The market extended its downtrend for the third consecutive week ending July 18, with the Nifty 50 falling below the psychological 25,000 mark, tracking the tepid start to the June quarter earnings season and tariff-led uncertainty. The persistent FIIs selling also weighed down the market, though there has been consistent support from DIIs buying.

On Monday, the market will first react to the earnings of index heavyweights (Reliance Industries, ICICI Bank, and HDFC Bank) announced after market hours on Friday and on Saturday. Overall, the benchmark indices, in the coming week starting from July 21, are expected to be in a consolidative mode amid global trade uncertainty, with focus on updates (if any) related to the US-India trade deal, and further corporate earnings (which will lead to stock-specific action), according to experts.

The BSE Sensex declined 743 points during the last week to 81,758, and the Nifty 50 fell 181 points to 24,968; however, the Nifty Midcap and Smallcap 100 indices outperformed the benchmark indices, rising 0.8 percent and 1 percent, respectively.

Siddhartha Khemka, Head - Research, Wealth Management at Motilal Oswal Financial Services, expects the market to remain in consolidation mode amid continued global trade uncertainty and a subdued start to the Q1FY26 earnings season.

According to Vinod Nair, Head of Research at Geojit Investments, a favourable resolution from the proposed US-India mini trade agreement could strengthen the outlook for export-oriented sectors and enhance India’s relative attractiveness among emerging markets. Also, strong earnings growth is vital to justify India's premium valuations, he said.

Here are 10 key factors to watch out for this week:

The June quarter earnings season will be in full swing in the coming week as total 286 companies will release their earnings scorecard including 12 Nifty 50 names like Infosys, Kotak Mahindra Bank, Bajaj Finance, UltraTech Cement, Eternal, Dr Reddys Laboratories, Tata Consumer Products, Nestle India, SBI Life Insurance Company, Bajaj Finserv, Cipla, and Shriram Finance.

Additionally, Bank of Baroda, Canara Bank, ACC, One 97 Communications Paytm, Havells India, IDBI Bank, Oberoi Realty, PNB Housing Finance, Colgate Palmolive, Dalmia Bharat, Dixon Technologies, JSW Infrastructure, Mahindra & Mahindra Financial Services, Mahanagar Gas, Schloss Bangalore (Leela Hotels), United Breweries, Zee Entertainment Enterprises, Bajaj Housing Finance, Coforge, Persistent Systems, Syngene International, Aditya Birla Sun Life AMC, Cyient, Hexaware Technologies, Indian Energy Exchange, Indian Bank, Petronet LNG, Poonawalla Fincorp, Tata Chemicals, Balkrishna Industries, IDFC First Bank, and Premier Energies will also announce their results this week.

Trump Tariffs Update

Globally, participants across asset classes will be watching closely for the next move from the Donald Trump administration, as there are less than two weeks left until the August 1 deadline (which is expected to be the last deadline extension for the tariff rate imposition on trade partners).

Media reports suggested that Trump is pushing for a 15 to 20 percent minimum tariff on all EU goods and remains firm on a 25 percent auto import duty despite the EU offering to remove its 10 percent tariff on US car exports if the US agreed to reduce its tariffs below 20 percent.

The Trump administration has already imposed a 10 percent baseline import duty on EU imports.

Global experts believe this tariff-led uncertainty could further delay Fed funds rate cuts, with the unlikely cut in the July policy meeting, but the probability of a 25-basis-point cut in September (which has already been down to just 50 percent).

Fed Chair Powell Speech

In this data-light week, the market will also focus on the speech by Fed Chair Jerome Powell scheduled on July 22, which is important in terms of interest rate guidance ahead of the FOMC rate decision in the last week of July.

Most Federal Reserve officials have already signaled a potential cut in the Fed funds rate during the remainder of 2025, while emphasizing the importance of trade and policy uncertainty and their impact on inflation.

