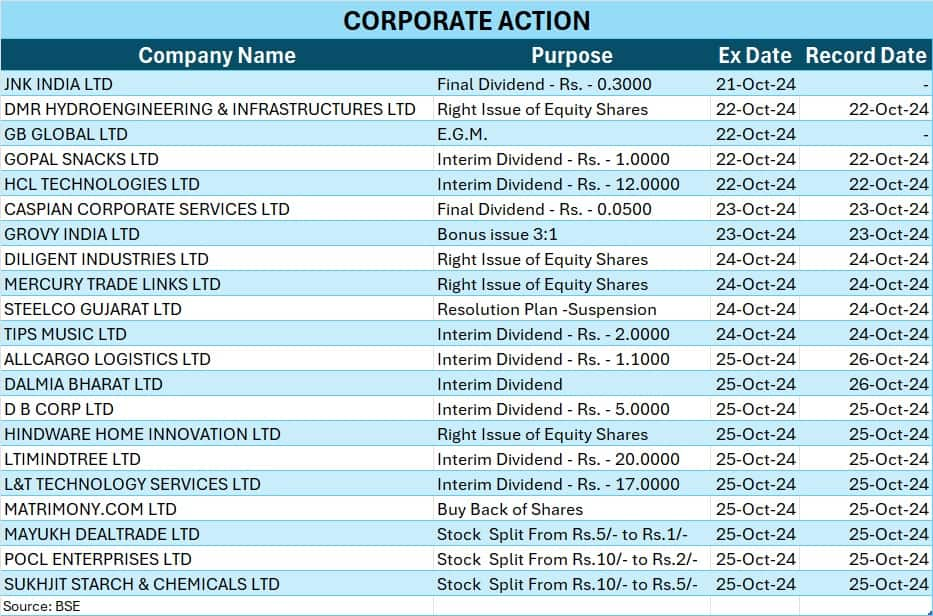

Corporate action

Here are the key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.