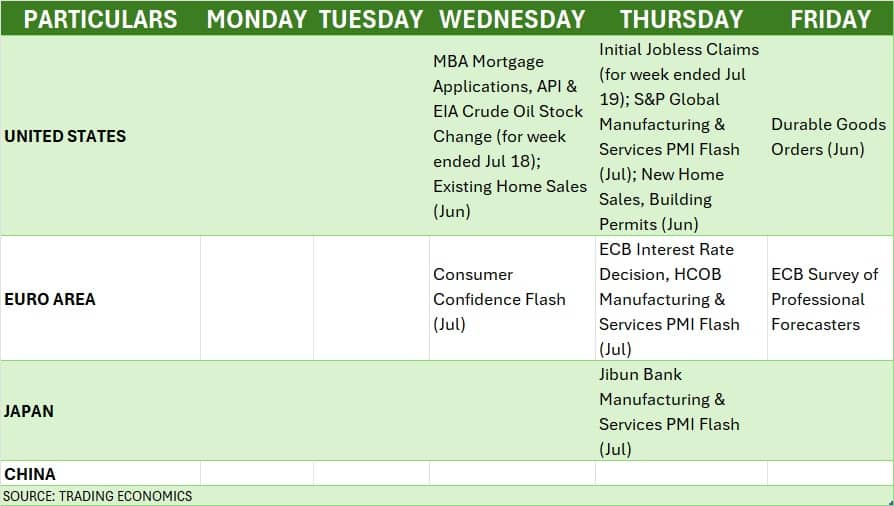

ECB Interest Rate Decision, Global Economic Data

Further, the European Central Bank's interest rate decision scheduled for July 24 will also be watched. Policymakers are likely to keep rates unchanged at 2 percent and want to wait for Trump's decision on tariff rates before going for change in interest rates.

Apart from the ECB, the market participants will watch manufacturing and services PMI flash numbers released by several nations, along with weekly US jobs data.

The mood at the FIIs (Foreign Institutional Investors) desk will also be closely watched this week, as their outflows continued last week with Rs 6,672 crore pulled from the cash segment, taking total selling for the current month to nearly Rs 17,000 crore. This may be due to valuation concerns amid muted earnings and tariff-led global uncertainty, following net buying over the previous three months.

In fact, FIIs consistently added short positions in the Index Futures since June 30, signalling bearish sentiment in the market.

On the contrary, DIIs (Domestic Institutional Investors) fully compensated FIIs' outflow, buying to the tune of Rs 9,491 crore during the week in the cash segment and Rs 21,894 crore worthof buying in July.

Meanwhile, the US dollar index continued to see buying for another week, closing 0.61 percent higher at 98.46, moving between the 20-day EMA and 50-day EMA.

Domestic Economic Data

Back home, infrastructure output for the month of June will be announced on July 21. This follows the manufacturing and services PMI flash numbers for July on July 24. Manufacturing and Services PMI for June expanded to 58.4 and 60.4, from 57.6 and 58.8, respectively, in May.

The foreign exchange reserves for the week ended July 18 will be released on July 25. In the week ended July 11, the reserves dropped to $696.670 billion, down from $699.740 billion in the previous week.

Investors will see a busy schedule of the primary market this week as total 11 new IPOs will hit Dalal Street including 6 from the SME segment and 1 from the REIT segment. The Rs 473-crore initial share sale of PropShare Titania, the second scheme of the Property Share Investment Trust REIT, will open on July 21.

Further in the mainboard segment, workspace solutions provider Indiqube Spaces' Rs 700-crore IPO, and laptops & desktops refurbisher GNG Electronics' Rs 460.4-crore maiden public issue will open on July 23. Hotel chain operator Brigade Hotel Ventures' Rs 759.6-crore initial share sale will be launched on July 24, followed by gold jewellery maker Shanti Gold International's IPO on July 25.

In the SME segment, Savy Infra & Logistics and Swastika Castal will open their IPOs on July 21. The public issue of Monarch Surveyors & Engineering Consultants will be launched on July 22, followed by TSC India's Rs 25.9-crore IPO on July 23. Patel Chem Specialities, as well as Sellowrap Industries' maiden public issues will open for subscription on July 25.

On the listing front, Anthem Biosciences from the mainboard segment will debut on the bourses effective July 21. In the SME segment, the trading in Spunweb Nonwoven and Monika Alcobev shares will commence on July 21 and July 23, respectively.

Technical View

Technically, the short-term trend turned favourable for bears, considering the index trading below the 20-day EMA and testing the 50-day EMA (24,900) in the passing week. Also, it broke the upward sloping support trendlines with above-average volumes last Friday. The momentum indicators are also weak, with the RSI reaching the 43.07 zone. Hence, if the Nifty 50 decisively breaks 24,900 (which also coincides with the lower line of Bollinger bands), the 24,800-24,500 zone can't be ruled out, but if the index defends or hovers around it, the gradual rebound toward 24,200-24,300 levels can be possible, according to experts.

F&O Cues

According to weekly options data, the Nifty 50 is expected to be in the broad range of 24,500-25,500, and the near-term range may be 24,800-25,300.

The maximum Call open interest was seen at the 25,200, followed by the 25,100 and 25,500 strike, with the Call writing at the 25,100 strike, and then the 25,000 and 25,200 strikes. On the Put side, the 24,900 strike holds the maximum open interest, followed by the 25,000 and 24,500 strikes, with the maximum writing at the 24,900 strike, and then the 24,950 and 25,000 strikes.

Meanwhile, the India VIX, often referred to as the fear index, remained in the weak zone, closing at 11.39 — its lowest closing level since April 2024 — down 0.59 percent for the week. It extended its downward bias for the fifth consecutive week, indicating continued complacency and stability in the market, but also signaling a potential alert for either a decisive breakout or breakdown.

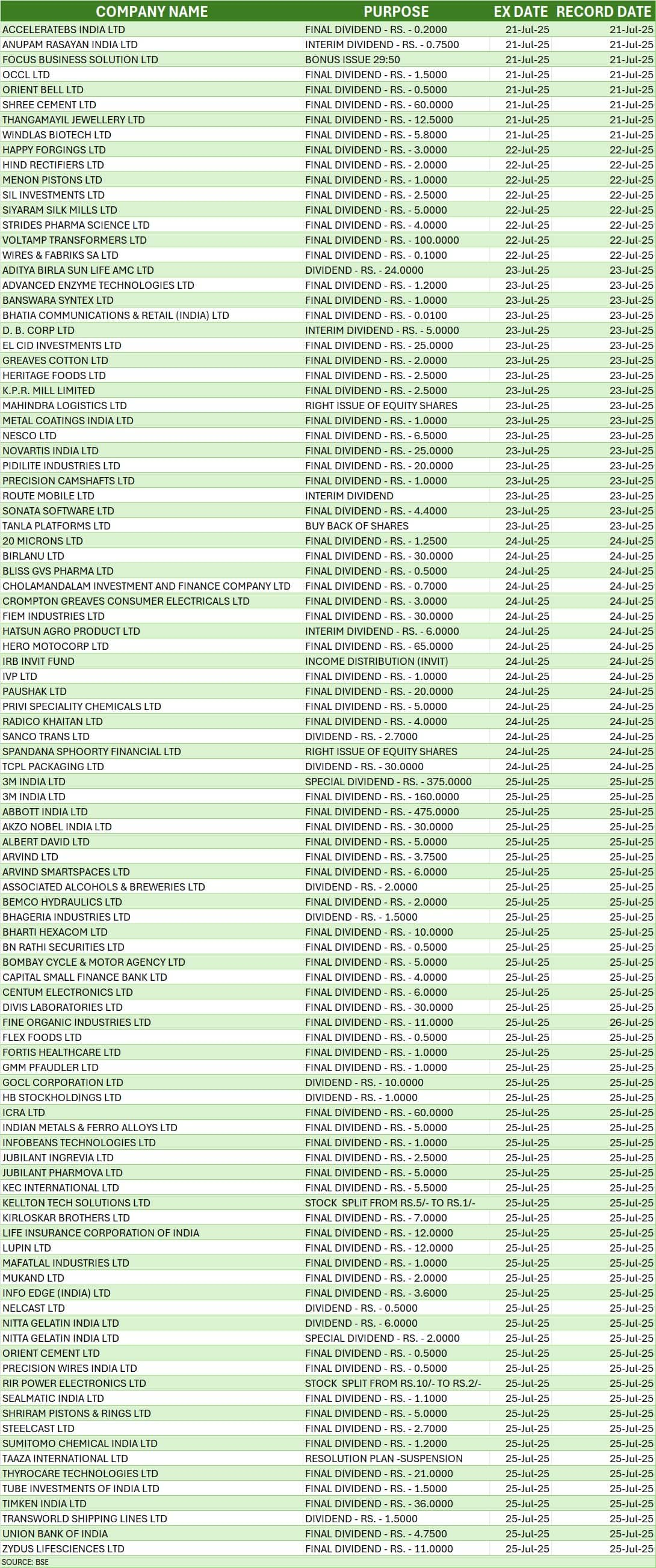

Corporate Action

Here are key corporate actions taking place in the coming week:

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.